I’m sure people in crypto are sick and tired of hearing about “another Layer 1 blockchain”. Why do we need so many chains with the same applications and nothing novel? This is a valid criticism.

Yet, Kujira has employed a very simple yet intuitive strategy to separate itself from the rest, something that can be appreciated by both degens and grandmas alike – SONAR, Kujira’s Decentralised Binance.

In this article, I will offer a balanced comparison of Binance and SONAR, why this mobile application could be Kujira’s killer USP, and how Kujira is positioning itself to accommodate all crypto participants.

Table of Contents

- What is SONAR?

- Orderbook Exchanges

- The Power of Decentralisation

- Types of Trade Orders

- Leverage Trading

- Why Bother Using SONAR?

- Alternative Trading Options

- Options Trading

- Grid Trading

- Liquidity

- Lending

- Providing Liquidity

- P2P Markets

- Additional Kujira Features

- MantaSwap Trade Routing

- NAMI

- Minting Stablecoins

- Staking and Airdrops

- LST-Fi

- ORCA

- Conclusion

What is SONAR?

First things first, what is SONAR? SONAR is a native mobile wallet app that aims to provide users with a seamless experience for interacting with Kujira’s blockchain technology. SONAR is more than just a wallet for sending and receiving tokens, but rather an application that incorporates all of Kujira’s premier dApps, wrapped in an intuitive UI, at the tips of your fingers.

It’s for this reason that I liken it to “DeBi” – Decentralised Binance. A mobile application that offers most of Binance’s features, some additional DeFi primitives, and a killer UI/UX with all the necessary tools to grow your capital. Entirely decentralized and accessible.

Orderbook Exchanges

Both Binance and FIN (Kujira’s DEX) operate using an orderbook. As a long-term model, orderbooks greatly surpass any of their competition for a variety of reasons:

- No need for inflationary incentives: Since orderbooks simply match a buy order to a sell order, there is no need to offer inflationary incentives for users to provide liquidity (as is the case for AMMs)

- Efficient limit order execution: Limit orders are guaranteed to execute at the advertised price with 0 slippage.

- Information into market depth: The orderbook provides traders with information as to where liquidity resides, providing a list of all limit buys and sells currently offered.

- Arbitrage: A single token can be traded via many different orderbooks/trading pairs at different prices, offering opportunities to arbitrage this difference in price.

However, since Binance is a centralized exchange, its orderbook and matching algorithm is entirely off-chain. This means that Binance has full control over the order-matching process, including the information displayed in the orderbook. Therefore, concerns can be raised about potential manipulation or selective disclosure of data, where users cannot verify this information themselves.

Indeed, there have been instances where users have reported discrepancies between the displayed orderbook and actual trade execution on Binance.

The Power of Decentralisation

In contrast, the orderbook exchange used on SONAR is FIN, a Decentralised orderbook exchange. Decentralized orderbooks are entirely onchain, meaning that the information provided by the orderbook and the matching algorithm is both transparent and verifiable.

Moreover, since there is no central authority that controls this process, the exchange is more resistant to manipulation due to its distributed nature.

A potential issue orderbook DEXs can face is the scalability of their matching algorithms. Without the need for consensus mechanisms, CEXs can be incredibly high throughput and match millions of orders every second. However, due to Hans’ Special Sauce, FIN has achieved a computational complexity of O(1). This means that the speed of order matching will remain constant regardless of the number of orders being executed simultaneously.

Types of Trade Orders

Similarities:

- Limit orders – an instruction to buy or sell a token at a specified price or better. You essentially set a limit on the price you’re willing to pay or receive.

- Market orders – A market order is an instruction to buy or sell a token at the best available price at the time. You prioritize immediate execution over price control.

In contrast, Binance offers some more advanced orders for tailored trade execution:

- Stop loss and take profits – Whilst these orders are essentially just limit orders, Binance offers a UI that allows users to determine their PnL within the UI itself.

- One-Cancel-The-Other Order – Combines two orders: a stop-loss and a take-profit. If one order triggers, the other is automatically canceled. Great for setting both risk and profit targets simultaneously.

- Iceberg Order: Splits a large order into smaller orders executed gradually over time. Helps avoid impacting the market significantly with a large order at once. Whilst SONAR doesn’t offer this yet, Kujira has a DCA solution called CALC. This incredible piece of tech allows you to buy/sell x amount of an asset every hour/day/week and could be added to SONAR at a later stage.

