Introduction to Neutron & the AEZ Ecosystem

Neutron, a general purpose blockchain platform built on the Cosmos SDK, and which is a part of the ATOM Economic Zone (AEZ). It manages financial activities through CosmWasm smart contracts, providing a robust framework for both local and cross-chain transactions. Its architecture is particularly adept at managing both local and cross-chain transactions, primarily funded through transaction fees. This financial ecosystem is managed through three contracts: The Reserve, Distribution Contract, and the Neutron DAO Core Module. Read more in their docs.

AEZ: A Hub for Innovation

The AEZ is a thriving network within Cosmos, fostering innovation and interconnectivity between partially-sovereign chains. It’s a collection of chains that share/use the security from The Cosmos Hub‘s validator set, and are in general, aligned in terms of economics, product offerings, market fit, and development. Neutron, as part of AEZ, plays a pivotal role in advancing decentralized finance (DeFi) as the first and primary permissionless (meaning general purpose) smart contract chain in the AEZ, as opposed to others, like Stride or Noble, which are appchains that have a very narrow focus. The AEZ is worth digging into in and of itself, which we have a great resource for, here.

Mars Protocol: Bridging Traditional Finance and DeFi

Mars Protocol is a decentralized credit protocol in Cosmos, aiming to integrate traditional financial services with DeFi. Put simply, it’s a decentralized lending & borrowing platform. Starting as a project on the original Terra Luna chain, Mars currently runs its own chain, while maintaining “outposts” on several other chains throughout the Cosmos that all report back to it’s main chain. Its features, including Rover Credit Accounts and the “Red Bank,” facilitate a range of services like spot and margin trading and yield farming. Mars Protocol V2 enhances this by enabling cross-chain financial operations and asset management.

Read more about Mars, Neutron & the AEZ on their associated Index pages, and help us keep them up to date with the ✏️ in the top right of the page!

The Neutron-Mars Protocol Acquisition: A Comprehensive Overview

The Proposal Overview

In a significant development, as outlined in their recent proposal on their forums, the Neutron Foundation will grant $3M USDC to the Mars Protocol Foundation over two years, while Mars will grant 60,000,000 MARS tokens to Neutron. This mutual grant, involving major financial and token transactions, is designed to cement the collaboration between Mars and Neutron, with the primary objective of fostering the growth of the Mars Protocol and leveraging its integration into Neutron’s ecosystem.

High level Overview

– A $3M USDC development grant to Mars from Neutron.

– A 60,000,000 MARS token grant to Neutron.

– Migration of Mars Governance and the MARS token to Neutron.

– The launch of Mars V2 on Neutron.

– A commitment to use the funds for mutual benefits, including leveraging the advantages of Neutron’s platform to enhance Mars Protocol’s capabilities.

Detailed Financial Arrangements

The financial backbone of this collaboration involves a meticulously planned exchange of funds and tokens between the Neutron and Mars Protocol Foundations. This exchange is designed not just as a simple transaction, but as a strategic partnership to fuel growth and development on both sides. The structuring of this financial support highlights the commitment to long-term collaboration, with a clear focus on milestones and outcomes.

-

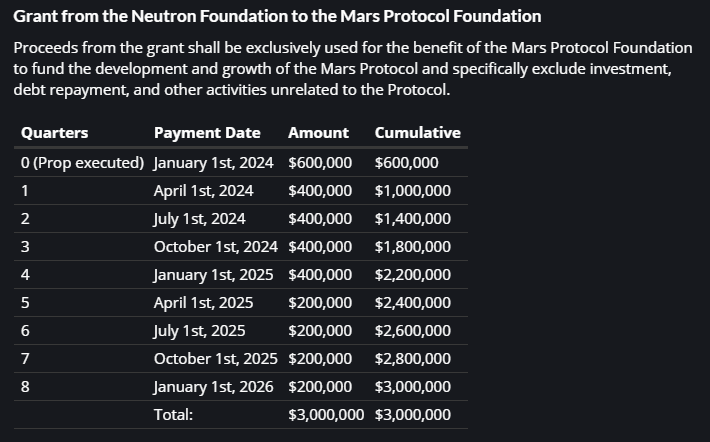

USDC Grant by Neutron Foundation: The Neutron Foundation will provide $3M USDC in quarterly installments over two years to the Mars Protocol Foundation.

- Payment Schedule (Annex A):

- Initial payment: $600,000 (January 1st, 2024)

- Subsequent payments: Varying from $200,000 to $400,000 at specified intervals

- Total by January 1st, 2026: $3,000,000

- Payment Schedule (Annex A):

-

MARS Token Grant by Mars Protocol Foundation:

- Amount: 60,000,000 MARS tokens

- Vesting Period: Linear vesting over six years

- Governance Participation: Allowed during the lockup period (Annex B)

Governance and Development Commitments

The proposal sets forth a series of governance and development commitments that are pivotal to the integration and functionality of Mars Protocol within the Neutron ecosystem. These commitments are structured to ensure a seamless transition of Mars Protocol’s governance to Neutron and the successful deployment of Mars v2, enhancing the collaborative nature of this partnership.

