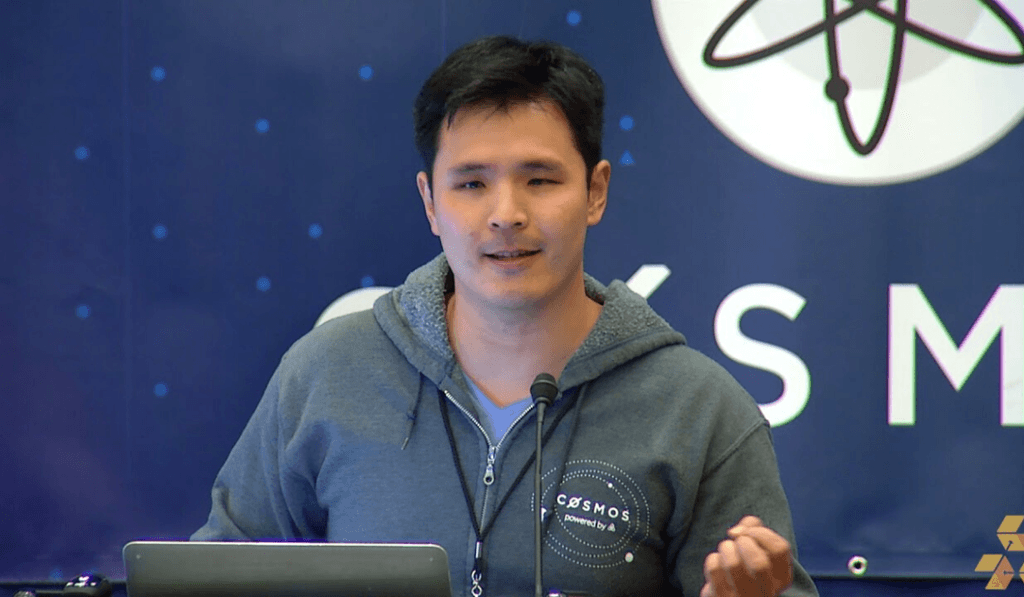

Background and History

BitU Protocol was developed to solve key inefficiencies in the DeFi space, particularly in liquidity management and staking. Traditional liquidity provision models often suffer from high slippage and capital inefficiency, which BitU seeks to address through its Automated Liquidity Management Mechanism (ALMM). Additionally, the protocol’s staking and yield-generating mechanisms provide users with attractive opportunities to earn rewards.

The project aims to democratize access to decentralized finance by offering a comprehensive platform for multi-asset trading, staking, and liquidity management. By automating complex DeFi processes, BitU enables users to maximize their returns while minimizing risk, making it a valuable tool for both new and experienced DeFi participants.