- Time-in-Force (TIF) Orders: Specify the validity timeframe for your order. Options like Good-Till-Canceled (GTC) or Immediate-or-Cancel (IOC) offer flexibility based on your trading timeframe.

These more advanced order types can be implemented in the future on SONAR to attract larger traders and offer a competitive UX. Right now, these orders are likely a low priority as they are predominantly utilized in leverage trading as opposed to spot markets.

Analogy Time: Imagine you are an average-looking bloke (too real?). You walk into the gym, and there are two women there. One is a rocket, straight 10/10, got it ALL going on. The other is a grinder, a little rough around the edges, but the potential is there and she’s progressing daily.

The 10/10 has reached their full potential, the ceiling has been hit. The grinder? Speculative interest can take over, who knows how far she can take things.

SONAR is the grinder, working hard to push the boundaries every day whilst letting you get in “early” before the rest give her too much attention.

Aristotle – 340 BC

Leverage Trading

In case you’re living under a rock, Kujira will be releasing perps trading soon, allowing it to compete with Binance which already offers both perps and margin trading.

Leverage is rife in crypto, and it is safe to say that whilst the casino is open, the masses will gamble. Until this point, SONAR only offers isolated margin on few digital assets whilst Binance likely offers more leverage markets than any other exchange in crypto.

Yet, when perps are released, anything with a verifiable oracle can be traded with leverage on SONAR, awakening the degen spirit in us all. The assets that will be traded can be established via governance, allowing the community to dictate what they want to gamble on. To avoid being sued by Binance, I will simply refer to their listing strategies as “questionable”. Allegedly.

Why Bother Using SONAR?

Playing devil’s advocate, Binance will however offer a superior trade execution than SONAR on most assets due to its impressive liquidity. But people in crypto are both lazy and skeptical. To explain what I mean here, CEX dominance has been decreasing daily, leading to more liquidity onchain. Once a crypto user establishes their liquidity in one place, it often takes a lot for them to move this elsewhere.

Thus, the Kujira-native users will now have a new casino to gamble in, and other users that download SONAR with these various DeFi primitives growing their assets without leverage can join too.

Are you beginning to understand the power of SONAR now? Attract a user with xyz product, and force them to stay by offering them 10 additional ones that grow their capital for them.

Analogy Time: Shopping Malls are a piece of sh*t. Everything costs more than it does online, it’s terribly organized, and things are impossible to find in your size. Yet, they get business every single day. Why? Everything is in one place. You can buy a TV, 5 kilos of smoked trout, and some winter socks in a single location for convenience.

SONAR is a dope-ass shopping mall. All the DeFi primitives and financial tools necessary to grow your assets in a single mobile application.

Karl Marx – 1858

Alternative Trading Options

Options Trading

Binance offers access to a diverse selection of options contracts across various cryptocurrency pairs, allowing tailored strategies based on market expectations. You may also choose from various expiry dates to fine-tune your strategy according to market volatility and anticipated price movements.

Currently, Kujirans cannot trade options. However, two protocols are building this important DeFi primitive as we speak – Yield Harbor and Fuzion.

Yield Harbor is a decentralized options trading protocol coming soon on Kujira, dedicated to this sector of DeFi. In contrast, Fuzion will offer a more bespoke OTC options trading experience, two differentiated products that are tailored to different options traders.

Once these are released, integrating them into SONAR is as “simple” as converting the web app UI into one that makes sense on mobile. Simple is in inverted commas since this relies on Brett not drinking too many beers. But seriously, making a dApp intuitive to look at and use on a mobile device is not easy, so this will likely be an iterative process.

Again, Kujira will have lower liquidity relative to Binance, but make up for this by offering users in Kujira the option to use an almost unlimited number of products to grow their capital.

Grid Trading

Binance allows users to set up grid bots – a type of automated trading bot that aims to capitalize on small price fluctuations by placing a series of buy and sell orders within a pre-defined range. Imagine a grid laid over a price chart, with the bot automatically buying when the price dips to a certain level and selling when it reaches a higher level, repeating this process within the grid area.

Whilst this functionality is not integrated with SONAR yet, Hummingbot adaptors for Kujira have been produced by the FunttasticLabs team. These allow users to establish customized market-making bots akin to grid bots on Binance.

The technical requirement for setting up a Hummingbot adaptor is rather high, but grid bots are usually utilized by experienced traders instead of retail participants. Personally, I don’t see a requirement to have this added to SONAR yet, but should usage take off, this could potentially be implemented.

