Solana’s SOL has been on a tear this year, and you’re lucky enough to have some. You’re also savvy enough to realize that it’s wise to take advantage of other opportunities with your newfound gains in other parts of the web3 space. But Solana is still a bit more siloed than other blockchains, and those opportunities to leverage it seem more limited than things like ETH.

Fortunately for you, it turns out that Kujira supports SOL and offers all sorts of powerful ways to use it! Time to learn how to bridge your SOL to Kujira, how you can earn APR by lending it, how you can borrow against it, and even how you can mint Kujira’s native stablecoin, USK, using it!

Contents

- Kujira Background

- Kujira Wallets

- Bridging SOL to Kujira

- Minting USK with SOL

- Borrowing/Lending on GHOST

- Trading SOL on FIN

- Useful Links

Quick Background

First a quick background on Kujira, in case you’ve never heard of it or don’t remember the details. Kujira is a Cosmos blockchain focused on combining the best capabilities of DeFi with the stellar experience afforded by the Cosmos SDK. Just like Solana, the gas fees are minuscule and transaction speed is fast.

But unlike Solana, the native token KUJI is completely non-inflationary. The total supply of 122mil tokens is all in circulation, and KUJI price in the last year has gone from a low around $0.40 to over $5 today.

The chain itself is focused on the primary DeFi primitives of lending/borrowing, liquidity provision, permissionless swapping and trading, liquid staking, and even bidding on liquidations! It’s good stuff.

Making a Kujira-Compatible Wallet

But let’s refocus on just how your SOL can get put to work here and why you might want to do so. Job one is going to be getting some SOL into the Kujira ecosystem in the first place.

First you need to create a Kujira-compatible wallet if you haven’t already. Kujira has their own excellent mobile wallet called SONAR, but we’ll focus on desktop for now and look at Keplr Wallet (supporting essentially all Cosmos chains). You can install the Keplr Chrome extension here.

Bridging SOL to Kujira

Once you’ve got Keplr set up, it’s time to send assets from Solana. For this we will use two different tools: Rocket X to get KUJI for gas, and Portal Token Bridge to send SOL.

