In the evolving landscape of environmental sustainability and digital innovation, a new player has emerged that seamlessly intertwines these realms: Aqualibre. This article aims to offer a comprehensive overview of AQLA, a company that has established its prowess in the field of carbon credit trading and is now venturing into the realm of cryptocurrency.

AQLA has previously made significant strides in addressing global environmental challenges through traditional business models. Now, they are extending their impact by embracing blockchain technology, signaling a strategic shift towards a more transparent, efficient, and globally accessible platform for carbon credit trading.

In this article, I will delve into the intricate details of the AQLA Protocol, providing an informative and educational insight into their journey from a real-world business to a pioneering cryptocurrency venture.

By exploring AQLA’s background, its transition to the digital domain, and its innovative use of blockchain technology, we aim to paint a clear picture of its objectives, challenges, and potential impacts.

Additionally, I will analyse in depth their new venture into the world of crypto, examining the motive behind the move, the intricacies of their tokenomics, and the anticipated role of their platform in the broader context of environmental sustainability. Our goal is to offer readers a nuanced and in-depth understanding of AQLA Protocol, highlighting how they are redefining the intersection of technology and environmental action.

- AQLA’s Protocol’s Real-World Business: A Foundation in Carbon Credit Trading

- Venturing into Cryptocurrency: Why Blockchain?

- Choosing Kujira: A Strategic Partnership

- AQLA Protocol Tokenomics: Understanding the Value

- Public Token Launch on Pilot, Kujira

- The Road Ahead: AQLA Protocol’s Future Goals

- Conclusion

- To Find out More about AQLA Protocol

AQLA’s Protocol’s Real-World Business: A Foundation in Carbon Credit Trading

AQLA, established for several years in the voluntary carbon market, has been a key player in real-world carbon credit trading. Carbon credit trading is an environmental initiative where a company, government, or other entity that produces carbon emissions can purchase a certain number of credits to offset its carbon footprint. Each credit permits the emission of one ton of carbon dioxide or an equivalent amount of other greenhouse gases. If an entity produces less emissions than the industry standard, it can produce and sell the surplus credits to another emitter who needs them.

This system incentivizes the reduction of emissions by turning the unused carbon credits into a valuable asset. AQLA’s focus on this trading mechanism supports green solutions like wind, solar, and afforestation projects, distinguishing their approach from the mandatory carbon market which typically involves taxing large-scale polluters.

Their commitment not only lies in trading carbon credits from eco-friendly projects but also in promoting global awareness and a shift towards a carbon-neutral lifestyle. This is supported by their blockchain-driven carbon platform, designed to help the wider business community in adopting effective carbon offset policies.

Venturing into Cryptocurrency: Why Blockchain?

The transition to cryptocurrency for AQLA Protocol is not only a strategic decision for enhanced transparency and efficiency in carbon credit trading, but it also capitalizes on the inherent advantages of cryptocurrency over traditional finance systems. Here’s how AQLA benefits from these key aspects:

- Near-Instant Transactions: One of the significant benefits of blockchain technology is the ability to conduct near-instant transactions. This feature is particularly advantageous for AQLA in the carbon credit trading market, where the speed of transactions can be crucial. Faster transactions mean that carbon credit trades can be executed and settled almost immediately, ensuring that AQLA’s platform remains efficient and responsive. This rapid processing reduces the waiting period for both buyers and sellers in the carbon market, facilitating smoother and more dynamic trading activities relative to traditional finance.

- 24/7 Trading: Unlike traditional financial markets that operate within specific hours, the cryptocurrency market is open 24/7. This round-the-clock trading capability allows AQLA Protocol to offer continuous access to carbon credit trading. Stakeholders and participants in different time zones can engage in trading activities at their convenience, significantly enhancing the global reach and operational flexibility of AQLA’s platform. This constant availability aligns perfectly with the global nature of carbon offset projects and the diverse geographical spread of participants in environmental initiatives.