Liquidity

I won’t beat around the bush here, despite “wen liquidity” perhaps being the most irritating question to read. Liquidity on Binance is orders of magnitude higher than Kujira, and therefore trade execution for the most part will be more efficient on the centralized exchange.

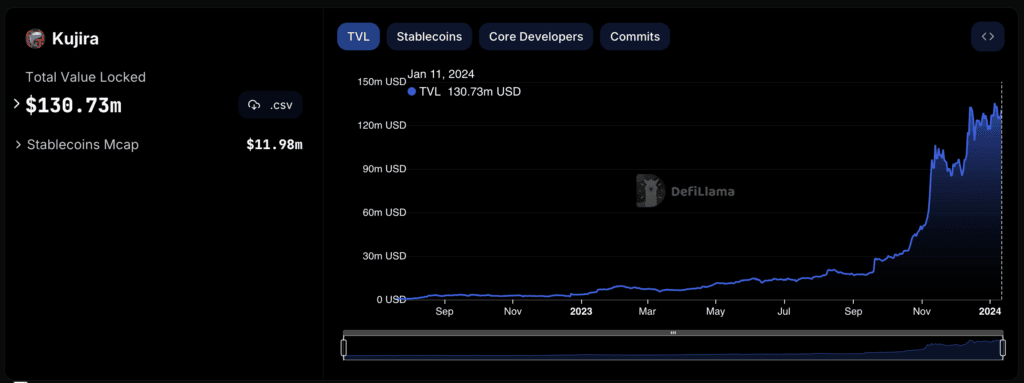

This does not come without a price, and the risks of centralized exchanges don’t need to be repeated. However, Kujira’s TVL has rocketed to over $100m in 2023, with every single measurable onchain metric pointing up and to the right.

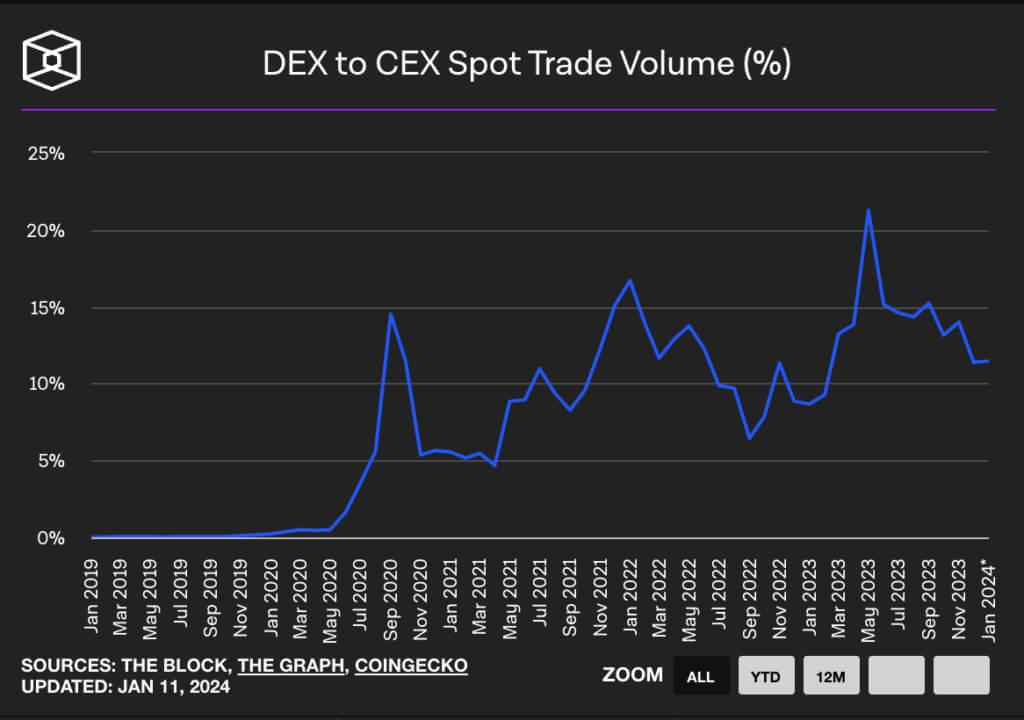

Moreover, DEX volume as a share of the market has been steadily increasing this last year. Onchain trading has boomed, with more experienced crypto users utilizing these new tools at their disposal. Liquidity is improving, and rapidly. Yet, when retail fully returns, I expect this trend to reverse since onramping to an exchange from your bank is just so simple.

But what makes that so different from downloading SONAR and onramping to Kujira instead? This is why a mobile application holds so much power. The ability to move money from your bank to your crypto wallets and trade digital assets on your mobile device with 0 barriers to entry is something to behold.

