The Cosmos ecosystem recently witnessed yet another massive step towards a more fleshed out, deeply liquid DeFi ecosystem with the passage of Proposal 853. This proposal, which earmarks 600,000 ATOM tokens from the community pool to boost ATOM’s liquid staking and decentralized finance (DeFi) presence, was proposed by the Persistence team, and can be found here , and the original forum discussion, here.

This strategic move, involving the Persistence protocol and its liquid staked ATOM token (stkATOM), is a significant step in the evolution of the Cosmos Hub and the broader Atom Economic Zone (AEZ), as well as the DeFi landscape on the Persistence chain.

Overview of Proposal 853

The proposal, passed on December 5, 2023, encompasses the allocation of 600,000 ATOM to pSTAKE Finance as protocol owned liquidity. This ATOM is to be used for liquid staking and enhancing stkATOM’s liquidity across two main Cosmos DeFi protocols. The distribution is split between liquid staking 300k ATOM with pSTAKE and pairing the remaining 300k ATOM with the stkATOM for liquidity provisioning (LP) on decentralized exchanges (DEXes), specifically Astroport on Neutron and Dexter on Persistence.

The pSTAKE team’s approach is a calculated effort to fortify the stkATOM liquidity pool within the Neutron ecosystem, which is expected to trigger a significant increase in trading activity. The expected outcome is a more substantial protocol revenue for Neutron, which, in turn, benefits the entire Cosmos Hub. Similarly, Dexter, the other DEX in the mix, is similarly envisaged to enhance stkATOM’s liquidity and trading efficiency on stkATOM’s home chain.

Benefits and Community Feedback

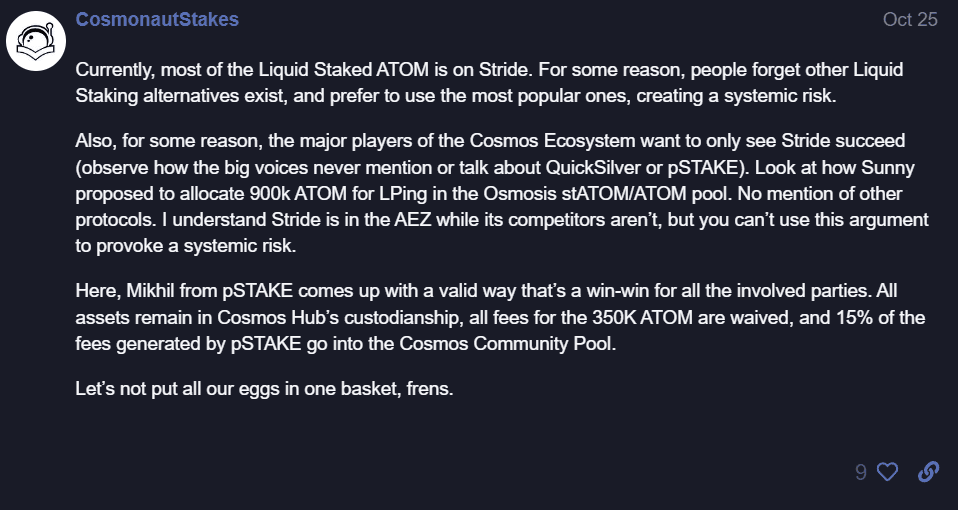

The proposal aims to strengthen ATOM as the core of the Cosmos “LSTfi” ecosystem, aligning various entities within and beyond the AEZ. Community members have voiced strong support, citing the need for diversification and competition in the liquid staking domain. Many view this move as a win-win situation, with benefits like fee waivers and revenue sharing arrangements bolstering the Cosmos Community Pool.

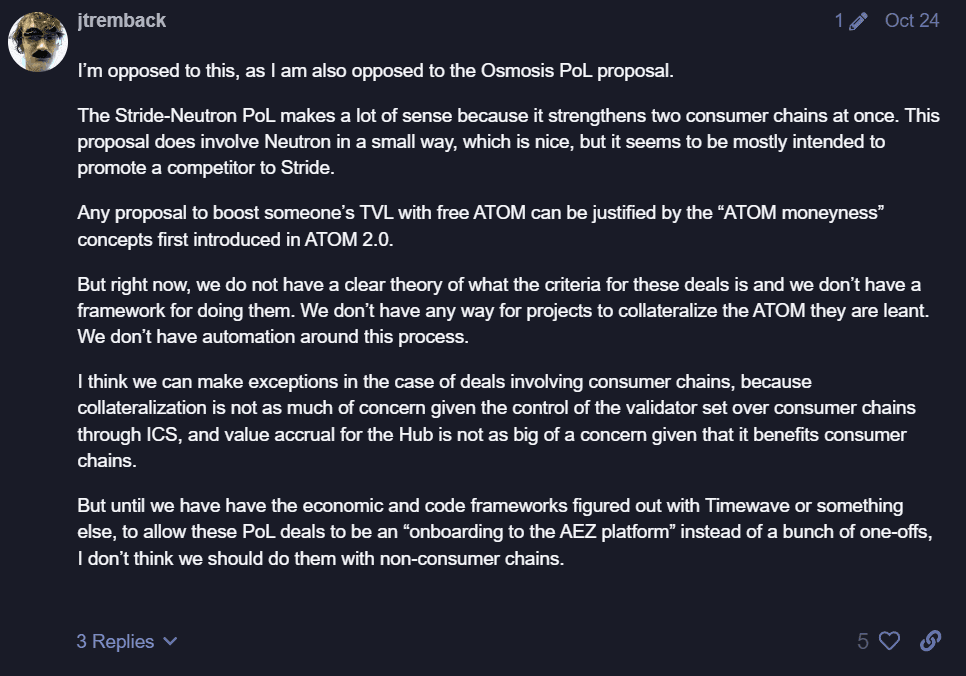

Concerns and Counterarguments

Despite the enthusiasm, some voices in the community express reservations. Concerns include a perceived lack of direct benefit to the AEZ and fears of creating a competitive environment for existing players like Stride.

However, proponents argue that fostering diverse liquid staking solutions is crucial for the ecosystem’s resilience and growth, and that the proposal’s inclusive approach is more reflective of a healthy, competitive market.

Implementation Strategy and Future Outlook

The implementation of the proposal involves a 3/5 multisig wallet for fund management, ensuring security and governance-led decisions until a more automated solution by Timewave Labs is ready. This interim solution reflects a pragmatic approach to governance in the rapidly evolving blockchain landscape.

Furthermore, the strategy of allocating resources for a year, subject to re-evaluation, indicates a flexible, responsive governance model aligned with the community’s evolving needs and aspirations.

In Closing

Proposal 853 stands as a testament to the Cosmos community’s commitment to nurturing a robust, diverse, and decentralized financial ecosystem. By strategically leveraging its resources, the Cosmos Hub not only enhances its position within the DeFi landscape but also sets a precedent for thoughtful, community-driven governance in the blockchain world. As the AEZ continues to grow, initiatives like these are pivotal in shaping its trajectory towards a more interconnected and resilient future.