Learn how to take profit into Stableswap LP’s.

In today’s episode, I introduce the second strategy in our Kujira Investor series, explaining the key concepts and benefits of employing this strategy before providing a comprehensive guide on how to LP stablecoins on BOW.

First things first though, what is a stableswap pool?

Strategy Explained:

Stableswap LPs

A stableswap pool is a type of decentralized exchange (DEX) liquidity pool that is specifically designed for trading stablecoins.

Stablecoins are cryptocurrencies that are pegged to the value of a fiat currency, such as the US dollar, with Kujira’s decentralized stablecoin (USK) attempting to remain pegged to $1. This relatively stable price makes them ideal for trading on a stableswap pool.

Optimal Peg Range

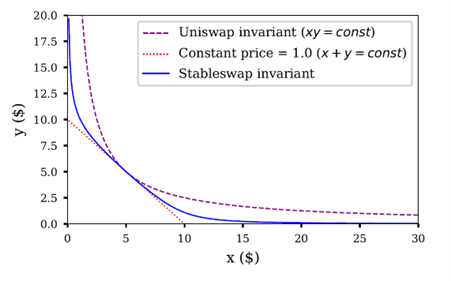

Stableswap pools result in a price curve that is flatter around the optimal peg range.

How this is achieved is complicated and less relevant to investors, so we will focus instead on the implications of this concept.

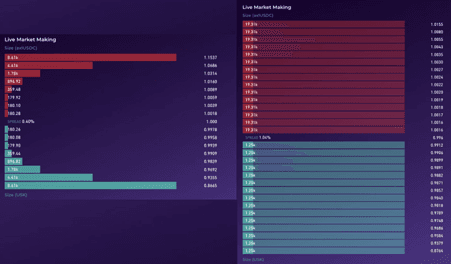

In this diagram, we can see that by placing larger limit orders around the central limit (which should be $1), larger trades will have a minimal impact when made around the peg, which is ideal for stablecoins like $USK.

You can view the differences in limit order placement between the standard XYK pool and the stableswap pool below.

Stableswap LP Benefits

BOW offers a USK-USDC stableswap pool on Kujira that offers several benefits, including:

High APR

- BOW currently offers a 40% APR on stablecoin LPs (as of 11/11/23).

Sustainable Yield

- 35% of the APR is non-incentivized trading APR, which means that the yield is sustainable even if the Kujira team stops providing incentives.

Put Your Assets To Work

- APR earned on stablecoins currently beats lending rates on GHOST.

- Investors can take profit from your Kujira Assets into a yield-bearing Stablecoin LP, generating stable, consistent returns.

How To LP Stablecoins On BOW

To start LP’ing stablecoins on BOW, you will first need to create a SONAR wallet, which you read up on how to do here.

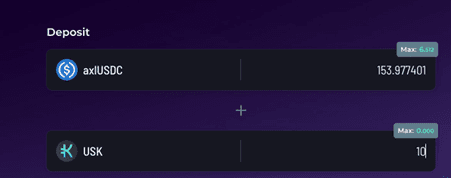

Upon creating your wallet, navigate to the stableswap LP and click ‘Provide’.

Unlike traditional LPs, which require a 50/50 split between assets, deposits for stableswaps work differently. Simply, add USK and see the amount of USDC you are required to deposit.

Now, let’s briefly explore some additional benefits of deep liquidity stableswap pools.

Stableswap LPs: Additional Benefits

Easier Transfer Of Stablecoins Into USK

As you may know $USK is the stablecoin native to the Kujira ecosystem, and is used for a multitude of purposes on Kujira, such as bidding on liquidations (ORCA), trading asset pairs (FIN), or lending (GHOST).

A deep liquidity stablecoin-stableswap LP implies a larger amount of available liquidity in the pool, making it significantly easier to transfer stablecoins into USK.

Improved UX For Traders

Deep liquidity provides a better user experience for investors, who benefit from better price execution on their trades and less slippage.

Increased Attractiveness Of The Kujira Ecosystem

A deep liquidity stablecoin stableswap pool makes the Kujira ecosystem more attractive to users, as it makes it easier to trade stablecoins and other assets on Kujira.

Deep liquidity makes it easier to trade stablecoins and other assets on Kujira, making the ecosystem much more attractive to current users and prospectie investors.

Strategy Summary

- A stableswap pool is a type of decentralized exchange (DEX) liquidity pool that is specifically designed for trading stablecoins.

- Deep liquidity enables easier transfer of stablecoins into USK, improving the UX for investors and making the ecosystem more attractive as a whole.

- LPing stablecoins on a deep liquidity stablecoin stableswap pool (BOW) is a great way to earn a sustainable yield, and is an attractive option for both current users and prospective investors.

Useful Links

- BOW stableswap pool

- BOW by Kujira

- Kujira Investor Series: Episode 1

- Depositing Funds To Kujira Article

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and web3, providing them with rigorous education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of the Kujira Academy, click here.