Your average retail user also won’t need millions in liquidity to execute their 3 to 4-figure investments, so the value to them arrives in the form of seamless integration of many different products in one single place. Sound familiar?

Lending

By putting your assets to work, investors can earn a yield on their cryptocurrencies while continuing to speculate on its price. On the Binance app, this comes in the form of “Binance Earn”, where users can deposit cryptocurrencies and lock them up for varying amounts of time to earn yield on top of them.

SONAR also offers users the opportunity to earn yield by lending their assets utilizing GHOST, but importantly there is no lockup for this activity. When cryptocurrency assets and lent on SONAR, an xAsset is returned that is liquid and can be redeemed for the underlying asset at any time.

Yield earned in SONAR is entirely sustainable too, with lenders receiving the interest paid out by borrowers and not inflationary rewards.

Providing Liquidity

Indeed, the same can be said for providing liquidity. On Binance Earn, many LPs are subject to lockup periods meaning users cannot withdraw their assets until some time has passed. In fact, you cannot really call them “your assets” on a centralized exchange – not your keys, not your crypto.

Compare this to providing liquidity on BOW, where all your assets can be withdrawn at any time and are held within your own wallets. The yield is competitive, incentives can be added from external third parties, and liquidity can be added and removed in seconds.

As BOW is a decentralized market maker, enabling users to supply liquidity to BOW is also beneficial to FIN by improving trade execution.

Flywheel Moment!

Increasing liquidity on BOW means the depth of FIN’s orderbooks increases and larger trades can be facilitated. If larger trades are facilitated, volume increases, improving the yield for LPs on BOW. If yield increases on BOW, deposits increase, improving liquidity on FIN again…

P2P Markets

P2P (Peer-to-peer) markets democratize crypto access, empowering individuals with direct trading and flexible payment options, fostering financial inclusion in the crypto ecosystem.

Binance P2P offers a peer-to-peer (P2P) platform for buying and selling cryptocurrencies directly with other users. It boasts a large user base, diverse payment methods, and competitive fees, making it a popular choice for P2P transactions.

Kujira’s P2P alternative is named Local Money and also boasts an impressive range of fiat currencies for users to onboard directly into the Kujira ecosystem. Despite being a vital corner piece in the Kujira ecosystem, Local has had an unfortunately rocky start to its life, but perhaps a SONAR integration will breathe life back into an important product.

Imagine users from all corners of the planet being able to onramp directly into the Kujira ecosystem via their local currency from the same mobile app that lets them then lend a dollar-based stablecoin. Not only are they beating hyperinflation in their local currency, but they will also earn 10%+ interest on their savings.

Seamless, accessible, decentralized economy.

Additional Kujira Features

The following features are only found in Kujira, setting the ecosystem apart from the biggest centralized exchange in crypto.

MantaSwap Trade Routing

Swapping from ATOM to KUJI is as simple as selling ATOM on the ATOM/KUJI trading pair. However, on an orderbook DEX, this might not be the most efficient trade route to give you the most KUJI at the end. Let’s give an example.

Instead of moving directly from ATOM -> KUJI, there may be more liquidity on ATOM/USK and KUJI/USK pairs relative to ATOM/KUJI. Thus, you would receive more KUJI at the end by routing through both pairs as follows:

ATOM -> USK -> KUJI

This is the premise behind MantaSwap trade routing, executing your trades through the most efficient route from token A to token B, ensuring you get the most bang for your buck.

This is great in itself, but Trade Splitting takes this to a whole new level. Currently, MantaSwap is integrated into SONAR swaps to route trades through only a single trade route. But what if it makes sense to split this trade through various pairs instead of just one? Another example:

Instead of doing ATOM -> USK -> KUJI

- 60% ATOM -> USK -> KUJI

- 20% ATOM -> KUJI

- 10% ATOM -> USDC -> KUJI

- 10% ATOM -> MNTA -> KUJI

By splitting your trade through the pairs above, you aggregate the liquidity found in each pair and increase the efficiency massively. Trade splitting is one of the biggest things Kujira will ship in the next few months.

NAMI

Although not launched yet, NAMI is a savings protocol that utilizes Kujira’s dApps to offer the best yield for stablecoin deposits. A one-stop solution that maximizes the returns on your stablecoins is a killer use case and can abstract away from crypto entirely.