- Borderless Payments: The global nature of environmental challenges and carbon offset initiatives necessitates a trading platform that transcends geographical boundaries. Cryptocurrency, known for its borderless payment capabilities, perfectly aligns with AQLA’s objectives. With blockchain technology, AQLA can facilitate transactions across borders without the typical hindrances of currency exchange rates, international banking fees, or delays. This global reach not only makes carbon credit trading more accessible to a wider audience but also streamlines the process, allowing for a more inclusive and diverse participation in environmental efforts.

Blockchain technology emerges as an unparalleled solution to these issues due to its fundamental characteristics. A blockchain is a decentralized ledger, meaning it is not controlled by a single entity but is instead a distributed database, managed by multiple participants. This decentralization ensures that no single party can manipulate the record of transactions, enhancing the system’s security and trustworthiness.

One of the key features of blockchain technology is its transparency. Every transaction on a blockchain is recorded and visible to all participants, making it nearly impossible to double-count or falsify carbon credit transactions. This visibility ensures that each credit is only counted once and that its origins and subsequent transactions are traceable and verifiable.

Moreover, blockchain networks operate with high efficiency due to their digital nature. Transactions can be executed and verified quickly, without the need for intermediaries. This not only speeds up the process but also reduces transaction costs, making carbon credit trading more accessible and appealing to a broader range of participants.

In summary, AQLA’s adoption of blockchain technology signifies a substantial advancement towards a more transparent, accessible, and reliable carbon credit trading system.

By leveraging blockchain, AQLA addresses the critical challenges of double counting and fraud in traditional carbon markets, paving the way for more effective and trustworthy environmental initiatives.

Choosing Kujira: A Strategic Partnership

AQLA Protocol’s selection of Kujira as the platform for their crypto venture was a deliberate and strategic decision. Kujira stands out in the blockchain world for its strong commitment to inclusivity and empowerment.

This ethos resonates deeply with AQLA’s mission, as both entities aim to create systems that are accessible and beneficial to a broad audience, not just a select few. Kujira’s decentralized finance (DeFi) ecosystem is particularly noteworthy for its user-centric design, ensuring that all participants, regardless of their background or financial status, have equal opportunities to engage and benefit from its offerings.

Moreover, Kujira’s advanced blockchain infrastructure is a key asset for AQLA, not only for its capacity to handle complex transactions but also for its robust DeFi applications.

The technology underpinning Kujira enables secure, transparent, and fast transactions, essential for effective carbon credit trading.

Beyond this, AQLA strategically utilizes Kujira’s DeFi dApps to lend out stablecoins accrued from their fundraising efforts and profits from over-the-counter (OTC) deals. This innovative approach allows AQLA to generate substantial revenue streams by earning interest, sometimes upwards of 10%, on these stablecoins.

Furthermore, this interest is redistributed to AQLA token stakers in the form of yield-bearing stablecoins, adding an attractive incentive for token holders. Thus, by leveraging Kujira’s robust and scalable blockchain for both carbon credit trading and DeFi lending, AQLA ensures that every transaction and investment is not only recorded immutably but also contributes to the overall value and sustainability of their ecosystem, a feat traditional markets often find challenging to replicate.

The concept of “democratizing carbon credits” involves making these environmental assets more accessible to a wider audience. Typically, carbon credit trading has been the domain of large corporations and specialized traders.

AQLA, through Kujira, aims to change this by allowing everyday individuals and smaller businesses to participate in carbon credit trading. This approach not only broadens the market but also raises awareness about carbon neutrality and environmental sustainability, encouraging more people and organizations to contribute to the global effort to reduce carbon emissions.

AQLA Protocol Tokenomics: Understanding the Value

AQLA Protocol’s tokenomics, meticulously engineered for environmental benefit and stakeholder value, make the AQLA token pivotal within their carbon credit trading platform. This non-mineable, carbon offset reward token, classified as a utility token in the EU and UK, supports a fixed supply of 280 million. Serving multifaceted roles, it facilitates fee settlement for carbon credits and purchases on the platform, while incentivizing active participation through a rewards system tied to pooled USDT/USDC collections on Aqualibre.

The strategic distribution of AQLA tokens aims to nurture long-term growth and sustainability. It is not merely a speculative asset; its value is deeply intertwined with meaningful environmental action and the platform’s overall health.

