-

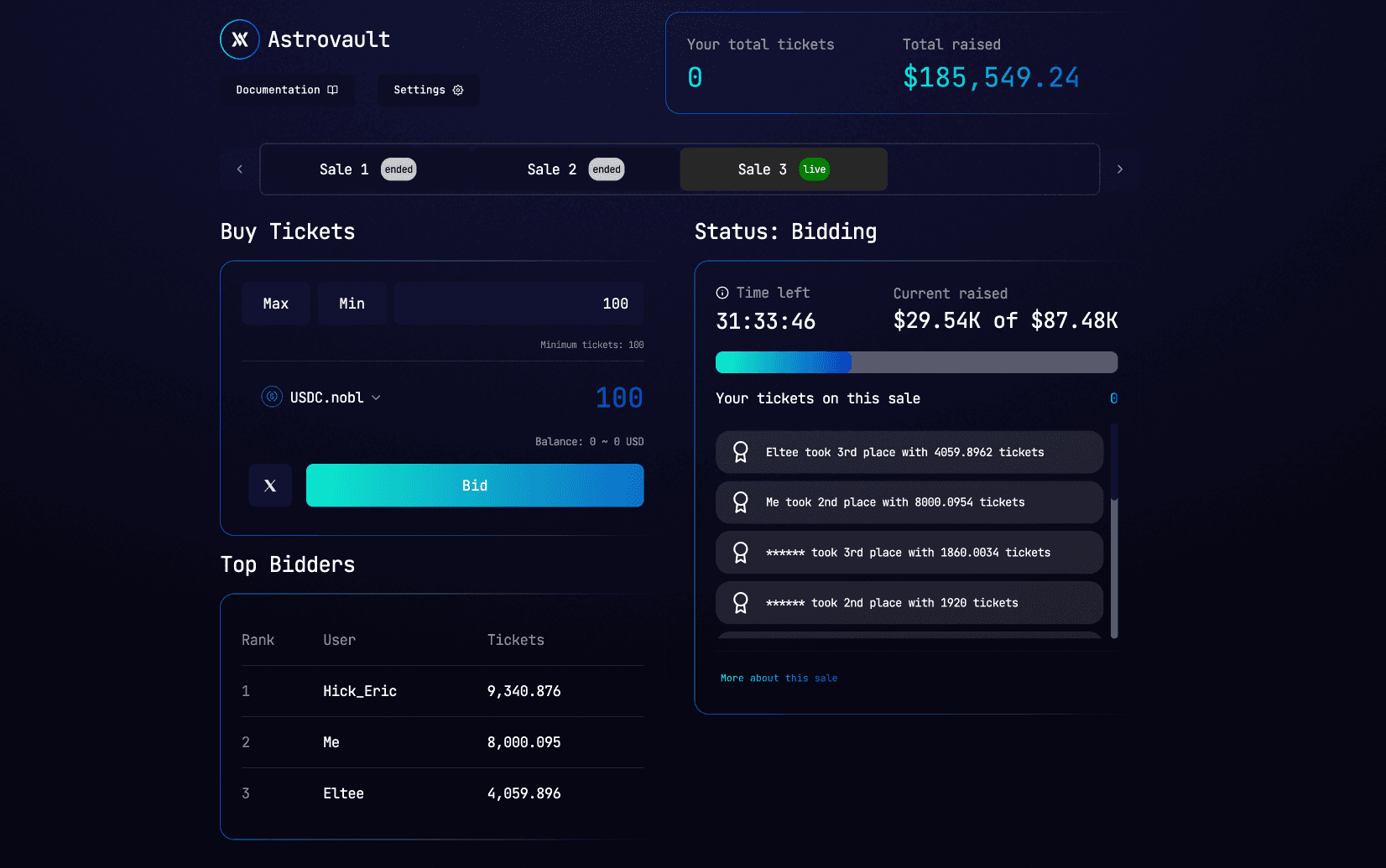

Micro-Sale Rounds: Each round begins with a specific FDV, escalating in valuation as rounds progress. Completed rounds lead to an additional month added to the vesting period of tokens from previous rounds.

-

Bonus Round Mechanism: If a round’s full token allocation isn’t sold, a 30-minute Bonus Round initiates, offering a final bidding opportunity. Unique rules apply to prevent bid sniping and reward early contributors. The final bidder in this round can win all remaining tokens if unsold by the round’s end.

-

Community Incentives: Teams can incentivize participants with rewards, including bonuses for early round contributors and those who rank high in ticket purchases.

-

Whitelisting Phases: Each micro-sale includes exclusive phases for whitelisted parties, such as liquidity providers on Astrovault and $JKL stakers, expanding to include previous round bidders in subsequent auctions.

-

Liquidity Support for Astrovault DAO: Instead of charging fees, teams contribute 10% of the public sale value in tokens to Astrovault DAO, fostering long-term asset liquidity. Post-auction, a pool is seeded on Astrovault with the final round’s pricing.