This article is for informational and educational purposes only and should not be construed as an offer, solicitation, or recommendation to buy or sell any financial instruments or engage in any investment strategy. The information provided does not constitute financial, investment, trading, or other types of advice and is solely the opinion of the presenter. It is important to conduct your own research and consult with a qualified financial advisor before making any investment decisions. The author and the organization they represent do not assume responsibility for any potential risks or losses arising from any investment decisions made based on the information provided.

Kujira is rapidly advancing its mission to create a comprehensive DeFi ecosystem with its native Layer 1 blockchain. Among its suite of decentralized applications (dApps), ef=”https://interchaininfo.zone/indexes/ghost-2″ target=”_blank” data-ici-summary=”A decentralized, open-source platform for creators and publishers” title=”Ghost”>GHOST

and BOW stand out for their lending and liquidity-providing capabilities.

This article explores an investment strategy utilizing Kujira protocols, focusing on lending wrapped Ethereum (wETH) on GHOST and providing liquidity on BOW for the USK/NSTK and USK/MNTA pairs. Additionally, the GHOST Lending Guide and BOW LP Guide offer walkthroughs for how exactly to implement this strategy.

Table of Contents

- GHOST and BOW

- Investment Strategy

- Strategy Results

- Walkthrough

- Conclusion

- Useful Links

GHOST and BOW

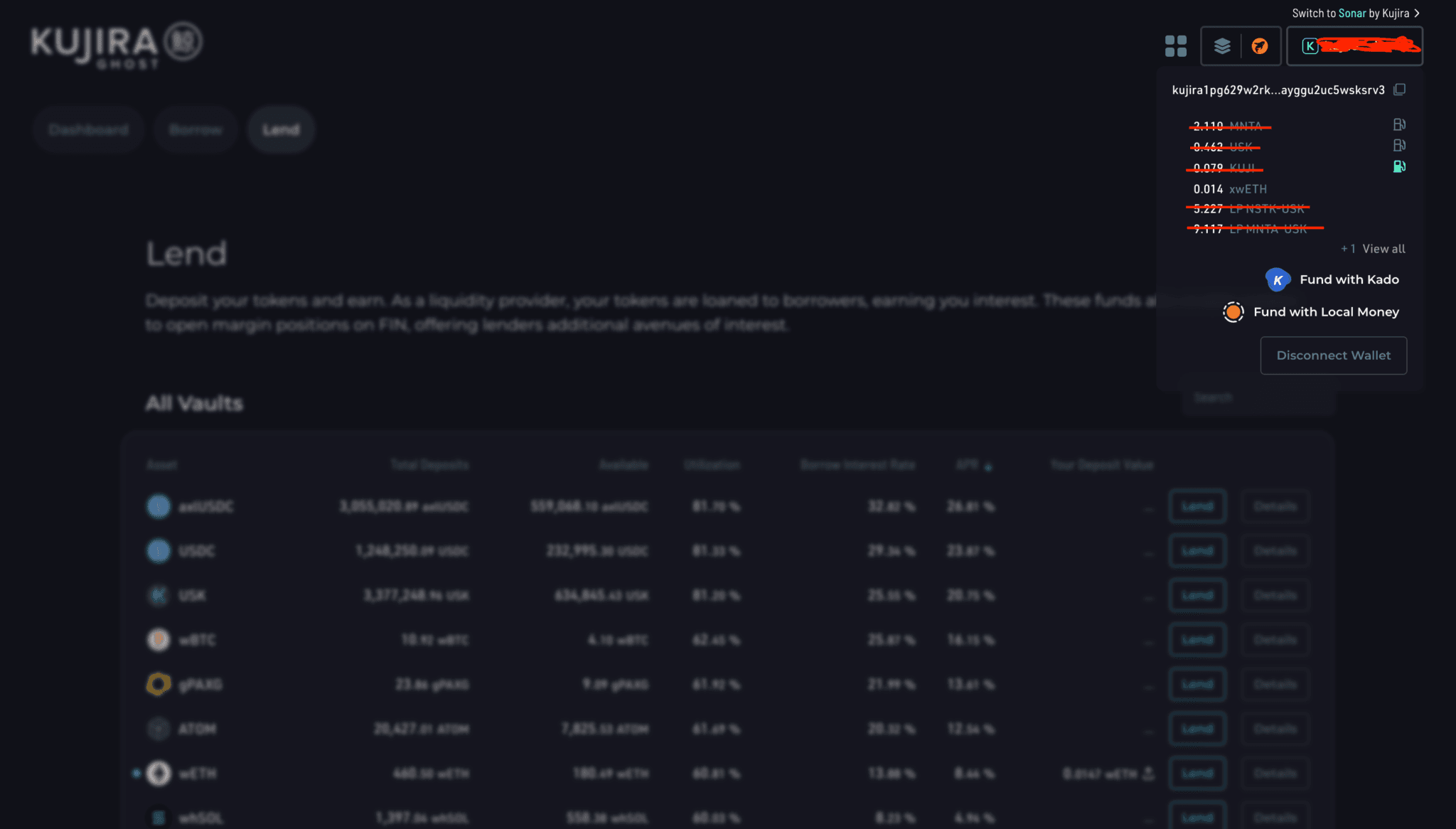

GHOST is a decentralized money market on Kujira designed for lending and borrowing through a supply-demand framework. It offers attractive returns without relying on artificial incentives. As an overcollateralized market, GHOST ensures lenders are covered even if borrowers default. Users can lend assets and receive liquid units of ‘xTOKEN,’ which accrue interest from borrowers’ open loan positions. This model allows investors to earn a variable interest rate, putting idle capital to work and earning a yield without a lock-up period.