By anchoring itself in practical utility and the ecological impact of the Aqualibre Project, AQLA sets a precedent in how cryptocurrencies can drive real-world change.

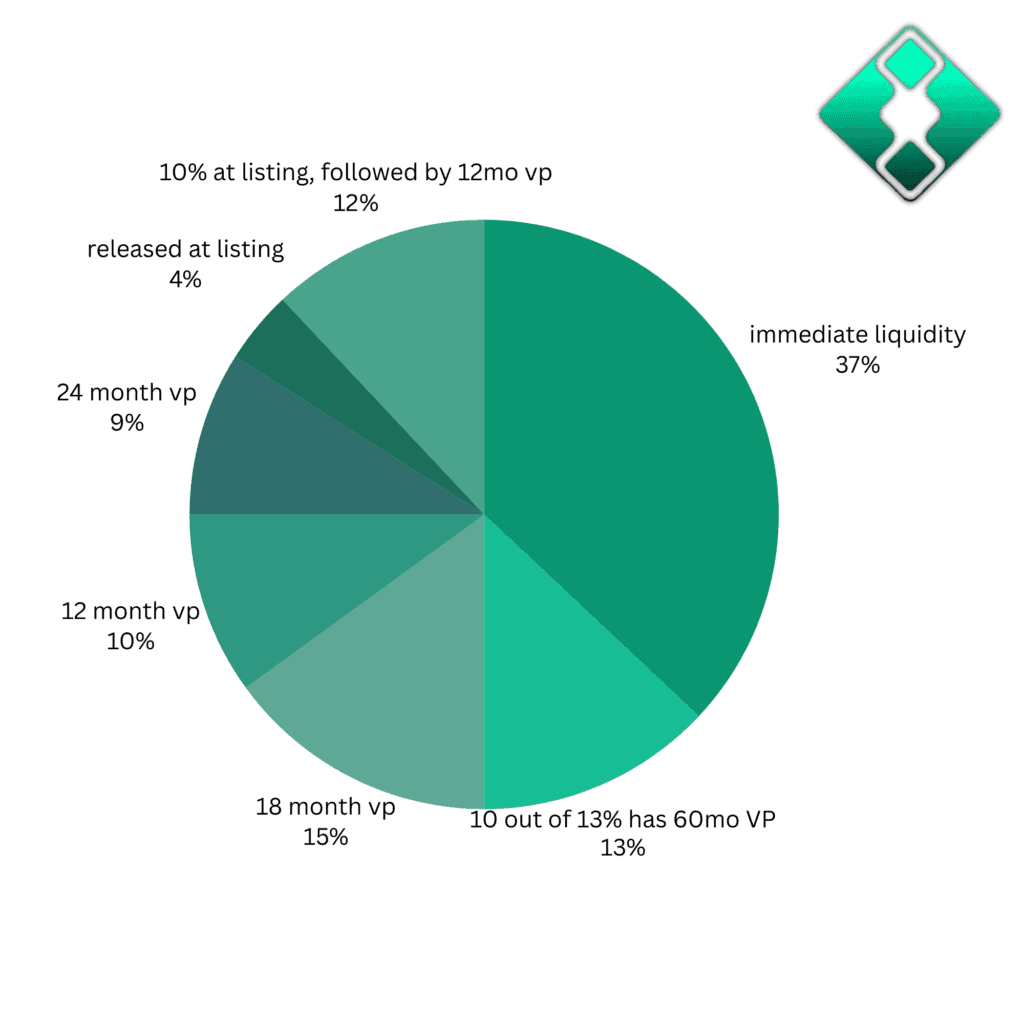

The token’s distribution strategy is meticulously structured to reinforce its utility and ensure long-term sustainability.

The whitepaper specifies that 20% of the total supply is allocated for platform development and operations, crucial for maintaining and enhancing the ecosystem. A strategic allocation of 15% is dedicated to marketing and forming partnerships, critical for broadening AQLA’s influence and effectiveness in the carbon credit market. Additionally, 15% of the tokens are distributed among the founders, advisors, and early investors, subject to a lengthy vesting period. This vesting period is meticulously designed to align their interests with the project’s enduring success. For instance, of the total token distribution:

- 37.0% (104 million tokens) are immediately released at the listing, providing immediate liquidity.