Using RocketX to get KUJI

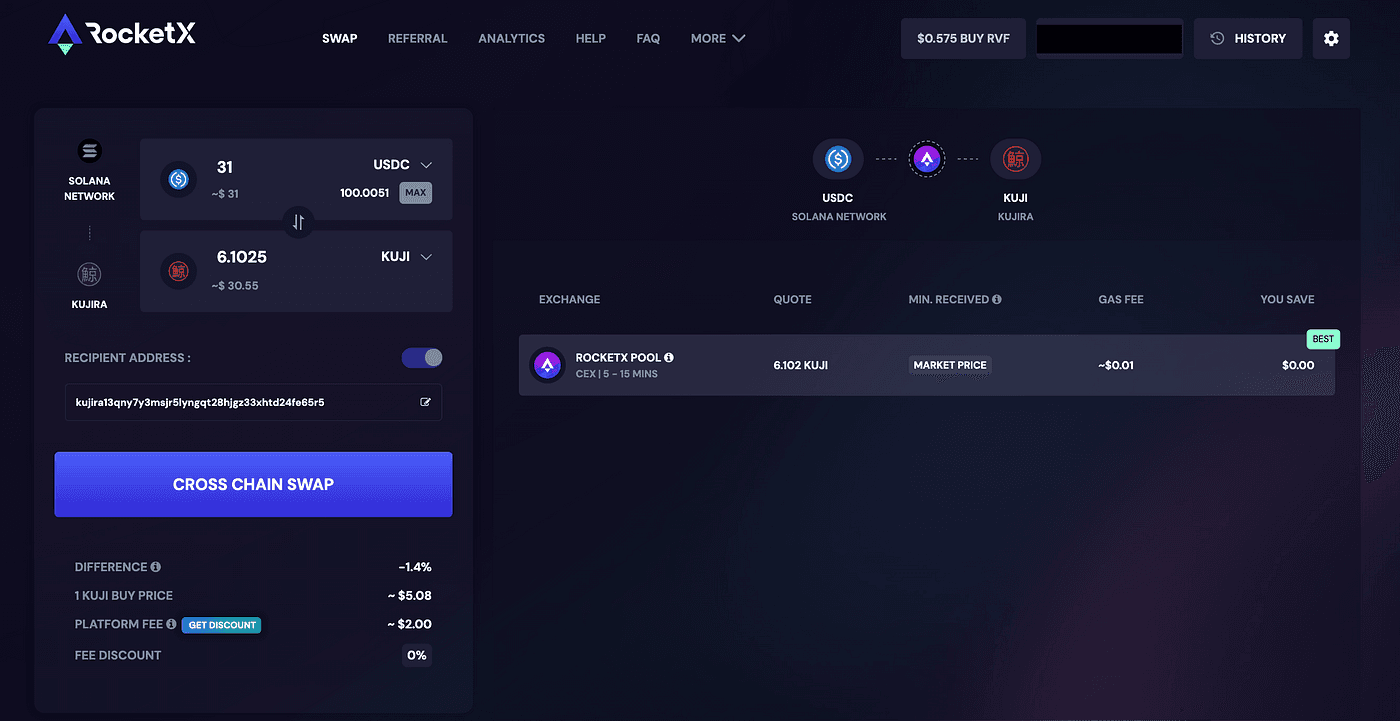

We’ll start with Rocket X since we need a bit of KUJI as gas for transactions on the chain. The downside is currently we have to send a minimum of $31 USDC (or equivalent value of SOL) to get that KUJI on the receiving end. The upside is that $31 of KUJI will potentially be all the gas you’d need for a lifetime of use of the Kujira blockchain!

So let’s cover the steps.

First go to https://www.rocketx.exchange/ and choose launch app before connecting your Phantom wallet. Then, choose to swap from the Solana network to the Kujira network. A huge list of options are supported on the send side, so pick your favorite. To make life easy you might choose either USDC or SOL – on the receiving side you’ll get KUJI.

You need to track down your Kujira wallet address as you have to manually enter the recipient on RocketX. Go to https://blue.kujira.network/wallet, connect your wallet, and copy the Kujira wallet address to enter into RocketX

Once you’ve got your swap set up, just hit “cross-chain swap” to execute it. RocketX estimates a duration of 5 to 15 minutes for the swap to complete and the tokens to arrive in your Keplr wallet. Once you’ve confirmed that you have received the KUJI you need for gas, you can move on to bridging SOL over with Portal Token Bridge.