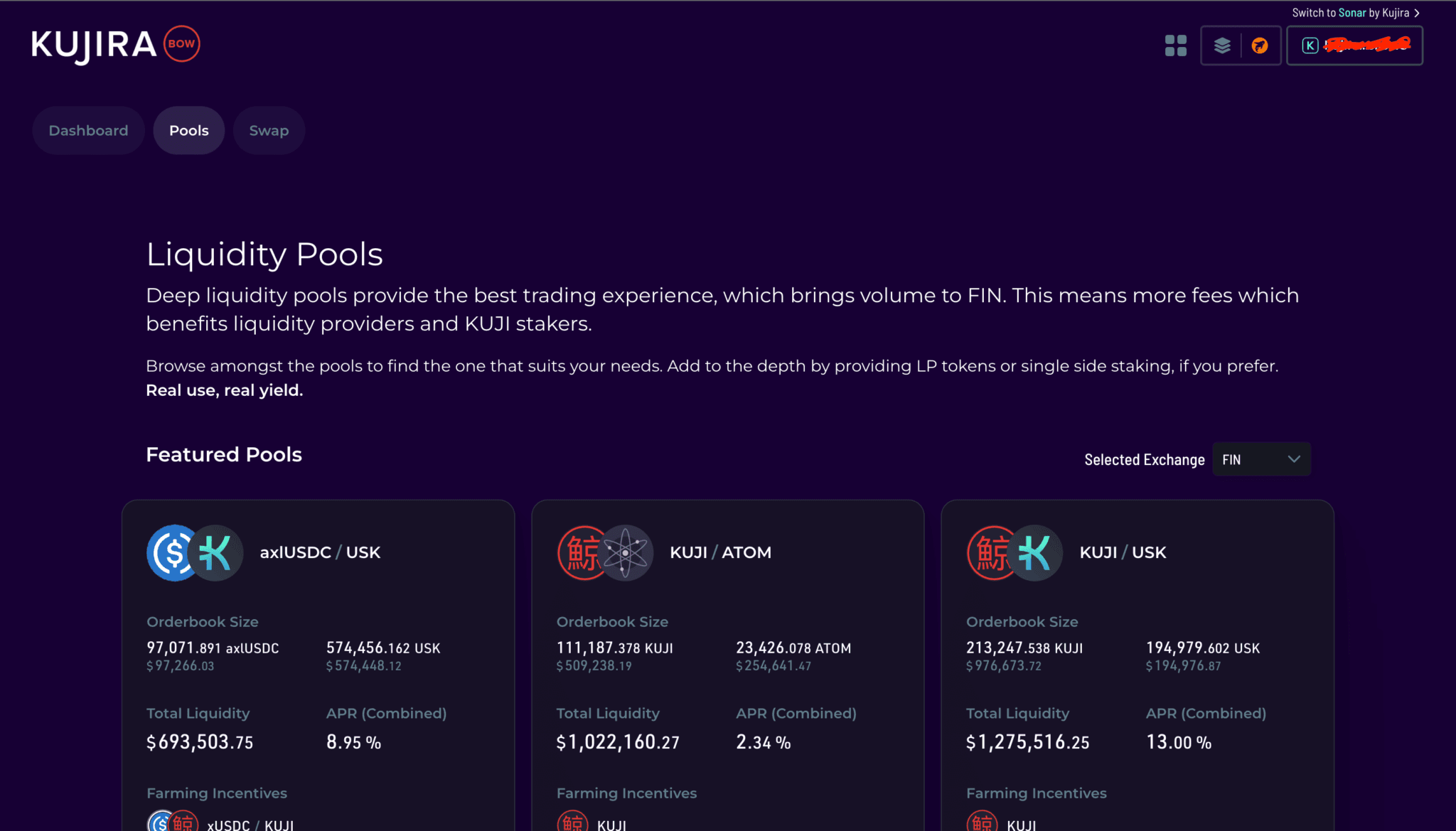

BOW is Kujira’s take on an Automated Market Maker (AMM), integrated with FIN, Kujira’s on-chain orderbook decentralized exchange (DEX). It narrows price spreads and deepens order book depth, providing an optimal trading environment. BOW’s unique algorithm places orders based on internal token balances, buying low and selling high, and adjusting orders as the market moves. This self-sufficient, on-chain market maker enhances trading on FIN and benefits the ecosystem by increasing volume and stability.

Investment Strategy

With 100 axlUSDC, over the past month, I put this strategy into practice on the Kujira blockchain by evenly distributing funds across the three investments:

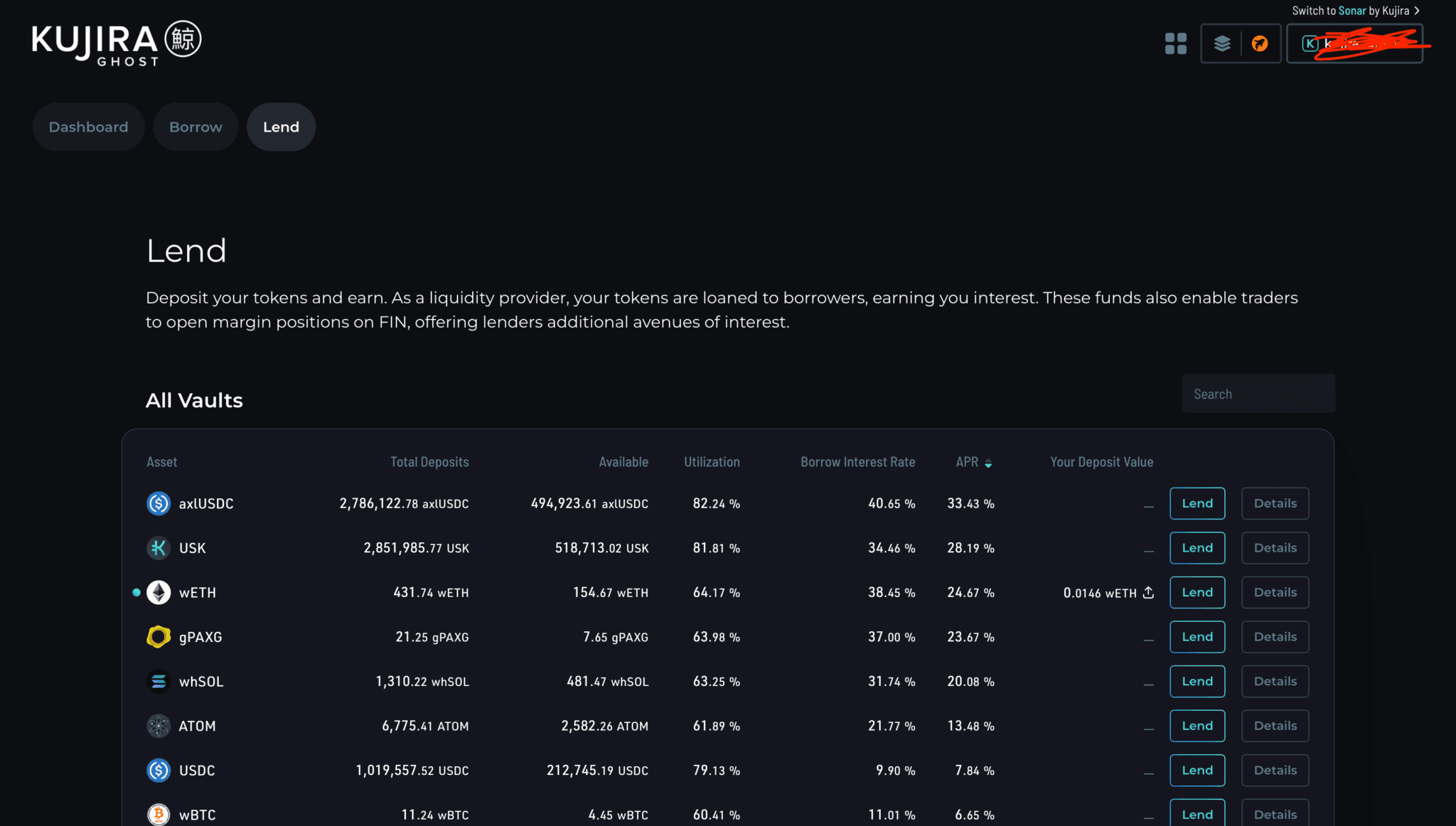

Lending wETH on GHOST: Firstly. I allocated approximately 33.33 axlUSDC to lend wETH on GHOST. This investment will earn variable interest, contributing to a passive income stream.

