Henlo everyone!

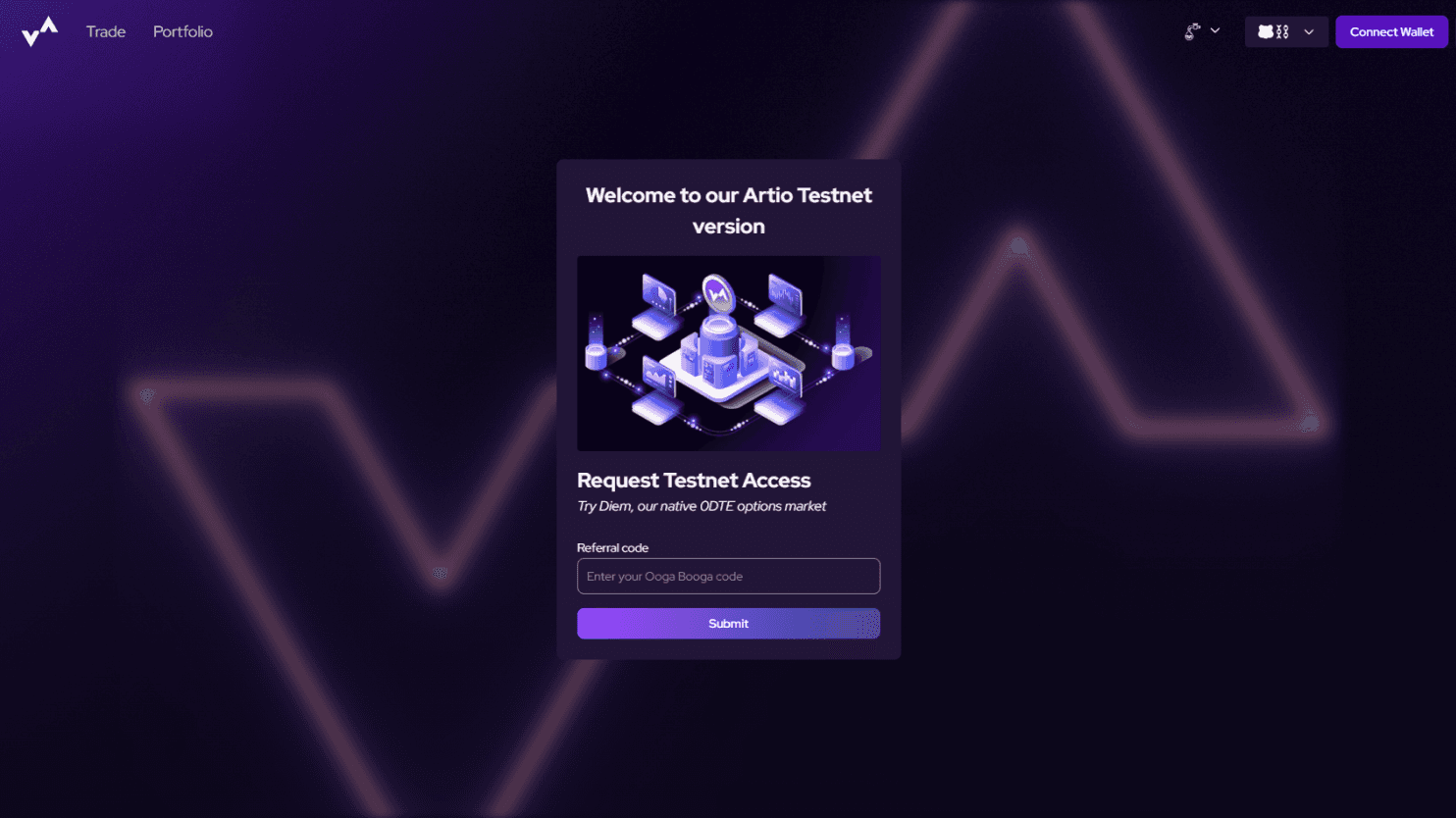

We’re thrilled to announce that IVX is now live on Berachain Artio Testnet, head to our Testnet website here!

IVX Artio Testnet

In the following article below, we’ll explain what IVX is, and importantly, how you can get set up on IVX to start trading 0DTEs!

First things first, to get started on the Test Net, you need an Ooga Booga code! We’ve got plenty of these to share but only with the most dedicated volatists among you!

Join our discord and see our pinned X tweet and we’ll get you set up!

So let’s get to the point: What is IVX?

IVX is a native options protocol built exclusively on top of the Berachain Polaris EVM tech stack and leverages the Berachain Berps market to bring the community feasible and easy-to-use Zero-Days to expiry options (0DTEs), all in a permissionless and secure manner.

Interacting with the IVX Artio Testnet dapp provides an opportunity to experience the features and benefits of 0DTE option markets atop IVX before its launch on Mainnet in Q2. By exploring the Testnet, users can gain a comprehensive understanding of the risk-to-reward of short-dated instruments, additionally, trading on Testnet allows our users to benefit from the large incentive program that is tailored specifically for our volatists surfers. Our rewards program aims to maximize users’ trading experiences while offering community-targeted incentives.