Send SOL with Portal Token Bridge

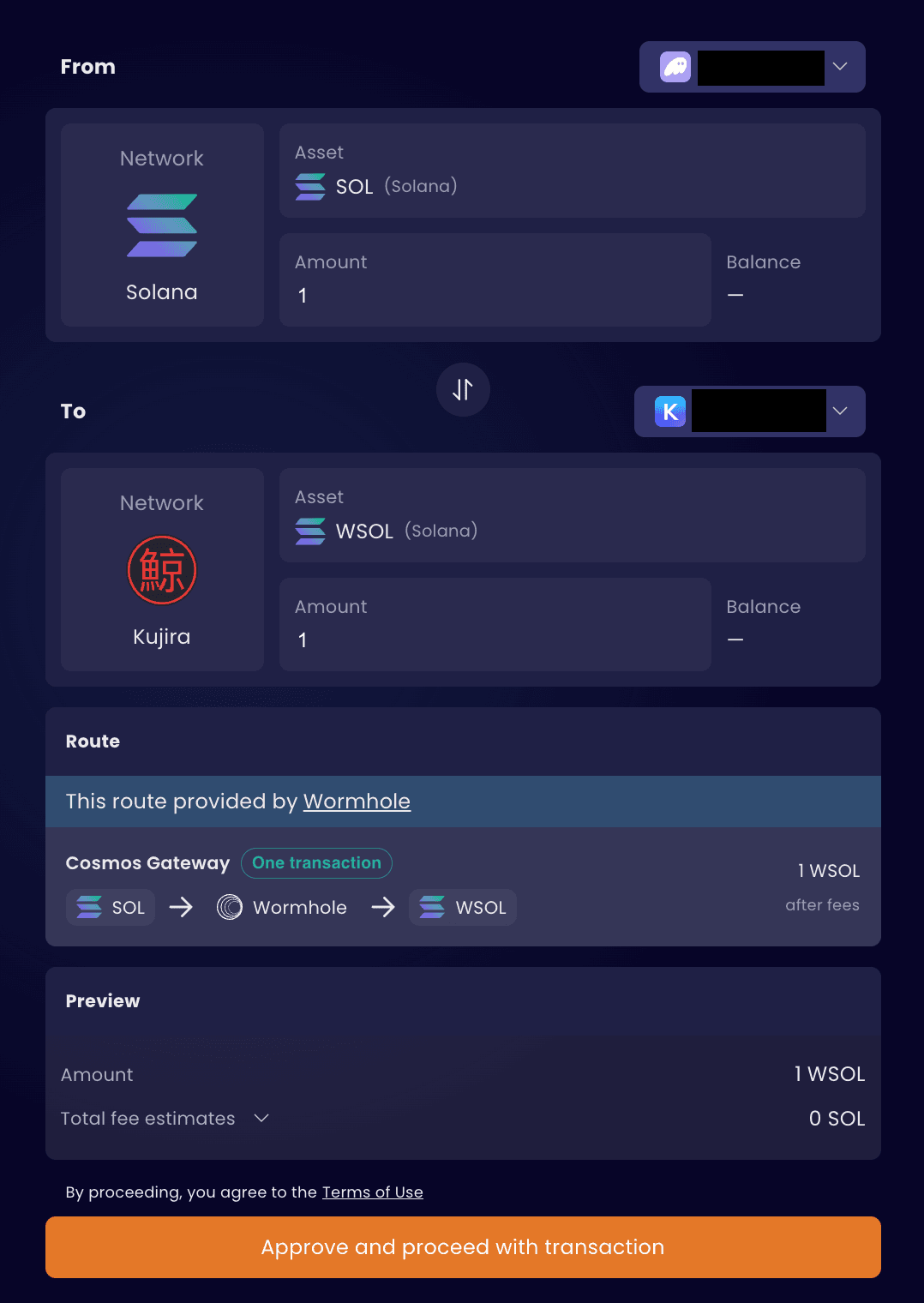

First select the Solana network on the “From” side, and then connect Phantom wallet. Select SOL as the asset you intend to send.

On the “To” side, first select Kujira as the destination network. WSOL will automatically be selected as the asset.

Now connect Keplr wallet; here you’ll choose the “Cosmos” chain but it will automatically recognize that you intend to go to Kujira. Just choose how much SOL you want to transfer and hit “approve and proceed with transaction”.

This one is remarkably quick! Delivery of SOL to the Kujira network should take just a few minutes at most.

SOL on Kujira

Now you’ve got SOL on the Kujira blockchain, and it’s time to get down to business! Note that you have specifically received whSOL, which means “Wormhole-wrapped SOL”.

Portal Bridge, powered by Wormhole, has taken your SOL and locked it on the Solana side and issued you this token of equivalent pegged value on the Kujira side.

As far as your activities on the Kujira blockchain are concerned, whSOL is SOL. Any place in Kujira that you intend to use SOL, you’ll be using whSOL. You can always reverse the bridging process to receive SOL back on the Solana network at any time.

Minting USK using SOL

Let’s talk about how you can use your SOL in the Kujira ecosystem. We’ll start by using some to mint their overcollateralized decentralized CDP stablecoin called USK. Whew that’s a mouthful! Hopefully it hit all your web3 buzz-word requirements.

What is USK?

Briefly, USK is a stablecoin that is backed by collateral like ATOM, MNTA, DOT, wBTC, wETH, whSOL(!), and others at a minimum of 166% collateralization ratio. That means that a person must provide 166% as much value in collateral as the value of USK they wish to mint. If their collateral value drops below that percentage, it gets liquidated (and you can bid on those liquidations on ORCA! No, not that Orca, but ORCA! That’s a story for a different article).

Note this is a decentralized stablecoin, created entirely by individuals on-chain who have provided other crypto assets. There’s no central authority with dollars in a bank account backing it. Censorship Resistance, people!