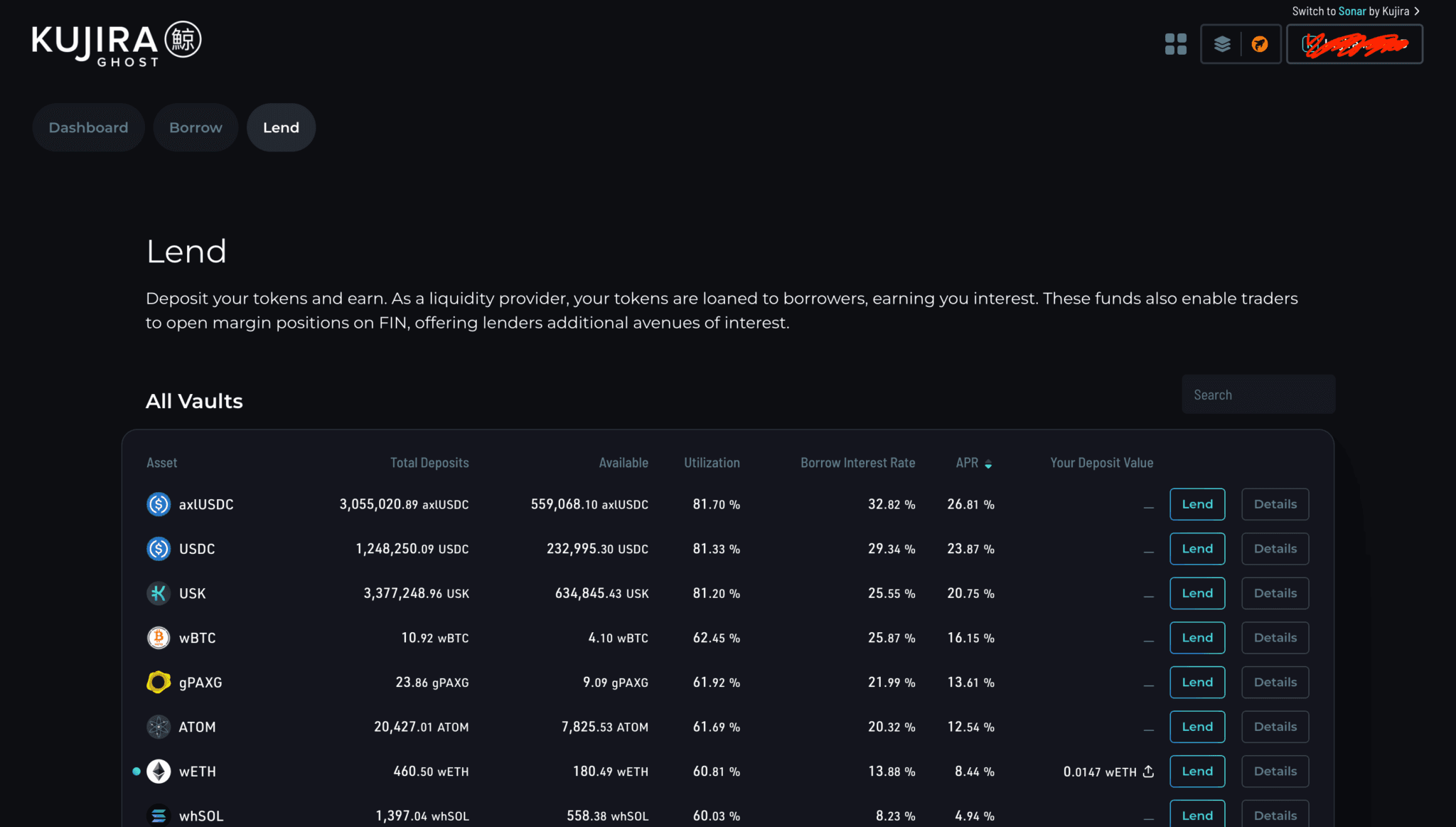

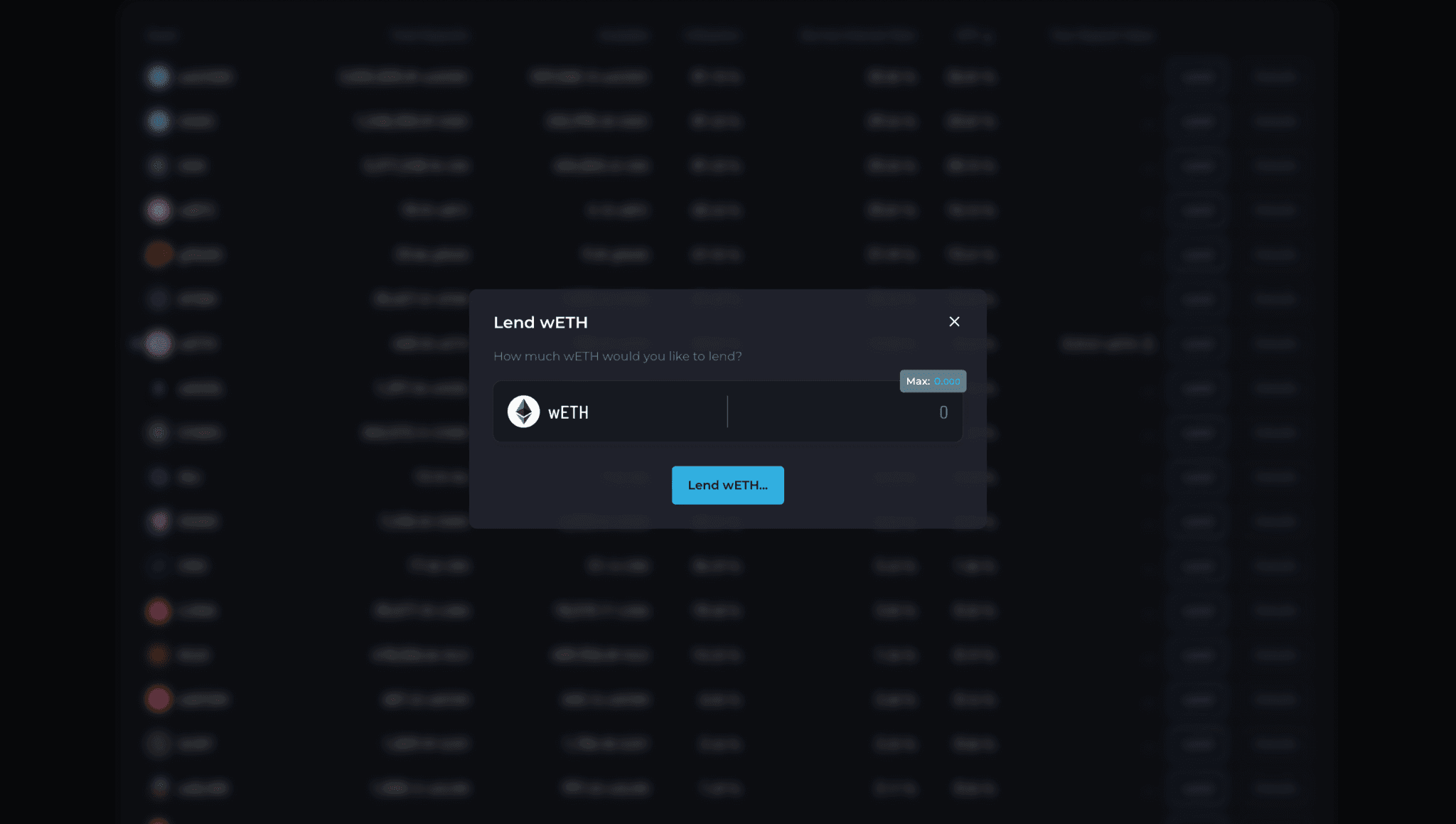

GHOST Lending Dashboard Displaying wETH Deposit

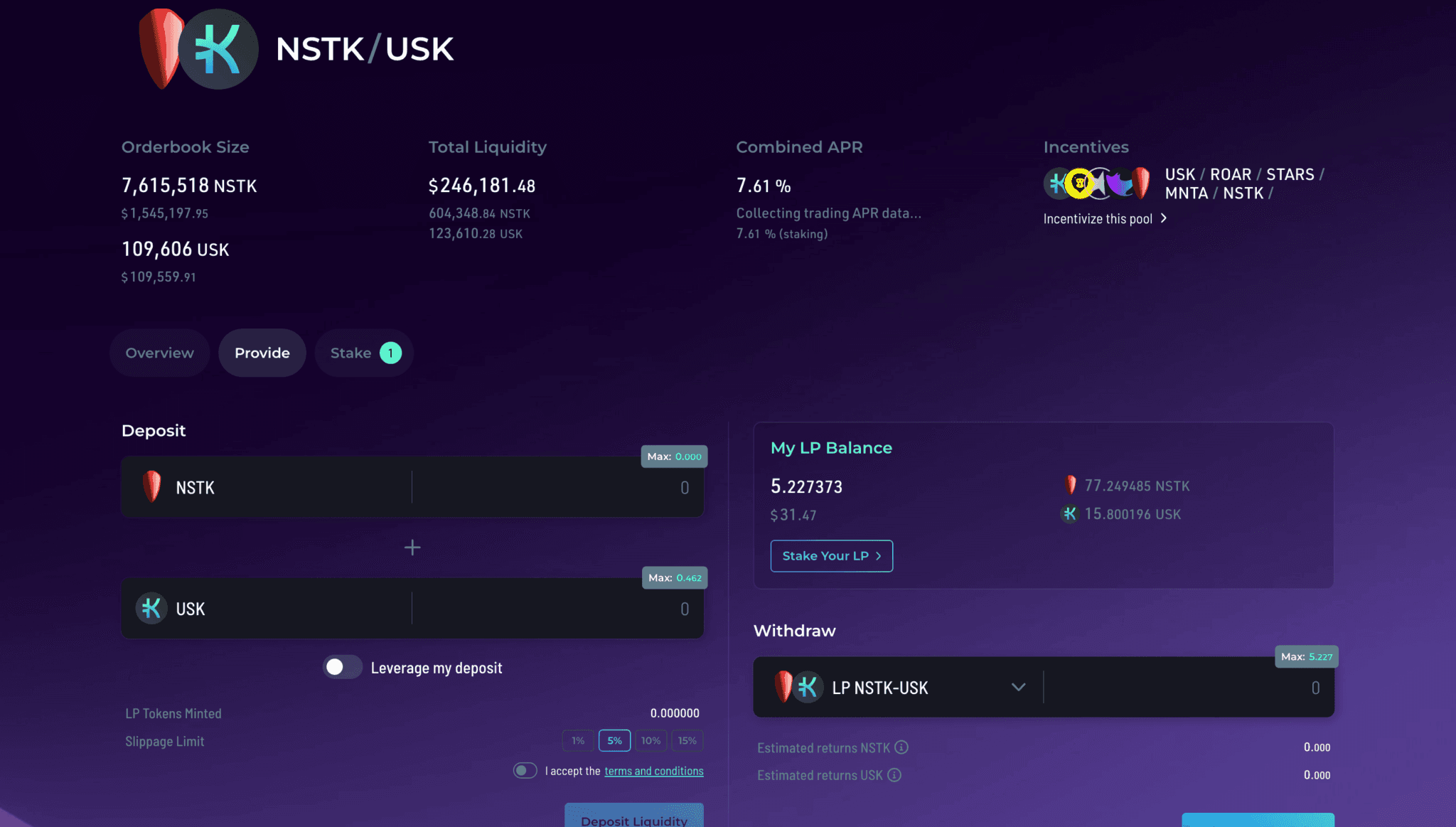

Providing Liquidity on BOW for USK/NSTK: I allocated another 33.33 axlUSDC to provide liquidity for the USK/NSTK pair on BOW. Providing liquidity earns a share of transaction fees and additional incentives if staked.

NSTK, associated with Unstake.fi, is a protocol designed to allow for instant unstaking in the Kujira ecosystem. It borrows from GHOST during the unbonding period and must pay interest. The protocol calculates the