Key Points

-

THORChain is facing significant financial challenges, including allegations of insolvency due to unserviceable debts from its lending and savings products.

-

The protocol’s THORFi services, including lending, have been paused for a 90-day restructuring period, although regular trading and swaps remain operational.

-

The core issue lies in flawed lending mechanics, where Bitcoin (BTC) and Ethereum (ETH) collateral was swapped for RUNE, exposing the protocol to extreme risks if RUNE’s price declined.

-

Liabilities currently exceed assets, with a gap in reserves for BTC and ETH collateral, leading to concerns about solvency.

-

Proposals for restructuring include tokenizing debt, freezing lending positions, creating recovery rights tokens, and prioritizing liquidity providers (LPs).

-

The RUNE token has experienced a sharp decline of over 30% within 24 hours, triggering further panic among users and stakeholders.

-

Community members and validators are debating possible paths forward, with comparisons drawn to previous crypto crises like the Terra/Luna collapse.

-

Validators have temporarily paused certain protocol functionalities to prevent a liquidity crisis while restructuring efforts are underway.

Overview of the THORChain Crisis

THORChain, a decentralized liquidity protocol, has recently entered a period of financial instability marked by allegations of insolvency and a sharp decline in the value of its native token, RUNE. The primary catalyst for the crisis stems from the protocol’s lending and savings features, which relied heavily on the price stability of RUNE. With RUNE’s value plummeting, the protocol now faces substantial liabilities that exceed its current assets.

As part of the response, THORChain validators have paused its THORFi services, including lending and savings programs, while swaps and trading remain operational. This decision marks the beginning of a 90-day restructuring period aimed at addressing systemic vulnerabilities.

TL;DR: THORChain’s financial troubles are tied to its lending features, which relied on RUNE’s price staying stable. To fix these issues, lending services are paused while the team works on restructuring the protocol to prevent further instability.

Flawed Lending Mechanics and Insolvency Risks

The Root Cause

The crisis can be traced to THORChain’s lending mechanism, where users borrowed assets by collateralizing Bitcoin (BTC) or Ethereum (ETH). Upon borrowing, the protocol utilized a minting and burning mechanism for RUNE as part of its collateral and debt management process, creating a systemic dependency on the token’s price. As RUNE’s value declined, the protocol became increasingly exposed to a “death spiral” dynamic:

-

Borrowers repaying loans required the protocol to mint and burn RUNE as part of its collateral and debt management process, rather than directly selling it to reacquire BTC and ETH.

-

This dynamic further impacted RUNE’s value, as the minting and burning mechanism, integral to the lending process, influenced its supply dynamics, creating a self-reinforcing cycle.

-

Minting additional RUNE tokens is an integral part of the lending mechanism, with burns occurring during loan closure under favorable conditions. While this process aims to manage liabilities effectively, it has also contributed to oversupply issues and diluted the token’s value during periods of unfavorable market conditions.

Current Liabilities and Asset Gaps

-

BTC Collateral: 1,604 BTC is owed, but only 592 BTC is available in the protocol’s liquidity pools.

-

ETH Collateral: 18,258 ETH is owed, with only 7,404 ETH available.

-

Outstanding Liabilities: The protocol’s unmet liabilities exceed $24 million at current market prices, while available liquidity is approximately $22-$23 million.

These shortfalls highlight the protocol’s inability to fully repay depositors and meet obligations, leading to insolvency concerns. However, RUNE supply caps and the circuit breaker mechanism are designed to mitigate such risks. If RUNE inflation approaches critical thresholds, lending operations are paused, preventing further liabilities and stabilizing the protocol.

TL;DR: THORChain’s lending system mints and burns RUNE to manage loans, but this design exposed the protocol to risks when RUNE’s price dropped, leaving it unable to cover liabilities.

Responses and Proposed Solutions

Validator Actions

Validators have paused THORFi services, including lending and savings programs, to prevent a rush to exit and stabilize the protocol. This pause is tied to the lending mechanism, which relies on minting and burning RUNE to manage equity and liabilities. By halting lending, the protocol aims to mitigate inflationary pressures on RUNE while restructuring to ensure long-term stability. Regular trading functionalities, such as swaps, remain active.

Proposed Restructuring Plan

Community members and developers have outlined a restructuring plan that includes:

-

Tokenizing Debt: Converting lending and savings claims into tokens that represent the owed value.

-

Recovery Rights Tokens: Creating tokens that pay a percentage of protocol fees to debt holders until obligations are fulfilled.

-

Unwind Module: Allocating 10% of system income to repaying debts through an automated module.

-

Secondary Markets: Allowing tokenized claims to be traded peer-to-peer.

-

Liquidity Provider (LP) Prioritization: Ensuring LPs are protected to maintain liquidity for swaps.

These measures aim to stabilize the protocol while preserving its long-term viability.

TL;DR: Validators paused lending to fix issues with RUNE’s minting and burning process, which created financial risks. The restructuring plan includes creating debt tokens and protecting liquidity providers to ensure stability.