Navigating to BLUE

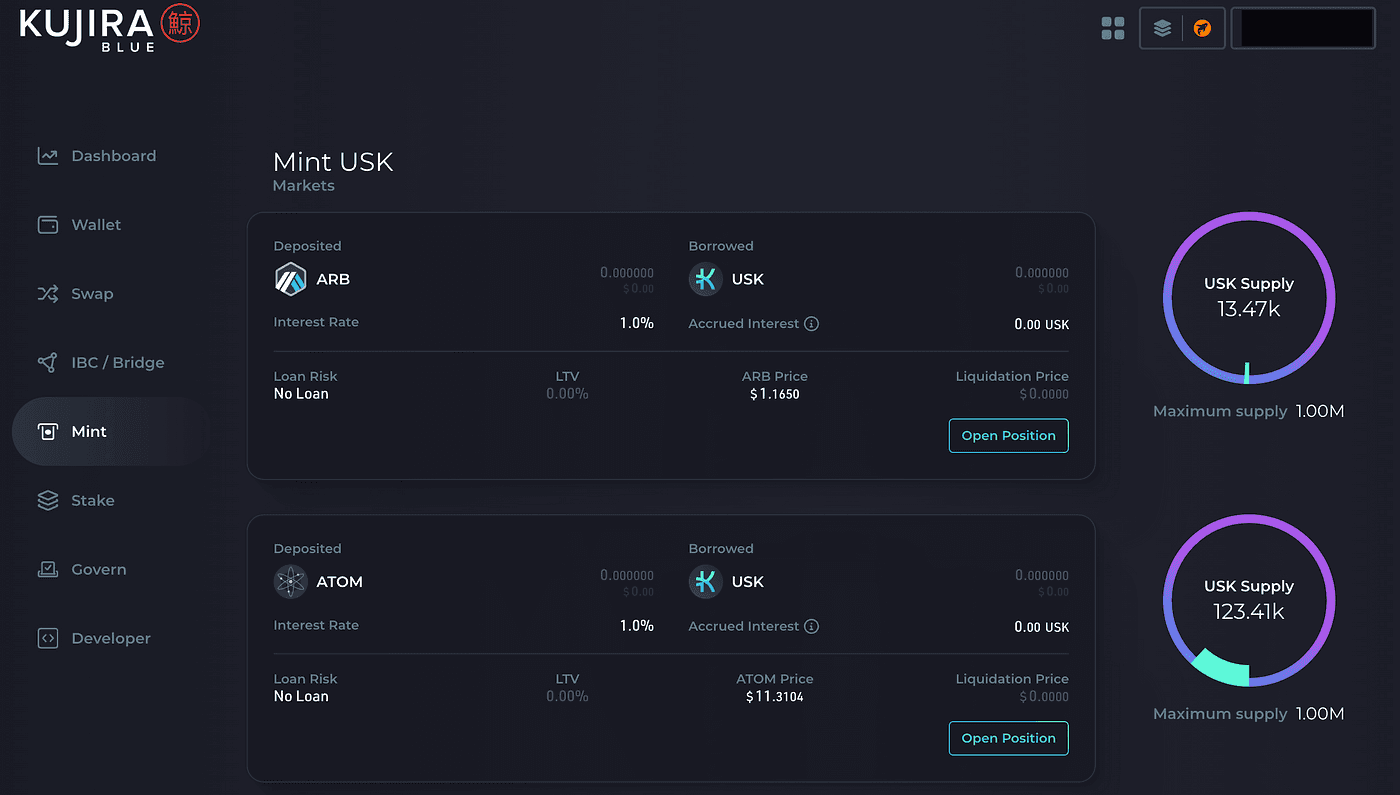

To mint USK with whSOL we’re going to head to the central hub of our Kujira life, BLUE. Head there and connect your Keplr wallet.

BLUE serves as the starting point for essential Kujira blockchain functions like staking, basic swaps, governance, bridging, and even getting insight into the full contents of a Kujira wallet. But we’re here first to take advantage of the ability to mint USK with our whSOL.

As a reminder, CDP stablecoins like USK are essentially loans; you’re taking out a stablecoin loan against collateral of some sort. CDP stands for Collateralized Debt Position, a fancy term for a loan. We’re going to mint USK as a loan against whSOL collateral.