maximum potential interest over the unbonding period to determine a safe and reasonable offer rate for users wishing to unstake immediately. It uses a reserve fund to cover any shortfalls between the agreed rate and the actual interest incurred, ensuring solvency and the ability to repay GHOST.

NSTK/USK LP Page

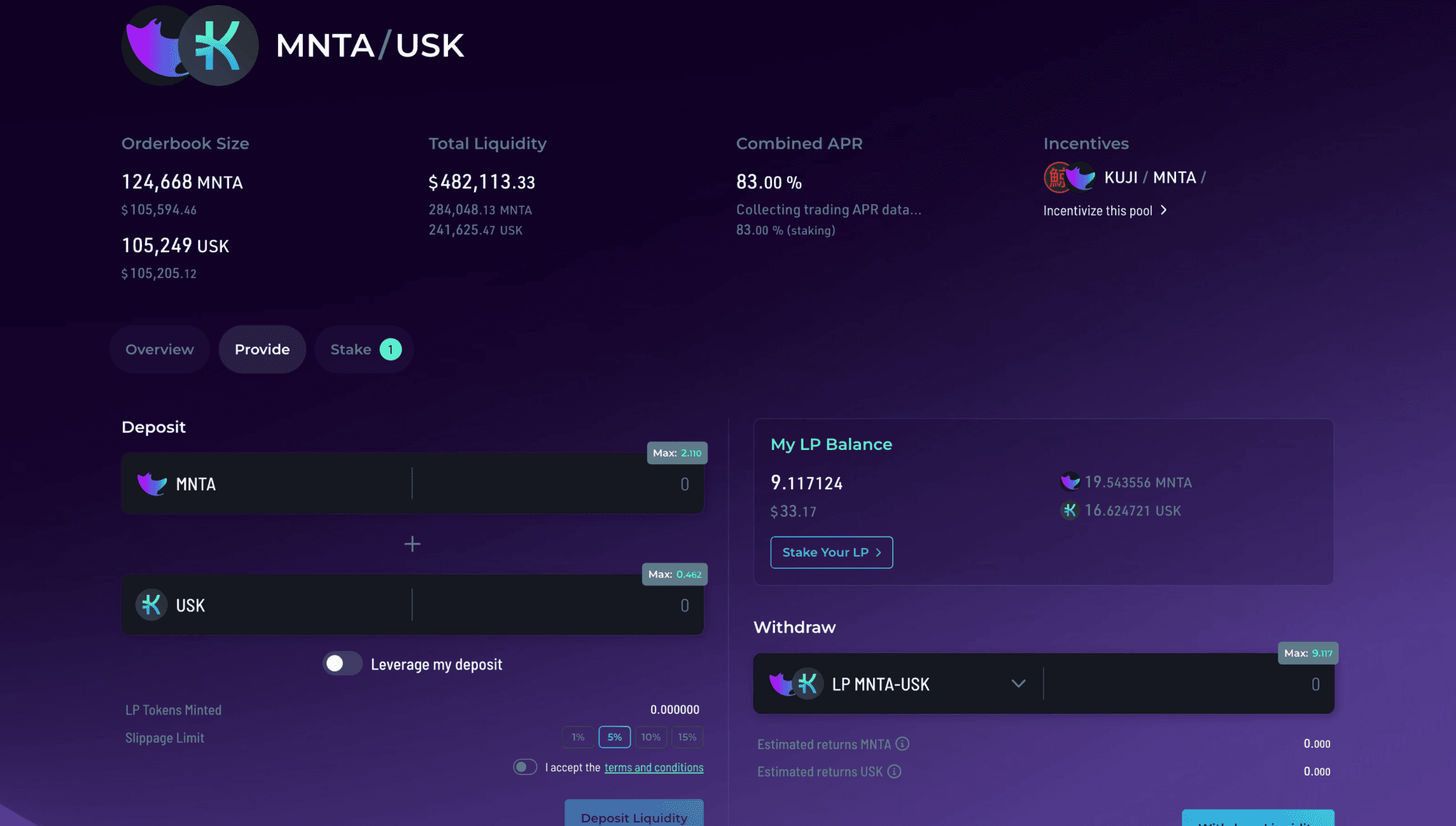

Providing Liquidity on BOW for USK/MNTA: I allocated the remaining 33.33 axlUSDC towards providing liquidity for the USK/MNTA pair. Similar to the USK/NSTK pair, providing liquidity here is rewarded with transaction fees and incentives if staked.

