The Intricacies of the Partnership

MetaMask, a decentralized application (dApp) browser and crypto wallet with over 22 million users, has recently integrated PayPal as one of its third-party “off-ramp” providers. This integration allows users to sell their Ethereum (ETH) and have the proceeds sent directly to their PayPal accounts. It’s worth noting that PayPal is not the exclusive off-ramp provider; MetaMask also collaborates with Moonpay and Transact for similar services. Users can choose their preferred provider based on their location and the fees involved.

MetaMask’s Sell Feature: More Than Just PayPal

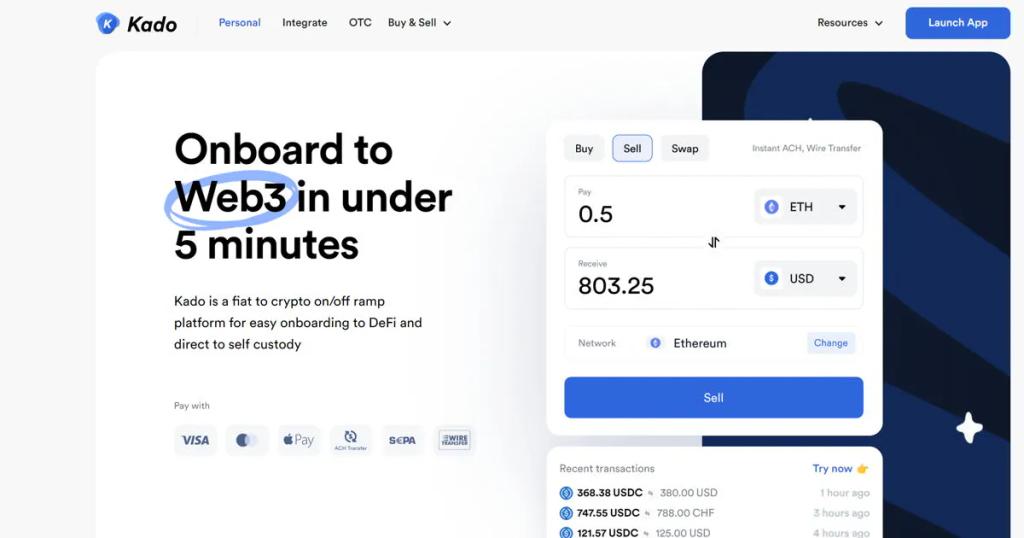

MetaMask’s new sell feature is not limited to PayPal; it’s a broader initiative to facilitate the conversion of crypto assets into fiat currencies. Users can select their country and the amount they wish to cash out, and MetaMask will present a list of third-party off-ramp providers that can facilitate the transaction. Once a provider is selected, the user’s ETH is converted into the chosen fiat currency at the current exchange rate, and the funds are transferred to the designated bank account. The entire process is completed within minutes, offering a seamless experience for users.

The Fee Structure: What It Costs to Cash Out

While the sell feature offers convenience, it comes with a cost. Users are responsible for Ethereum network gas fees, which are paid to miners for validating transactions. Additionally, third-party providers like Moonpay or PayPal may charge transaction fees. For example, a MetaMask demo using Moonpay in the U.S. showed an additional transaction fee of approximately 8% of the total amount being cashed out. Users should be fully aware of these costs before initiating a transaction.

Global Availability and Future Prospects

Initially, the sell feature is available in the U.S., the U.K., and certain parts of Europe. MetaMask plans to extend this service to other regions, aiming for global coverage. The feature’s success will hinge on its ability to offer a smooth, cost-effective experience while navigating a complex regulatory landscape.

Regulatory Considerations: The ECB’s Stance

The European Central Bank (ECB) has expressed reservations about private companies like PayPal entering the crypto market in any capacity, including partnerships like this. The ECB warns that these companies aim to expand their customer base and market share, potentially leading to monopolistic practices. This raises questions about the long-term impact of such private-sector involvement in the crypto space, especially concerning regulatory oversight.