Minting USK Guide

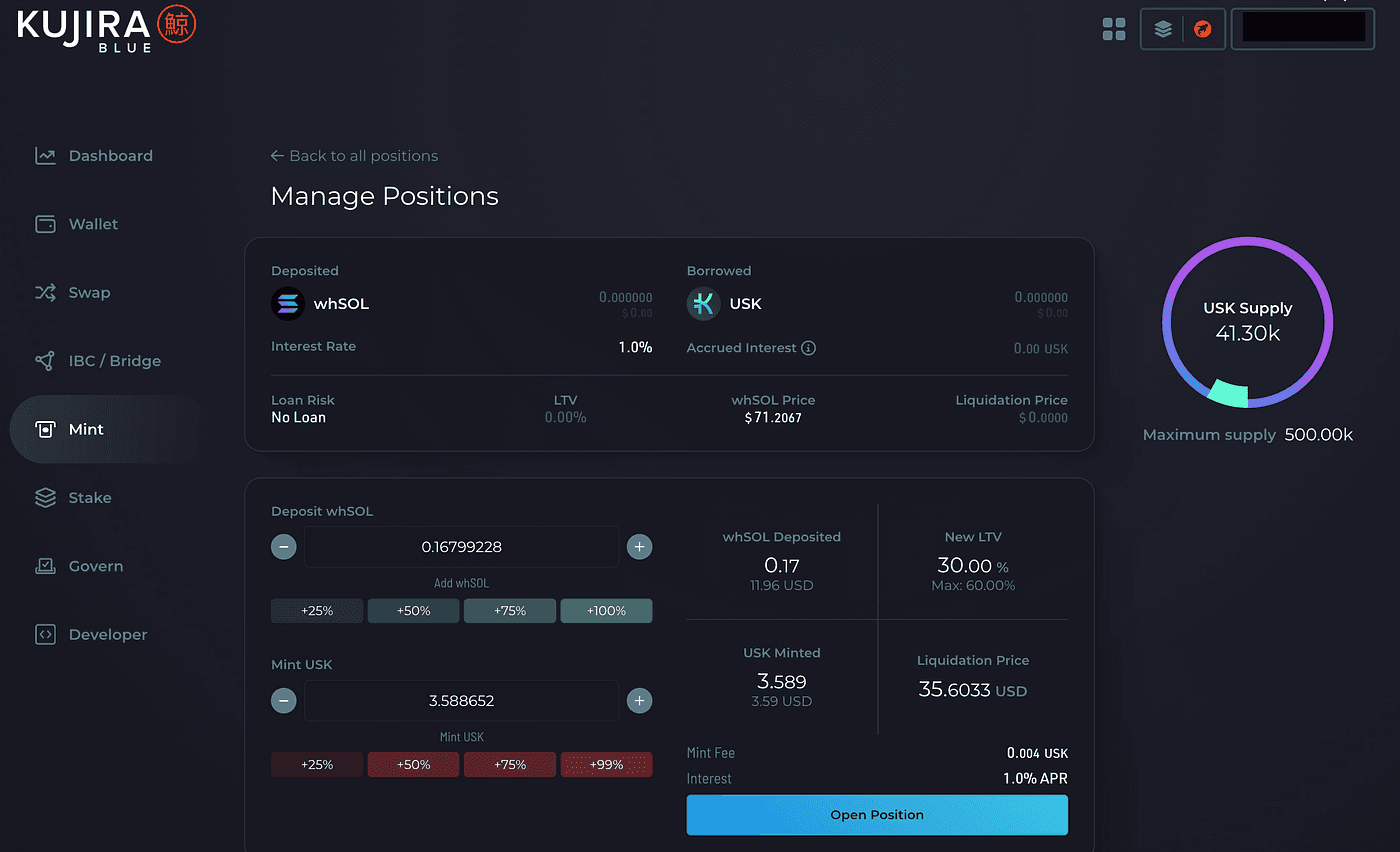

To do so, click Mint on the left side of the main page.

Here you’ll see all the Mint Markets for USK, one for each potential form of collateral allowed for minting the stablecoin. Scroll down and locate whSOL from the list and click “open position”. On the resulting “Manage Positions” page, choose to deposit an amount of whSOL.

Then under “Mint USK” enter a value for how much you intend to mint. Remember that USK must be collateralized at 166% or greater (meaning that for every 1 of USK you intend to mint, you must provide $1.66 or more worth of whSOL)

If the value of whSOL falls such that your minted USK value exceeds your collateral requirement, your position will be at risk of liquidation. With this in mind, pick an amount of USK you’re comfortable with minting and note the information provided regarding your LTV (Loan-to-Value ratio) and potential liquidation value. Your risk tolerances are your own, but clearly the more USK you mint the higher the risk of losing your collateral to liquidation.

GIF demonstrating a user minting 10 USK with 1 whSOLOnce you’ve decided on an amount of USK you’re comfortable with minting, click “open position” and approve the transaction in Keplr wallet. Your whSOL will be provided as collateral and you will receive USK in your Keplr wallet.

If you want to close the position, simply click the -100% button under “Burn USK” and then choose “close position”. This will pay back the USK debt and return the whSOL to your wallet.

Lend & Borrow on GHOST

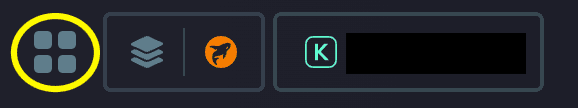

For now let’s explore the ecosystem further with our freshly minted USK and our remaining whSOL. Our next stop is going to be Kujira’s premiere money market lending and borrowing platform, GHOST. Head there by locating the icon of 4 squares near your wallet address in the top-right of the page and selecting ef=”https://interchaininfo.zone/indexes/ghost-2″ target=”_blank” data-ici-summary=”A decentralized, open-source platform for creators and publishers” title=”Ghost”>GHOST

from the list.