Market Reactions and RUNE’s Price Decline

Price Impact

The RUNE token has experienced a dramatic decline, dropping over 30% in 24 hours. This volatility is partly influenced by the minting and burning of RUNE as part of the lending mechanics, which affects the token’s supply dynamics and can exacerbate price fluctuations. This sharp downturn has been attributed to:

-

Panic among users and stakeholders due to insolvency concerns.

-

Increased selling pressure from borrowers repaying loans.

-

Market participants shorting RUNE in anticipation of further declines.

Community and Validator Perspectives

Opinions within the community vary:

-

Some, like @NaveenCypto, argue that only THORFi services are paused and the base protocol remains functional, dismissing insolvency claims as market manipulation.

-

Others, like @1984_is_today, emphasize the protocol’s insolvency risks and advocate for immediate restructuring.

-

Many are drawing comparisons to the Terra/Luna collapse, predicting a full death spiral and the potential end of the protocol.

TL;DR: RUNE’s price crash is linked to flaws in the lending system, where minting and burning RUNE added volatility. The community is split between optimism for recovery and fears of collapse.

Broader Implications and Comparisons

Lessons from the Crisis

The THORChain crisis has drawn comparisons to the Terra/Luna collapse of 2022, highlighting the dangers of unsustainable tokenomics. Key lessons include:

-

The need for robust economic models that minimize reliance on native token fluctuations.

-

Transparent and over-collateralized lending mechanisms to reduce systemic risks.

Future Prospects

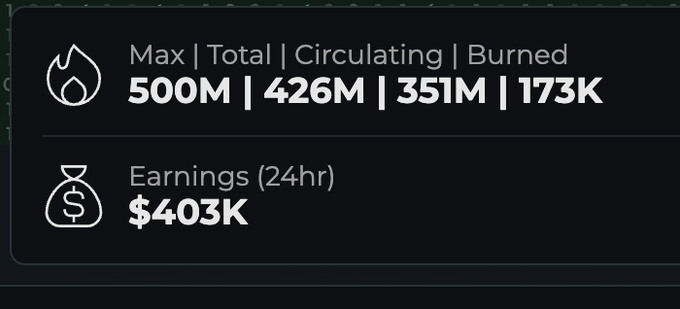

Despite the current challenges, THORChain remains a high-revenue protocol, generating over $30 million annually from fees. With effective restructuring, the protocol could recover and continue to grow.

TL;DR: THORChain’s future depends on restructuring its lending system to be more sustainable. With over $30 million in annual revenue, the protocol has the potential to recover if these changes are made, offering some hope for recovery that Terra LUNA didn’t have.

Conclusion?

Firstly, we will attempt to update this article overtime as more beneficial information emerges. See bottom of this article.

For now however, THORChain’s financial crisis reveals critical vulnerabilities in its lending mechanics, leading to insolvency concerns and a sharp decline in RUNE’s value. Validators and the community are working on restructuring plans to stabilize the protocol and address outstanding liabilities. While the situation remains uncertain, the protocol’s strong revenue potential and proposed recovery measures offer a path forward. Stakeholders must remain vigilant as developments unfold.

Updates

- Update from @THORChain on Jan 24, 8:40 PM EST.

- Proposal #1 from @proof_steve on Jan 24, 2025 4:41 PM EST

- Proposal #2 from @jpthor on Jan 25, 3:23 AM EST.

- Update from @jpthor on Jan 25, 3:40 AM EST.

- Claims that no users will lose funds in the long term from @jpthor on Jan 25, 4:38 AM EST.

Proposal #1 summary:

Discount Auction Module for Unwinding Lending Positions

This proposal from @proof_steve introduces a system to unwind THORChain lending positions without minting new RUNE while offering borrowers immediate exit options.

How It Works:

Discount Auction Module (DAM):

- Tokenizes borrower positions using a snapshot of BTC/ETH value.

- Allocates 10% of system income to the DAM.

- Runs daily auctions if the DAM exceeds a minimum RUNE balance.

Borrower Exit Options:

- Bid at a Discount: Borrowers can bid to close loans with DAM funds, with higher discounts securing priority.

- P2P Sales: Borrowers can sell tokenized positions peer-to-peer.

- Wait: Borrowers can hold until the DAM accumulates enough RUNE to close all loans.

Proposal #2 summary:

This proposal from @jpthor introduces a structured five-year plan to reduce Thorchain’s outstanding debts and unwind specific financial positions using existing protocol functionalities.

Key Elements:

Unwind Module:

- Allocates 10% of Thorchain’s system income to a dedicated Unwind Module before other distributions (e.g., nodes, developers, LPs).

- Funds in the module are reserved for systematically unwinding debts and positions.

Unwind Manager:

- Executes a daily routine to process:

- Borrowers: Randomly selects borrowers to repay debts using Unwind Module funds, returning collateral and removing debt.

- Savers: Converts saver positions into single-sided LP positions.

- RUNEPool: Gradually exits participants, transferring positions to the RESERVE. Once complete, the entire RUNEPool position is sold back to RUNE to replenish the RESERVE.