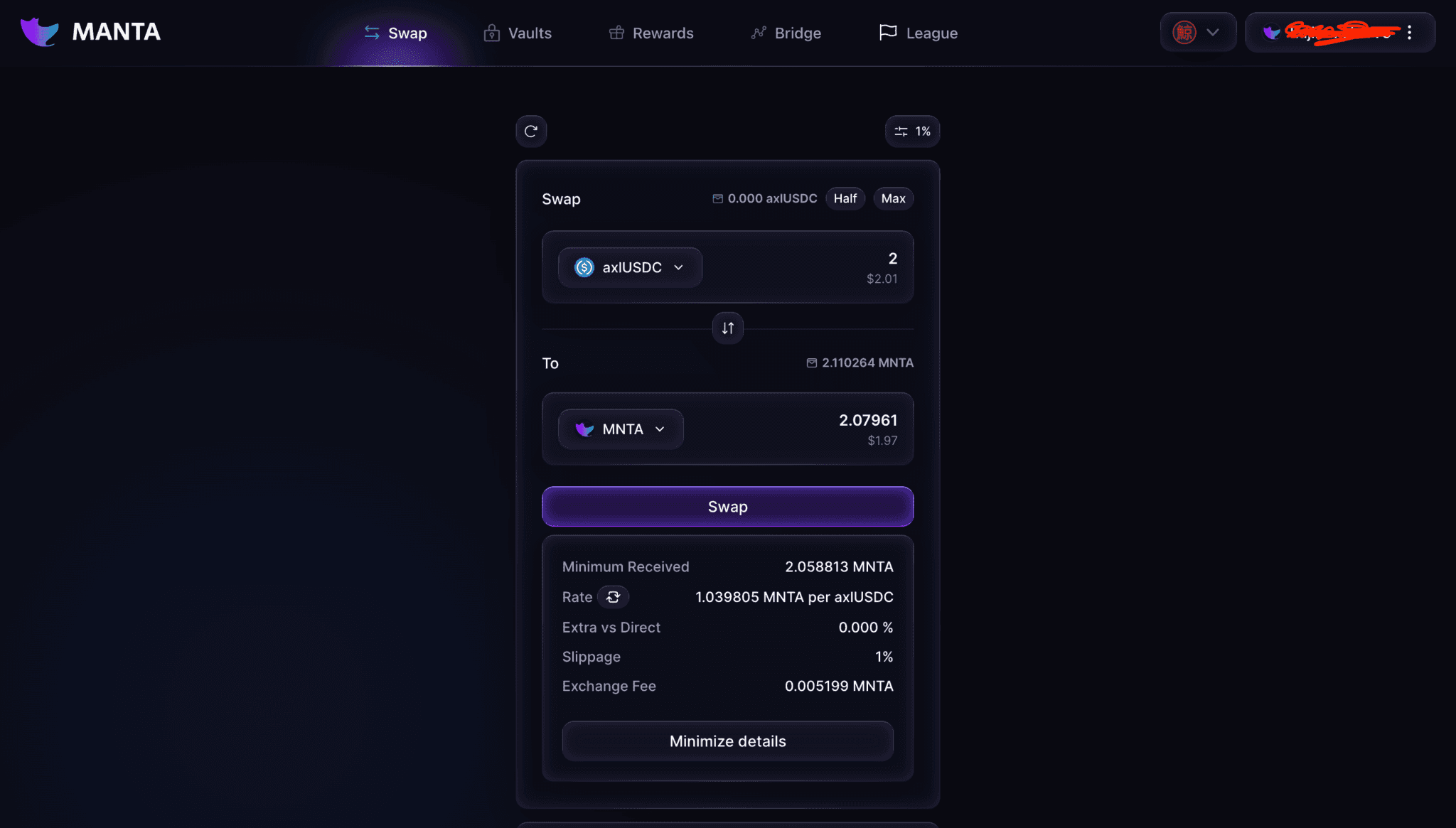

MNTA is the governance token for MantaDAO. MantaDAO is a decentralized market-making organization deeply integrated with Kujira’s FIN. It aims to provide liquidity and improve the trading experience on the orderbook DEX. MantaDAO operates through a sustainable model, building protocol-owned liquidity (POL) and generating revenue without relying on inflationary rewards. Its mission supports the Kujira ecosystem by ensuring low slippage and reliable price tracking, benefiting traders and KUJI stakers alike.

MNTA/USK LP Page

Over the past month, the yield from each investment was monitored. Lending on GHOST provided a variable interest based on borrowing rate to deposits ratio, while liquidity providing on BOW offered variable returns based on trading volume and incentives.

For liquidity providers who stake their LP tokens, they will be exposed to greater APR due to the incentives which are given out to stakers of incentivized trading pairs.

The performance will give insights into how these stable and passive income strategies perform on Kujira, helping to refine future strategies.

Strategy Results

Over the course of this past month, the portfolio returned a yield of 11% as measured from November 11th, the date of investment, to January 11th, the date the xwETH was exchanged back for wETH and the LP tokens were cashed out for the tokens comprising the trading pair.

Notably, due to an oversight on my part, the LP tokens were not staked to receive the incentives. While not being relevant to the USK/NSTK trading pair due to the low incentives, this severely limited the yield from the USK/MNTA trading pair which was heavily incentivized. A rough estimate of the additional yield which could have been generated is 5.4% with respect to the value of the portfolio. This is based on the APR from staking estimates listed on the BOW lending page. Therefore, if the LP tokens were staked, the portfolio would have generated approximately 16.4% yield.

Important Note: One day after writing the above section (now Jan. 12), the prices of NSTK, wETH, and MNTA dropped from yesterday’s local highs and the total yield has dropped to 3% (while the LP tokens and xwETH were traded in, I did not cash out into stablecoins). This just goes to demonstrate how in volatile environments like crypto, nominal yield over a short period of time is an unreliable measure of an investment strategy long term. This emphasizes my point below about token yield.

While the nominal yield is an important measure for investors looking to transfer their money back to fiat within the short to mid-term, more important measures for investors who believe long-term in the projects they are invested in are the yield with respect to the tokens (wETH, MNTA, NSTK). Another way of phrasing this type of yield is how much more of said token has been generated via this investment.

Token yield, as opposed to USD yield, is particularly helpful as it demonstrates a direct comparison between an investment strategy of holding the tokens in question and the investment strategy of utilizing the tokens via lending or liquidity providing.

Additionally, for those looking to cash back to fiat in the mid-long term, token yield is crucial for estimating implied nominal yield. Implied nominal yield is the yield with respect to USD generated at some given point in the future given your estimate of token appreciation over that period of time.

The token yields for wETH, NSTK, MNTA, and USK across these strategies were 2.2%, 13.3%, -14.6%, and 3.8% respectively. I know what you are thinking… how on earth did you get negative MNTA token yield from this strategy? This is one of the quirks of providing liquidity. In a situation where the exchange rate for the tokens you deposit changes (e.g. MNTA appreciates in price relative to USK), the ratio of tokens you will receive upon withdrawing your LP tokens will change. This makes negative token yield possible.

However, it is not possible to get negative token yields on both tokens in the pair. In this situation while I had -14.6% MNTA token yield, I received a token yield of 18% for USK on the same LP investment. I also experienced a negative USK token yield but a greater positive NSTK token yield on the LP NSTK/USK investment. This quirk is definitely something to consider if you are looking to provide liquidity and you see the exchange rate between the tokens drastically changing.

These token yields reflect that by utilizing the Kujira ecosystem and putting my capital to work with this strategy, I have generated that percentage more (or less) of these tokens with which I can ride the imminent bull market.

Walkthrough

This section provides step by step guides on how to lend on GHOST and how to provide liquidity on BOW respectively. These guides assume that the user has already onboarded themselves into the Kujira ecosystem. Click here for a guide to onboarding funds into Kujira.