Why trade 0DTEs on IVX?

Below are some of the key reasons why trading on IVX is so attractive.

- High leverage exposure with minimal capital required

- No risk of liquidation for buyers, and a high APY availability for sellers

- Suitable speculation tool for short time-frame trades (news, announcements, reports, on-chain events)

- Ability to use different type of margins, without the need to sell your assets

- Trade via an easy-to-use and flexible interface

Now to the real sauce, how do you trade 0DTEs on IVX? (take notes)

Below is a step-by-step guide on what you need to do to get started with trading on IVX Berachain Testnet :

‘How to make it’ playbook

Step 1 – Get an Ooga Booga code

To get a code and have access

to the trading interface, make sure to first join our Discord, follow us on X and put your notification bell on, as we will be dropping multiple codes in the coming days. Codes will be given to valuable community members that support IVX.

Step 2 – Submit your code and sign a transaction:

Submit the code you received in the appropriate box, remember that codes give you access to IVX through a chosen EVM wallet, after you submit your unique code, you will have to sign a transaction to whitelist your wallet address into using the IVX trading interface, the supported wallets are Metamask and Rabby Wallets. Each code has a one-time use only.

Step 3 – Get some $BERA from the faucet

Head to the official faucet here.

Get $Bera gas fees

As well, on IVX you can also head directly to the faucets via the interface options in the image below.

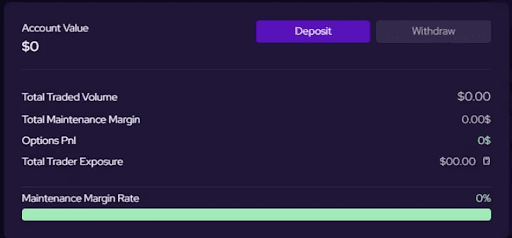

After you whitelist your wallet address to use the IVX trading interface, a pop-up will appear that will allow you to create a smart contract portfolio to trade with.

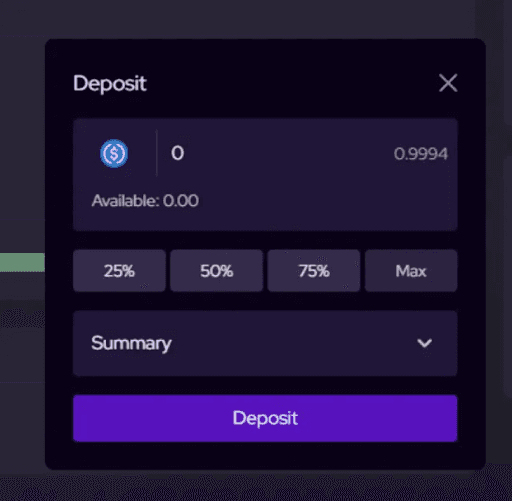

Deposit ivxUSD to trade with

Press on ‘Create Account’ and sign the transaction.

Step 5 – Receive $ivxUSD and deposit them into your portfolio:

IVX users need $ivxUSD, a mock test net token, to deposit into the portfolio during the test net which users can then trade with.

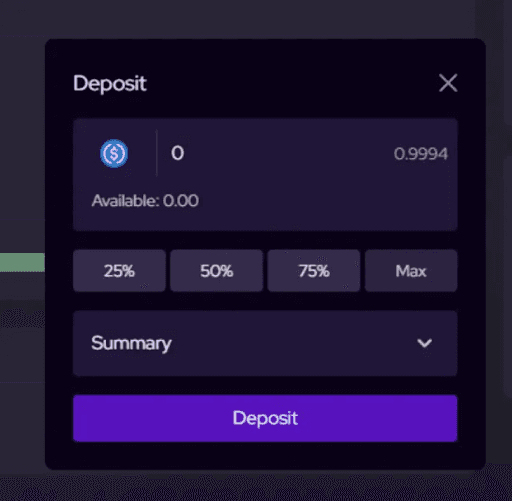

Step 6 — Deposit $ivxUSD into your portfolio:

Once tokens are received, deposit $ivxUSD into your portfolio which can be seen on the portfolio tab.

Press on ‘Max’, Click ‘Deposit’ and execute the transaction.

Step 7 – Open your first position:

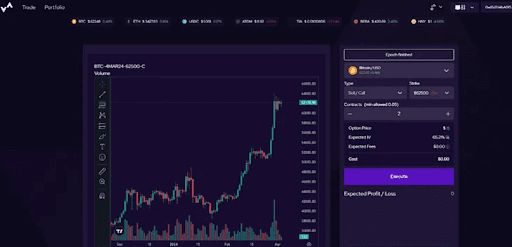

Head to the “Trade” tab, choose “Trade Altcoins and Defi Tokens” and the trading panel interface will open. Here you can see information regarding the assets and type of options you would like to trade.

Trading Interface

Now your position is opened so get ready to generate some large PnL tickets!🫰