- 13.0% (36 million tokens) have 10.0% released at the listing, followed by a vesting period of 60 months, ensuring long-term commitment.

- Another 15.0% (42 million tokens) have no initial release at listing but follow an 18-month vesting period, reinforcing sustained involvement in the project.

- 10.0% (28 million tokens) have no release at listing, with a vesting period of 12 months an additional 24 months, demonstrating a commitment to long-term project growth.

- 9.0% (25 million tokens) follow a similar pattern with no release at listing but are vested over 24 months, ensuring consistent engagement over a significant period.

- 4.0% (11 million tokens) are entirely released at the listing, adding to the token’s initial liquidity.

- Lastly, 12.0% (34 million tokens) have 10.0% released at the listing, followed by a 12-month vesting period and an additional 24 months, balancing immediate engagement with long-term commitment.

These varied vesting schedules for different allocations of AQLA tokens underscore the project’s focus on sustainable growth and long-term value creation.

By structuring the token release in such a manner, AQLA ensures that key stakeholders remain invested in the project’s success over an extended period, aligning their interests not just with immediate gains but with the enduring impact and advancement of the platform.

The AQLA token incentivizes holders through a dual-incentive rewards system that promotes active engagement and contribution within the platform. This comprehensive rewards system is structured as follows:

- Staking Rewards: AQLA token holders are encouraged to stake their tokens in the platform’s liquidity pools. This staking mechanism not only contributes to the liquidity and stability of the platform but also rewards participants with additional AQLA tokens. The exact percentage of staking rewards is dynamic, influenced by various factors including overall platform activity and the amount staked.

- Governance Participation: Holding AQLA tokens grants users governance rights, allowing them to participate in crucial decision-making processes. This governance mechanism includes voting on proposals related to the platform’s development, policy changes, and new initiatives. The influence of a token holder in these governance activities is proportional to the number of tokens they hold and stake, integrating a democratic approach where the community’s voice directly shapes the platform’s trajectory.

Through these mechanisms, AQLA’s tokenomics fosters a participatory ecosystem where token holders are rewarded for their active involvement and long-term commitment, aligning individual incentives with the collective goals of the platform.

In summary, AQLA’s tokenomics are a thoughtful blend of utility, reward, and governance, crafted to underpin a sustainable and impactful platform. By linking the token’s value to the business’s success and its environmental mission, AQLA establishes a unique model where cryptocurrency and ecological responsibility converge.

Public Token Launch on Pilot, Kujira

The impending public token launch of AQLA on Pilot, Kujira’s innovative launchpad, marks a pivotal moment for the initiative. This event, commencing on December 9, 2023, and concluding on January 31, 2024, invites investors and environmental enthusiasts to engage with a significant crypto-environmental venture.

A total of 103.6 million AQLA tokens will be offered, with prices ranging from $0.01 to a maximum of $0.25 per token. The auction-style sale on Pilot, which is part of the Kujira network, will function through a bid placement system.

Participants will state their bid price and amount, and upon the sale’s conclusion, bids are processed starting from the highest price, with the remaining tokens being returned to the Treasury.

This transparent and inclusive process, accepting USDC, allows for broad participation, catering not just to seasoned crypto traders but also to those passionate about environmental initiatives. The launch on Pilot, known for its user-friendly and accessible platform, underscores AQLA’s commitment to democratizing access to environmental solutions through blockchain technology.

The Road Ahead: AQLA Protocol’s Future Goals

AQLA Protocol is not just focused on carbon credit trading and its cryptocurrency venture; they have expansive future goals that intertwine environmental sustainability with innovative blockchain solutions.

Their immediate plan includes gaining access to substantial trades in the carbon credit market, with an estimated $120 million in trades over the next 24 months and an additional potential of $21 million in trades within the next year.