GHOST Lending Guide

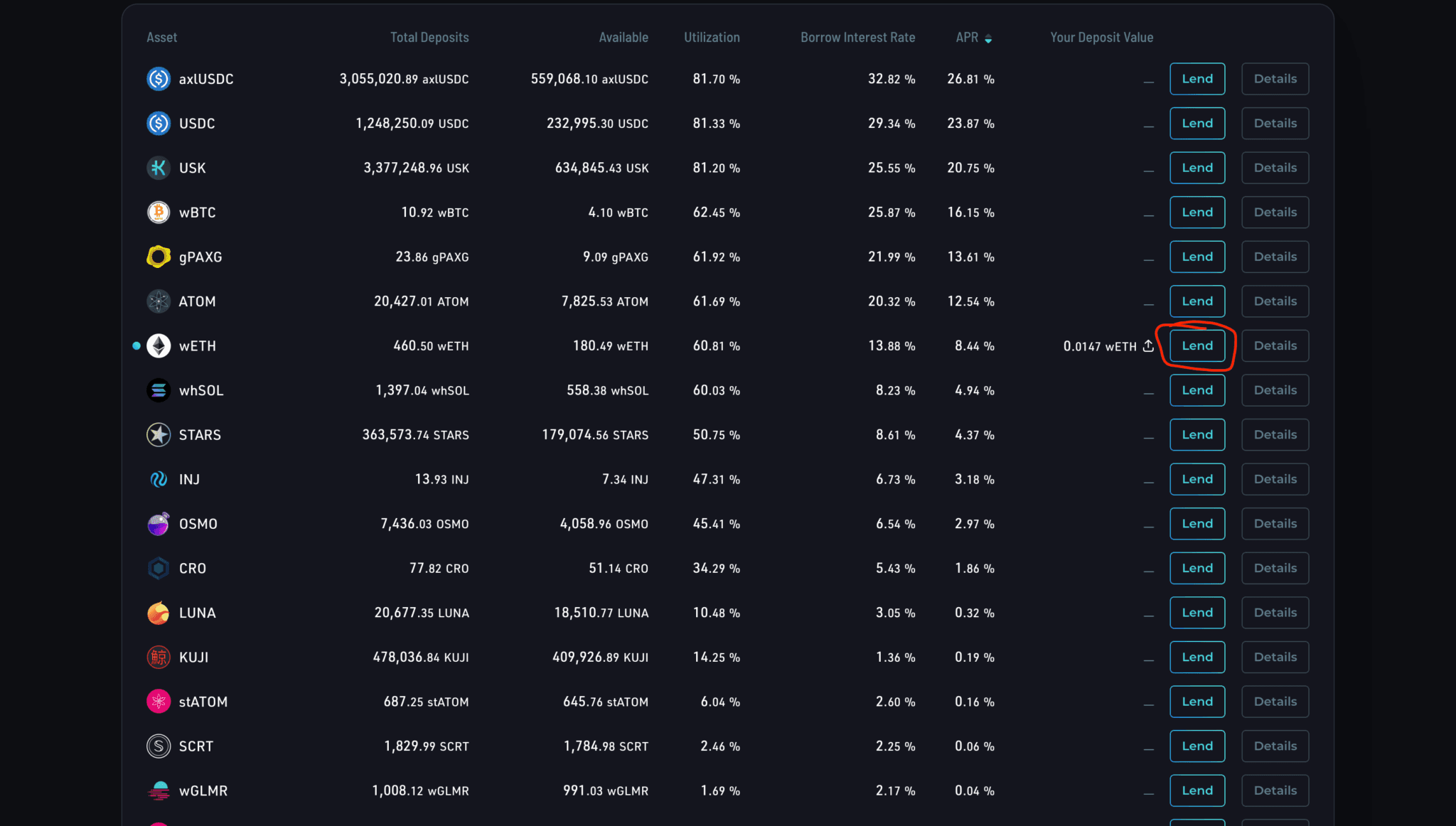

1. Navigate to the “Lend” page on GHOST. Determine the asset you wish to lend in the list. See the APR column to estimate the potential upside of the investment. See the “Total Deposits” column as well as the token price (which you can find on CoinGecko) to approximate the stability of the interest rate. Take this into account alongside your knowledge and belief in the token.

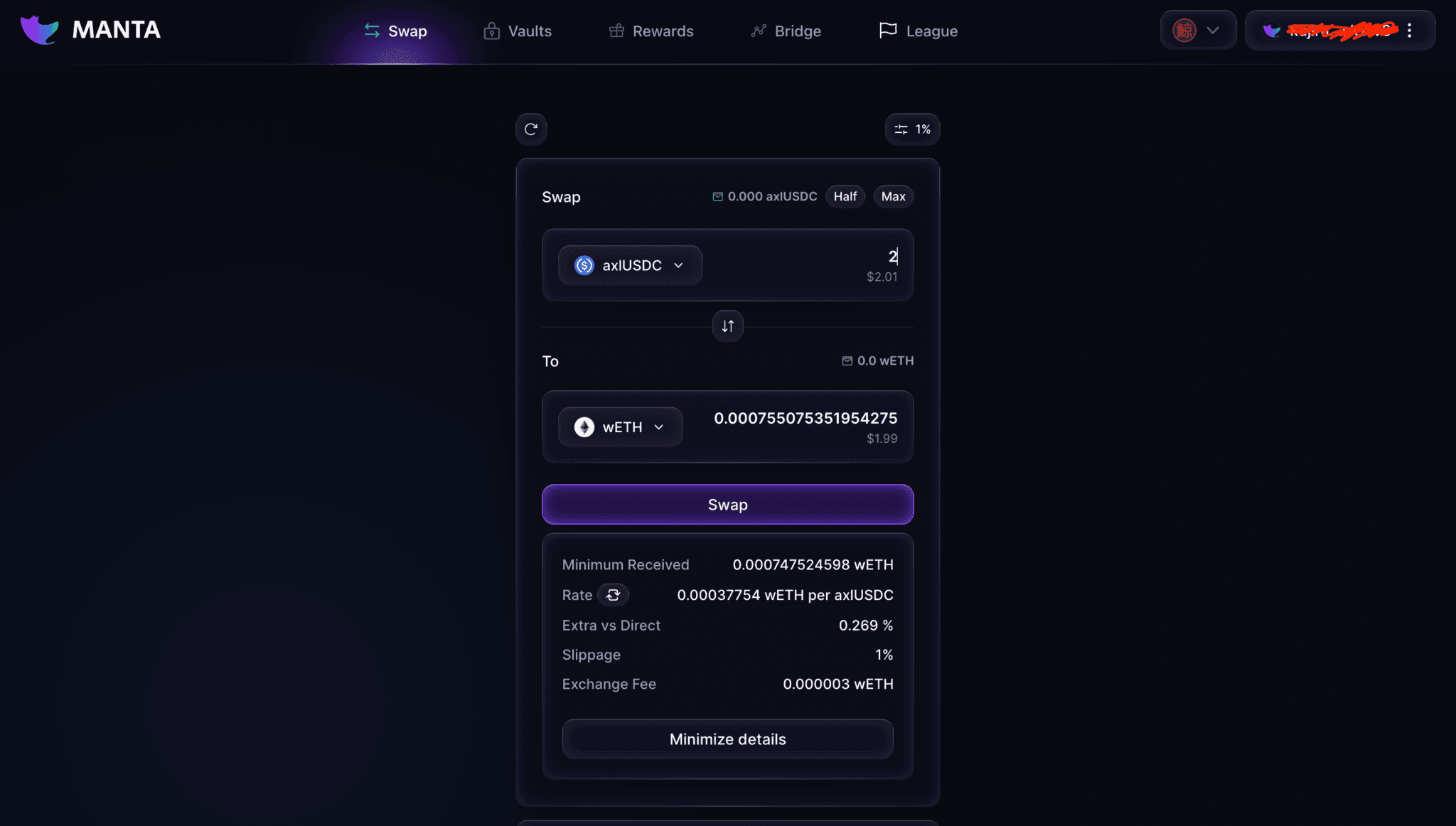

2. Use MantaSwap or FIN to trade the asset in your current wallet for the asset you are looking to lend (not necessary if you already have the token in your wallet). Also, ensure that you have some KUJI for gas fees.

3. Navigate back to the “Lend” page on GHOST. Connect your wallet by clicking the button in top right corner. Once your wallet is connected, click the “Lend” button in the row corresponding to the asset you are looking to lend.

4. Enter the amount you are looking to lend. Click the max button if you are looking to lend all of that token in your wallet. Click the “Lend [TOKEN]” to proceed with the transaction. Confirm the transaction through your wallet.

5. Once the transaction has been processed you should be able to see the xTOKEN in your wallet when hovering your cursor over the box which displays your wallet address.

