In this article, I will walk you through how to mint USK, provide liquidity on BOW, and the benefits that LPs provide to Kujira. Within the article, you will see GIFs and pictures that demonstrate how each process works to aid your understanding. Minting USK and providing liquidity is the perfect way to gain more exposure to the digital asset sector whilst also leveraging this extra capital to earn yield on top of it.

Contents

- Minting USK

- Providing USK Liquidity On Bow

- Benefits And Incentives For Providing USK Liquidity

- Useful Links

Minting USK

- Go to https://blue.kujira.app/

- Navigate to the “Mint” tab:

Tab on BLUE to mint USK - Click “Open Position” in the blue box.

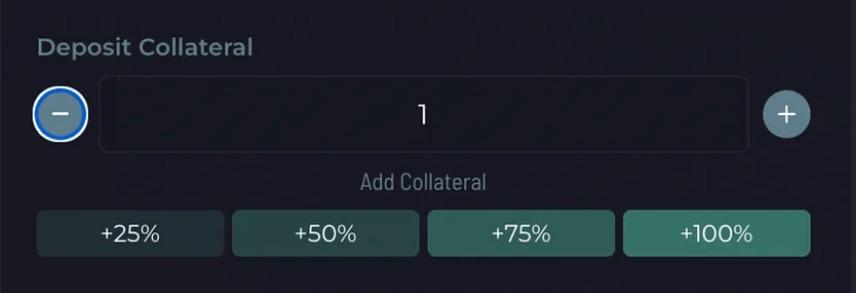

- In deposit collateral, enter the amount of ATOM (for example) you wish to lock up. Remember you can only borrow up to 60% of this value, so factor this into your decision — a lower LTV is safer as it is more resistant to market downswings.

There are many different collateral types for you to choose too, such as wBTC or wETH.

Deposit collateral to mint USK against -

Enter how much USK you wish to mint. When this number is entered, you will see some stats to the right that show what your open position will look like once created. The most important numbers to look at are the LTV and the liquidation price. Watch the GIF below to see how this works:

GIF demonstrating 1 ATOM used to mint 3 USK -

Click “Open Position” and approve the transaction in the Keplr popup.

You will now have minted USK using various cryptocurrencies as collateral, increasing your overall exposure to digital assets. But now that you have leveraged your capital, what can you do with the USK?