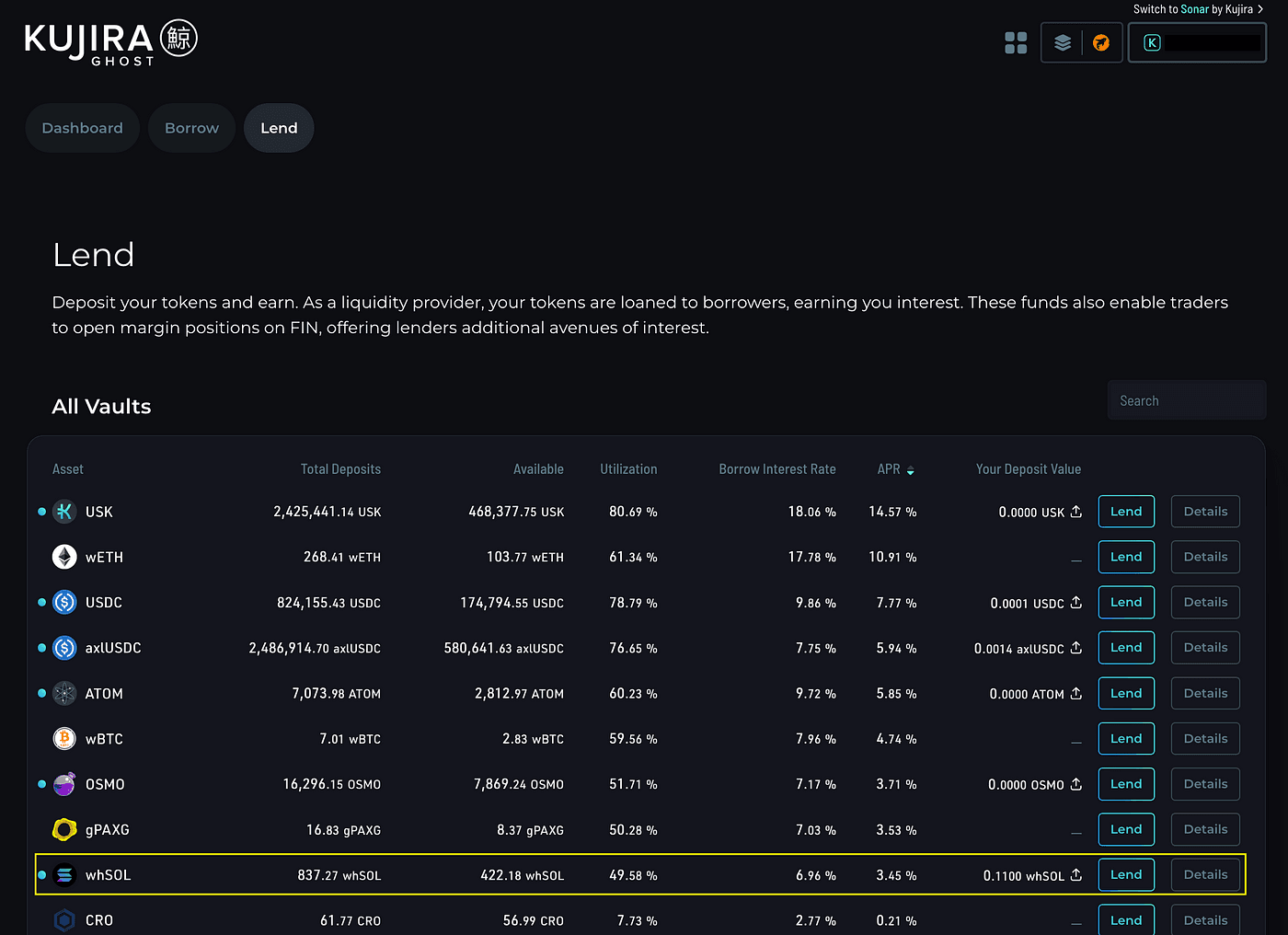

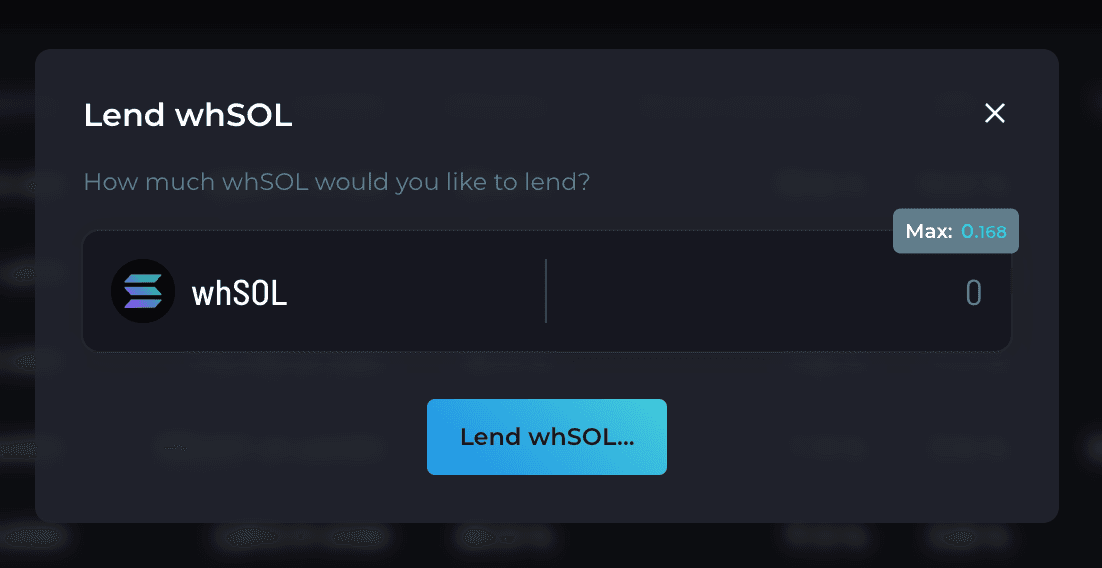

Lending

If you’ve used any lend/borrow market anywhere in DeFi, GHOST should be pretty familiar territory. On the Lend page you can choose to lend your freshly minted USK and earn interest on it. Alternatively you can lend some of your whSOL here. Simply find the asset on the list and click Lend.

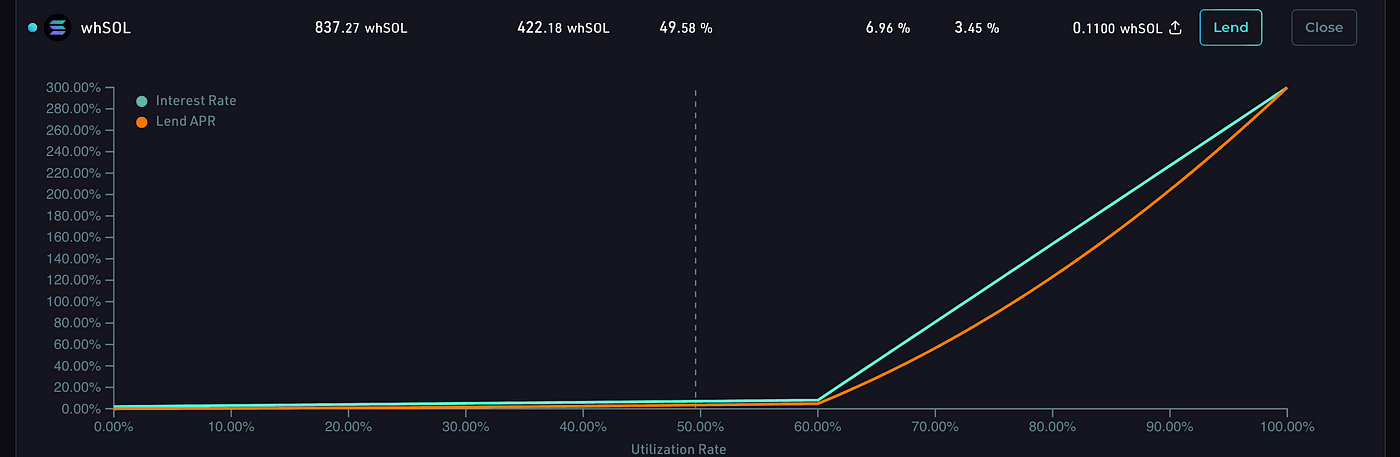

You can also get more info about any given asset’s individual lending market by clicking Details. You’ll be presented with a nice graph of the interest rate and Lend APR for the asset, including how far along up the “kink” it is.

The kink is the point where the amount of the asset being borrowed by users is close to the maximum, and therefore the APRs increase dramatically to incentivize more lenders to offer the asset and for borrowers to repay.

If you lend your whSOL here you will receive xwhSOL as your receipt token. This functions similarly to any typical non-rebasing liquid staked derivative token like wstETH or mSOL; the value of the token increases against its source token by the APR.

That is to say that as your lent position accrues interest, the value of xwhSOL increases compared to whSOL. Just as mSOL lets you use your liquid-staked SOL for other defi activities on Solana, xwhSOL will enable you to use your whSOL for additional future DeFi activities on Kujira.

Borrowing

GHOST also offers the option to borrow against your assets. Under the borrow section you’ll see a few featured markets and a Quick Borrow tool. Here you can borrow additional whSOL against KUJI collateral.

Click the “detailed view” toggle to see all the additional borrow markets available. Currently the only option available to borrow against whSOL is USK, and it simply returns you to the option to mint new USK as we covered above.