xwETH Displayed in Wallet

BOW LP Guide

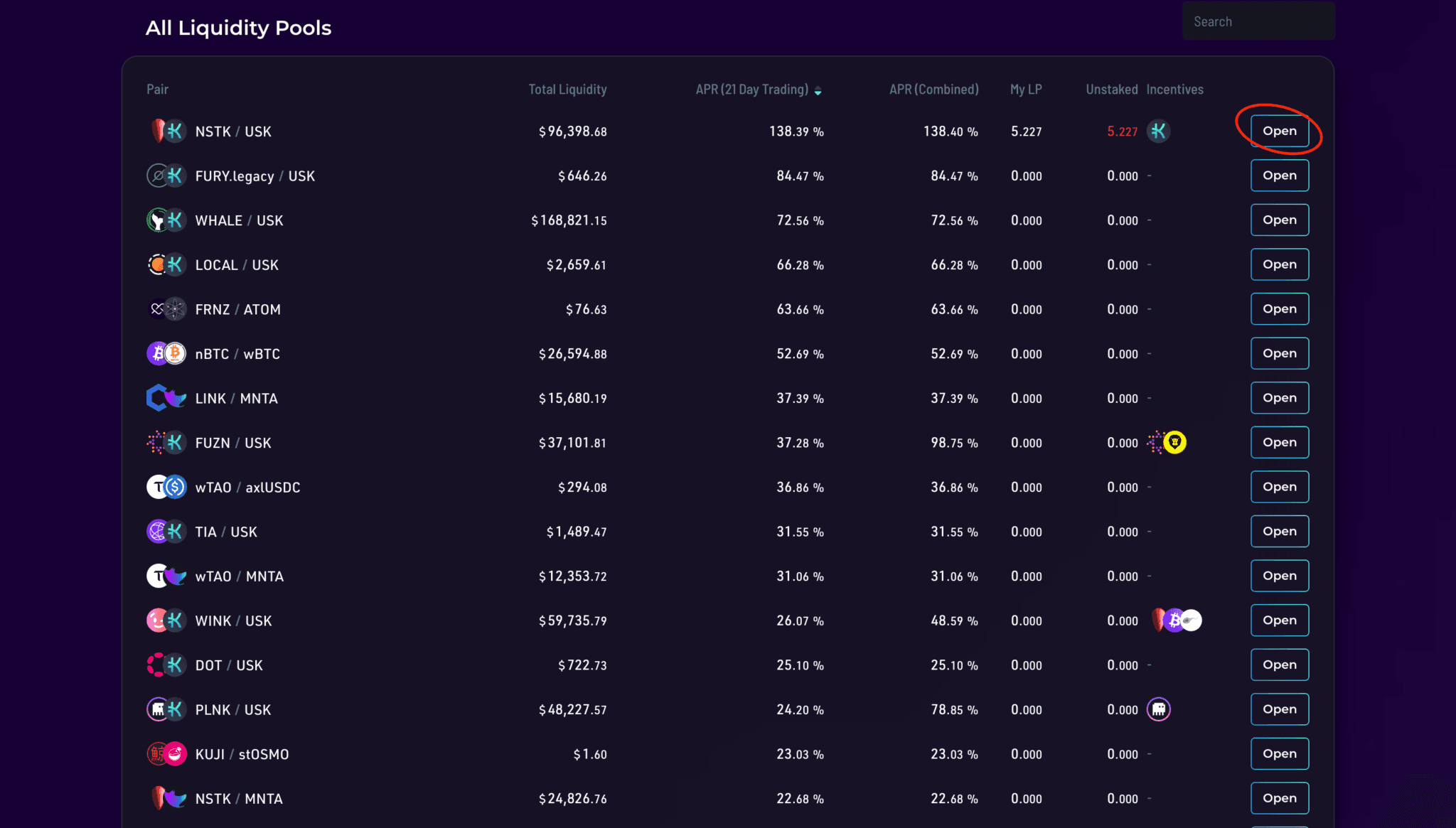

1. Navigate to the “Liquidity Pools” page on BOW. Scroll through the different pairs noting the liquidity which often correlates to the pools stability as well as the APR to look at potential yield. Determine a liquidity pool you would like to contribute to.

2. Use MantaSwap or FIN to trade the assets in your current wallet for the two assets in the liquidity pair (not necessary if you already have the tokens in your wallet). Please note, you will have to contribute approx. the same value of each token to the pool. Also, ensure that you have some KUJI for gas fees.

Mantaswap axlUSDC to MNTA UI

3. Navigate back to the “Liquidity Pools” page on BOW. Locate the LP pair you are looking to provide to and click the “Open” button on the right-most column.

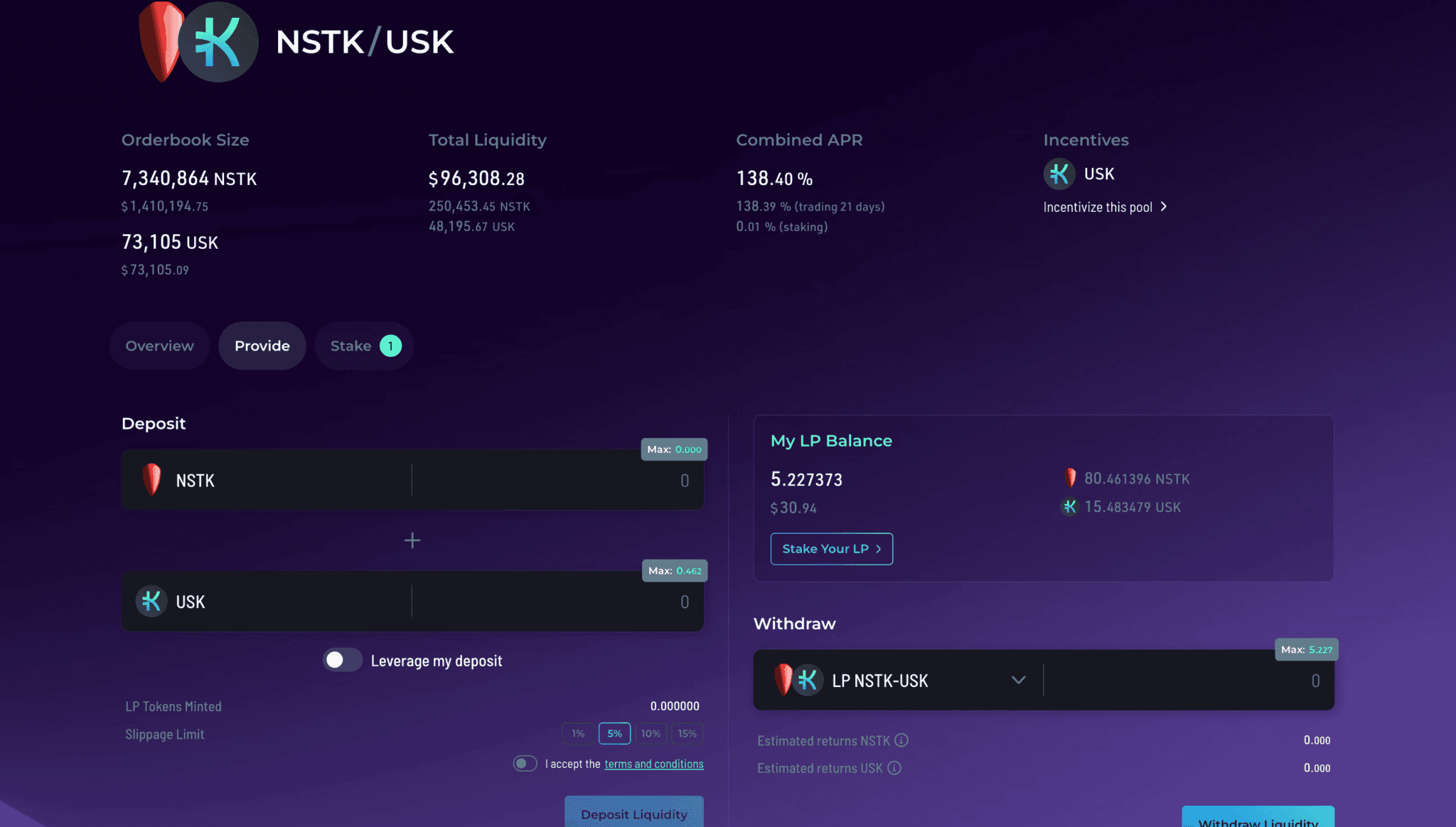

4. Click on the “Provide” button and input the amount of one of the tokens you would like to contribute to the pool. The corresponding amount of the other token of the same value will autofill. Then toggle the “I accept terms and conditions” button (read through them if you like) and click on the “Deposit Liquidity” button and confirm the transaction with your wallet.