Providing USK Liquidity On Bow

- Go to https://bow.kujira.network/pools

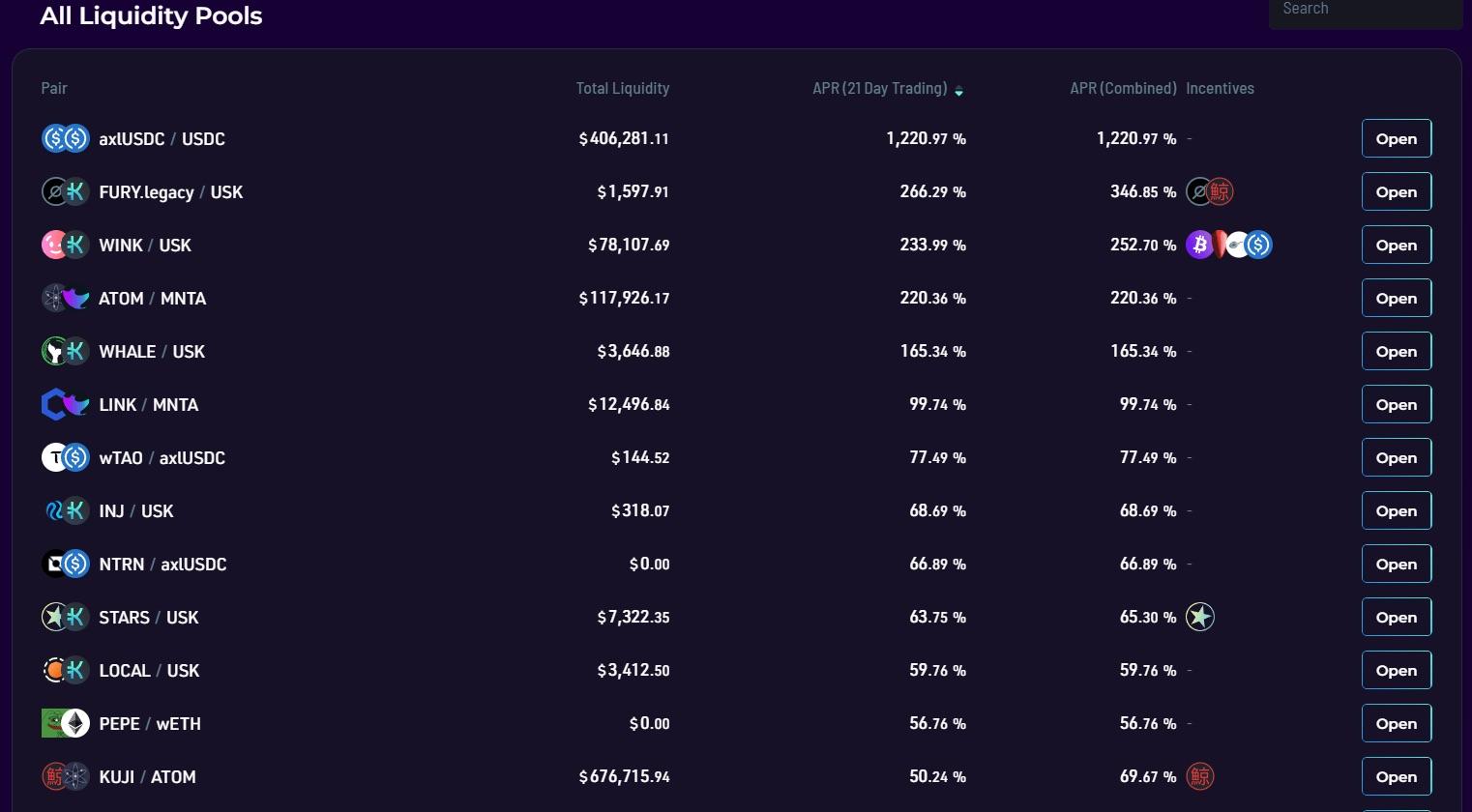

- In the “Pools” tab, scroll down to All Liquidity Pools. Here you can order the pools by 21-Day APR and APR + Incentives (APR combined). Select “Open” on the pool you would like to provide liquidity to.

BOW LP homepage - Here you will see statistics such as total liquidity and the combined APR of the LP you selected. Click the blue “Provide” button next to “Get started by providing liquidity for this pool.”

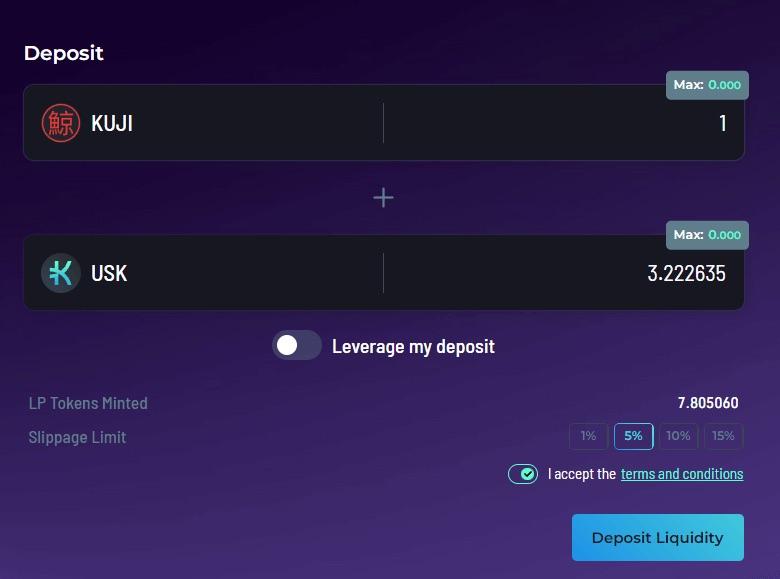

KUJI/USK LP on BOW offering 51% APR - Enter the amount of KUJI/USK you would like to add. Most BOW pools are standard XYK pools and therefore will require you to deposit a 50/50 split of both assets. Read and accept the terms and conditions, then click deposit liquidity. Lastly, sign the transaction in the wallet

Benefits And Incentives For Providing USK Liquidity

Providing Liquidity is beneficial to both the user and the Kujira ecosystem. The yield that LP providers receive is derived directly from trading fees generated on FIN. LP providers can unbond at any time as there is no lock period. In addition to receiving a high APR percentage, incentives can also be provided to any pool, by any user. The current APRs can be seen in the graphic below.

APR offered for LPs on BOW

BOW’s primary purpose is to increase the volume of trading on FIN and enhance the benefits of staking. LPs help tighten the bid/ask spreads of pairs on FIN (meaning less slippage is incurred on trades). Increases in trade volume attract more users to FIN, generating more fees for LPs. A large increase in volume will onboard both more users and builders to the Kujira ecosystem.

This completes this walk-through. You now know how to mint USK, provide liquidity to an LP on BOW, and the benefits it provides to both the user and the Kujira ecosystem.

Useful Links

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.

Written by Kurayami