Trading whSOL on FIN, Kujira’s order book DEX

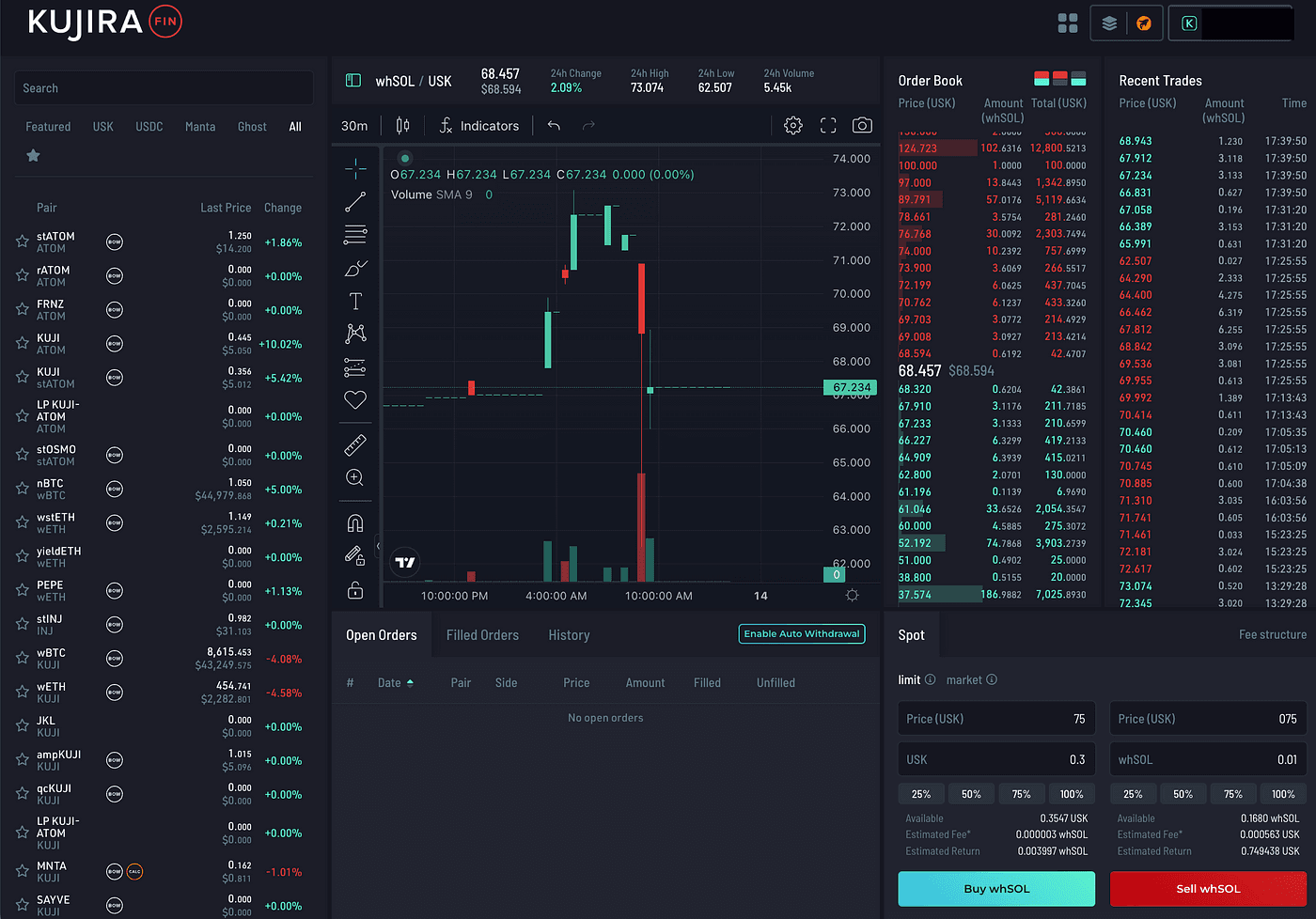

One final stop that we’ll briefly touch on where you can make use of your whSOL is the order book DEX called FIN. Again return to the icon of four squares near the wallet info on the top right and choose FIN. You’ll be presented with Kujira’s on-chain order book DEX. This should look familiar to anyone who’s used any CEX order books like those on Binance, KuCoin, or MEXC.

A full review of how to use FIN is beyond the scope of this article, but if you search for SOL in the top-left you’ll be presented with the main available trading pairs. Here you can place limit orders or market orders for your whSOL and pay lower fees than if you just use the quick swap interface on BLUE.

So now you’ve seen just a few of the potential uses for your SOL in the Kujira ecosystem. You can swap it for assets from all over web3, provide liquidity to the FIN orderbook DEX, and even bid on whSOL liquidiations on ORCA!

Useful Links

Written by Photon Miles

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.