- Migration of Mars Governance: From Mars Hub to Neutron, slated by end of Q4 2024

- Deployment of Mars v2 on Neutron: Targeted by end of Q3 2024

- Protocol Upgrade Exclusivity: Major upgrades exclusive to Neutron for three months starting January 1st, 2024

- Perpetuals Implementation: If developed, to be initially deployed on Neutron with a minimum 3-month exclusivity

Revenue Sharing and Collaboration

The revenue-sharing and collaboration aspect of the proposal is a critical component, aimed at solidifying the financial and operational integration between Mars and Neutron. This section details how both entities plan to share resources and work together, underlining the depth and extent of their partnership. The revenue-sharing mechanism is particularly innovative, marking a significant step towards a more integrated approach to resource allocation within the Cosmos ecosystem.

- 10% Revenue Sharing: Mars Protocol DAO to direct 10% of protocol revenue to Neutron DAO Treasury for ten years

- Mutual Commitments: Include Mars moving its governance and token to Neutron, along with joint efforts in development, MEV-resistant markets, and improved block speed

- Future Developments and Enhancements: Focused on DeFi innovation and integration

Risk Considerations

Acknowledging the dynamic and uncertain nature of blockchain and DeFi developments, the proposal carefully outlines the potential risks and uncertainties. These include the possibility of changes in the detailed terms of agreements and the need for approval by the respective DAOs. This pragmatic approach to risk management underscores the realistic and strategic planning inherent in this partnership, ensuring that stakeholders are aware of the potential challenges and are prepared to address them.

The proposal, while promising, is subject to numerous risks and uncertainties, including potential changes in the detailed terms of agreements and the possibility of non-approval of initiatives by the respective DAOs.

This extensive collaboration between Neutron and Mars Protocol is poised to significantly impact the DeFi landscape within the Cosmos ecosystem, combining Mars’ ambitious DeFi goals with Neutron’s robust app-building platform. The mutual commitment and shared vision outlined in the proposal suggest a future of innovative and user-centric DeFi developments, although contingent on the successful implementation and approval of all proposed terms and conditions.

In Other News

Neutron Listed on Bitget

On November 15, 2023, Bitget, a leading cryptocurrency exchange and Web3 company, announced the listing of Neutron (NTRN) in its Innovation Zone and Cosmos Ecosystem Zone. This significant development enabled Bitget users to trade Neutron’s native token, NTRN, through NTRN/USDT trading pairs, with deposits opened and withdrawals beginning from November 16, 2023.

Cosmos Proposal Approves Transfer of Unclaimed NTRN Tokens

On October 30, 2023 the Cosmos Hub announced the approval of proposal #835, which authorized the transfer of 42.7 million unclaimed Neutron (NTRN) tokens to the Cosmos Hub community pool. This governance decision involved the transfer of tokens from an unclaimed airdrop, valued at approximately $18 million, to be utilized in a manner beneficial to both the Cosmos Hub ecosystem and Neutron.

NTRN’s Price Surge on Binance Listing

The native token of Neutron, NTRN, experienced a substantial 48% increase in its value to $0.53 following the news of its listing on Binance on October 10, 2023. Binance introduced several trading pairs for NTRN, including NTRN/BTC, NTRN/USDT, and NTRN/BNB, with withdrawals opening on the following day. This listing was anticipated to greatly enhance the token’s liquidity and trading volume.

Staking NTRN on Binance Launchpool

Following this, Binance offered its users a unique opportunity to earn NTRN tokens by participating in its Launchpool platform. From October 11 to October 30, 2023, users could stake BNB or stablecoins such as TUSD and FDUSD to earn rewards in NTRN. This initiative distributed 2% of the total NTRN token supply, amounting to 20 million NTRN tokens, to participants of the Binance Launchpool.

Lido Finance Picks Axelar and Neutron for wstETH Introduction to Cosmos

Lastly, in a strategic move way back in mid-September, Lido Finance chose Axelar and Neutron for the integration of its wrapped liquid staked ether (wstETH) token into the Cosmos ecosystem. This partnership, aimed at increasing wstETH’s liquidity in the inter-blockchain protocol ecosystem, marked a key step towards its adoption in additional Layer 1 markets. Both Neutron and Axelar committed 1% of their genesis supply for token incentives, fostering a market for wstETH through diverse DeFi use cases.

. . .

These updates highlight the dynamic nature of the cryptocurrency market, illustrating Neutron’s increasing prominence and influence in the blockchain and DeFi landscapes, and indicating that the general future for Neutron is painted in additional partnerships, upgrades, and general fundamental growth.