Provide Liquidity for NSTK/USK Page

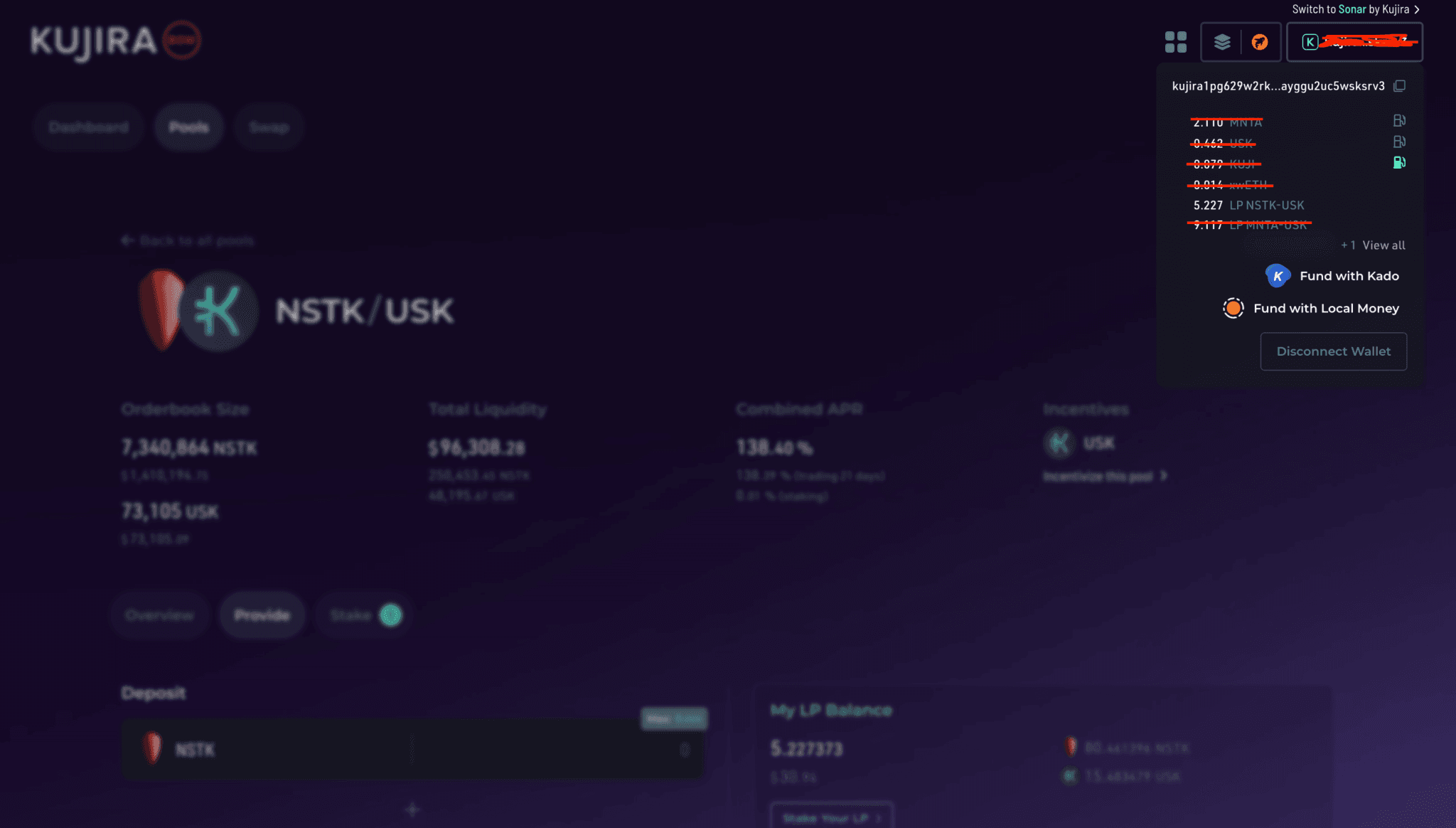

5. Once the transaction has been processed you should be able to see the LP token in your wallet when hovering your cursor over the box which displays your wallet address.

LP NSTK-USK Displayed in Wallet

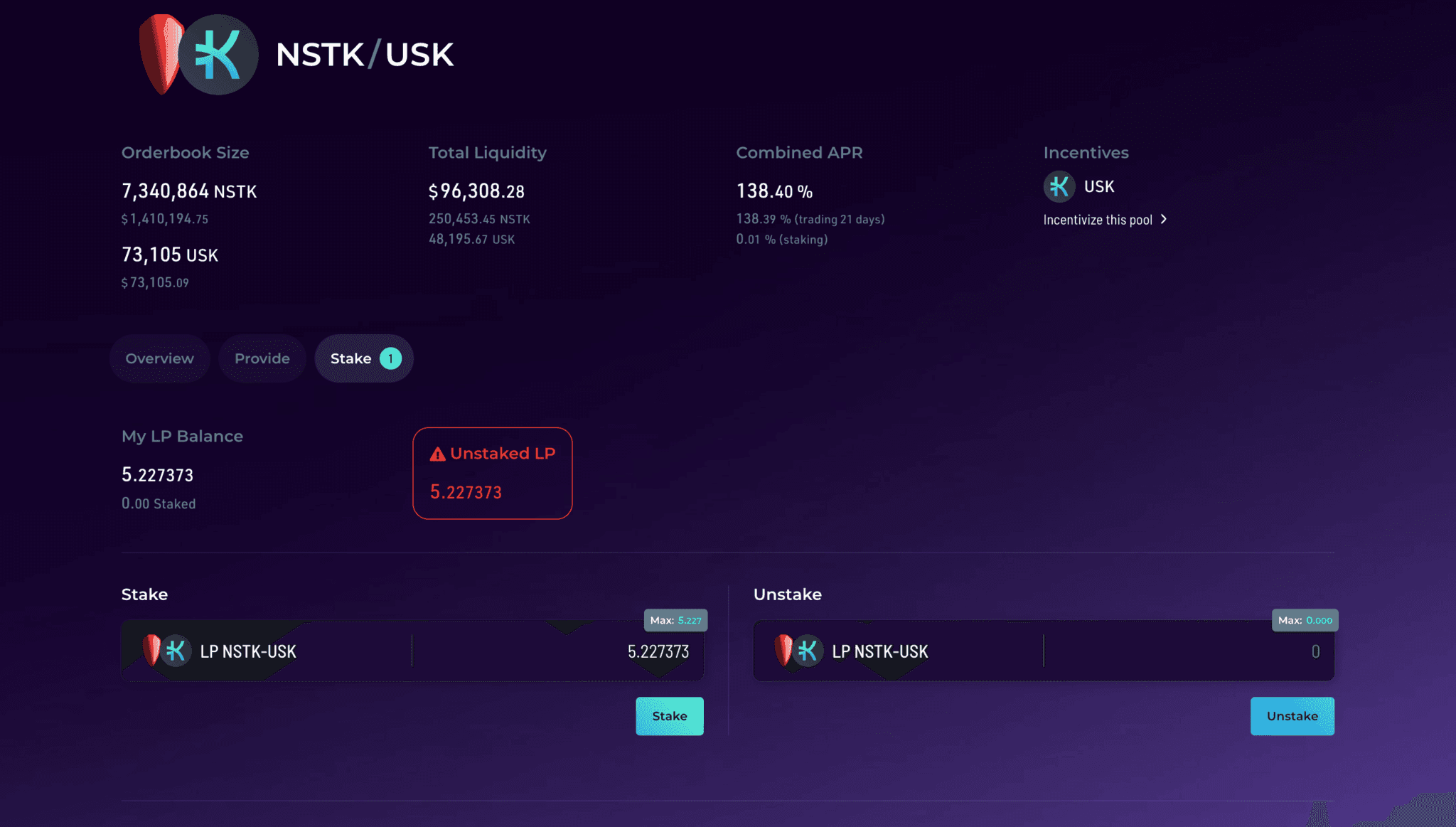

6. To stake your LP tokens click on the “Stake” button located to the right of the “Provide” button. Staking will reward you with the incentives. To view the rewards derived from the incentives you can view the fine print under “Combined APR” or scroll down to the “Additional Incentives” section. Upon reaching this page you can input the number of LP tokens you would like to stake and then clicking the blue “Stake” button.

LP NSTK-USK Staking Page

Conclusion

The strategy of lending wETH on GHOST and providing liquidity on BOW for USK/NSTK and USK/MNTA pairs offers a diversified approach to earning yield within the Kujira ecosystem. The strategy does have its quirks as seen when providing liquidity and there is a drastic change in exchange rate between the tokens and one token in the pair returns negative token yield. Importantly, if one returns negative token yield, the other side of the pair will give a positive token yield greater than the other token’s negative token yield.

By understanding and utilizing the unique features of GHOST and BOW, along with emerging projects like NSTK and MNTA, investors can actively participate in Kujira’s growth while seeking profitable opportunities. Take your first step into Kujira’s innovative DeFi world. Leverage the unique advantages of Kujira’s dApps and join a community dedicated to sustainable decentralized finance.

Useful Links

- Introduction to GHOST

- Well Hello, Bow!

- Understanding MantaDAO and Kujira Highly Symbolic Relationship

- WinkHub: Kujira Academy

- Kujira Academy Litepaper

- Kujira Academy Twitter

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.

Written by LiuCobe