By Q3 2023, AQLA aims to collaborate on a Direct Air Capture Project in the UK, offering carbon offset accreditation services. This project will not only provide various carbon methodologies but also pave the way for AQLA to develop its high-quality carbon credits starting in Q4 2024.

This ambitious venture involves finalizing stage 1 negotiations, assisting in creating leases with governments, introducing development and methodology documents, and being installed as the Project Developer to produce carbon credits.

AQLA’s roadmap also highlights its intention to expand into different areas of green technology and environmental solutions. This includes exploring the potential of blue hydrogen as a clean energy source, with plans to develop a blue hydrogen plant that could revolutionize energy consumption patterns and significantly contribute to reducing carbon emissions.

Additionally, AQLA is contemplating diversifying into waste-to-energy and plastic recycling projects, tapping into other crucial environmental sectors. Beyond these specific projects, AQLA’s vision extends toward becoming a pioneering force at the intersection of blockchain technology and environmental sustainability. They are committed to enhancing their blockchain platform to maximize impact and establishing themselves as a leader in promoting eco-friendly practices through cutting-edge technological solutions.

This includes continually evolving their platform to meet the dynamic needs of the carbon credit market and leveraging blockchain to bring transparency, efficiency, and accessibility to environmental sustainability efforts.

AQLA’s plans reflect a deep commitment to not just being a participant in the green economy but a driving force in shaping a more sustainable and technologically advanced future.

Conclusion

AQLA Protocol epitomizes the innovative union of traditional business models with cutting-edge technology to confront pressing global challenges.

At the crux of this transformative journey lies the ingenious melding of carbon credit trading with blockchain technology, a step that not only enhances transparency and efficiency but also unlocks new potentials in environmental sustainability.

AQLA’s strategic alliance with Kujira further amplifies this impact, leveraging Kujira’s robust and inclusive DeFi ecosystem to democratize access to carbon credits while ensuring transparent and secure transactions.

This bold foray into the intersection of environmental initiatives and the cryptocurrency realm raises several critical questions that merit further exploration and understanding:

- Accuracy and Integrity of Carbon Credit Data: How does AQLA plan to ensure the accuracy and integrity of carbon credit data on its blockchain platform, considering the complexities of carbon offset projects and potential discrepancies in reporting emissions reductions? The effectiveness of AQLA’s platform hinges on its ability to provide reliable and verifiable data, a task demanding meticulous attention to detail and robust verification mechanisms.

- Development of High-Quality Carbon Credits: AQLA’s commitment to environmental impact extends to the development of its own high-quality carbon credits. Can AQLA elaborate on the specific methodologies it will employ in key areas such as Direct Air Capture, Rainforest Protection, and Oceanic Mangrove Protection? Understanding these methodologies is vital for assessing the potential and efficacy of AQLA’s environmental contributions.

In conclusion, AQLA Protocol’s journey is a vivid example of how innovative thinking and technological adoption can redefine the approach to global environmental challenges.

By integrating the precision and transparency of blockchain with the urgency of carbon credit trading, AQLA stands on the precipice of forging a path towards a more sustainable future. Its collaboration with Kujira enhances this vision, offering a platform that not only caters to the crypto-savvy but also to those passionate about environmental change.

As AQLA continues to evolve and address these critical questions, it positions itself not just as a participant in the crypto and environmental spheres but as a potential leader in bridging the gap between these two worlds.

Understandably there are doubts, concerns, and a lack of clear awareness of what AQLA intends to do and what they have already done. AQLA isn’t alone in this quagmire, my personal opinion is that this is often the case with new, potentially novel, and emerging technologies and projects, especially ones seeking to bridge together two previously unconnected worlds, like that of cryptocurrency and carbon credit trading for example.

What I would say predicated upon this is to be patient with AQLA, consider it a privilege to know of their ambitious goals this early in their conception, and be your own journalist in and around this subject, the AQLA team I’m sure would love to hear from you and have been very receptive and willing to answer any questions or doubts people have in public on X (formally Twitter). I for one am confident and hopeful of the potential good AQLA can do for the world.

To Find out More about AQLA Protocol

Written by El Governor

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.