You’d have seen those advertisements of FinTech mobile applications that offer fancy ways to invest your money, offering an APR you can count on one hand. Now imagine the same advertisement offering you 10% APR on your fiat using only sustainable rewards that accrue from borrowers’ interest rates. This feels like an absolute MUST to be included in SONAR.

“Appreciated by both degens and grandmas alike” – SONAR providing dApps for all market participants.

Minting Stablecoins on Kujira

You’ve on-ramped FIAT through SONAR and swapped into some cryptocurrencies, but you want to put these assets to work. Simply launch the “Mint” tab and mint our decentralized, overcollateralized stablecoin USK using your newly bought tokens as collateral. You can now use this newly minted USK to lend in GHOST, or LP on BOW, or purchase more KUJI Koins on FIN. All from the comfort of your mobile phone, all in a single UI, seamlessly transferring assets from one dApp to another with just a swipe.

Staking and Airdrops on Kujira

Perhaps the creme de la creme of Kujira is the value accrual to the token, KUJI. Here is a list of all the rewards that accrue to KUJI stakers *CURRENTLY* (as it will only increase):

- Fees

- 0.5% ORCA liquidations

- Airdrops from protocols that launch on Kujira

- 5% of stables raised on PILOT launches

- 0.5% of tokens launched on PILOT

- Revenue from Alliance tokens on Kujira

- Mint fee on USK

- Minted USK interest payments

- Borrow fee on GHOST

Airdrops are pretty common to holders of the token central to an ecosystem, and this is likely to continue as more projects launch on Kujira. Remember, there is a community pool of over 3M KUJI tokens, only increasing in $ value as we move further into the bull market.

A single token central to all dApps in the Kujira ecosystem, funneling all sustainable revenue.

LST-Fi On Kujira

Unstake, formally known as nutsack, will make Kujira the defacto LST hub on Cosmos. This is a bold claim, and probably deserves an entire article dedicated to the reasoning, but I will try to break this down simply here.

The ability to instantly unstake LST derivatives into the bonded token has the following benefits:

- Obtain the unbonded token at a better redemption rate than LST pairs on DEXs, removing the need for them

- Users can interchange between LSTs immediately, allowing them to become yield opportunists – converting to the LST with the best yield at any one time.

- LST protocols can vampire market share instantly by offering immediate conversion from one LST to its own. For example, Quark can immediately convert stATOM -> qATOM for use within its ecosystem.

Flywheel Moment!

As demand for instant unstaking increases on LSTs, the demand for borrowing of the unbonded token increases too. This increases the yield for lenders, allowing more borrowing to occur, and therefore more unstaking.

The last bullet point is most crucial here. As an LST provider, it is in your best interest to utilize the Kujira network to ensure your users can easily convert into your LST without needing to seed any liquidity on a DEX, or offer incentives for this activity.

This makes perfect sense for Quark, who I will now move on to. Amazingly Autistic Amit (with love) is cooking something incredible in the shadows right now, with a public roadmap that does not get its deserved attention.

Quark is built using the same philosophy as the Kujira ecosystem – with composability at the forefront. By integrating with dApps like GHOST, FIN, ORCA, e.t.c, Quark LSTs will enable an immeasurable amount of strategies to be built. These include cash-flow manipulation, self-repaying loans, yield tokenization, and more. Given that Amit is the brains behind ef=”https://interchaininfo.zone/indexes/ghost-2″ target=”_blank” data-ici-summary=”A decentralized, open-source platform for creators and publishers” title=”Ghost”>GHOST

and a core Kujira developer, you can rest-assured that whatever he cooks will COOK.

I’ve had the pleasure of knowing Amit for the last year or so and I can say without hesitation that this man is brilliant (and somehow younger than me…). Integration of his bespoke LSTs into the Kujira ecosystem, and on SONARs mobile application, will cement Kujira as the LST hub for Cosmos. Bookmark this.

ORCA

Saving the best for last, Kujira’s premiere product ORCA.

ORCA is the world’s first public marketplace for bidding on liquidated collateral. By effectively participating in a Dutch auction, users can obtain liquidated collateral at up to a 30% discount to the current market price. Now that GHOST is live, users can also use ORCA to sell yield-bearing xAssets at local tops up to 43% above the market price.

Yes, you heard me right. Buy assets below the current market price and sell them above the current market price. Now, ORCA has been a bit of a sleeper since the Terra days, with leverage on Kujira not jacked to the tits like it was during TeFi days.

However, the bull market brings greed, and greed loves leverage, and leveraged greed loves to be liquidated. I expect things to ramp up quickly as teams build upon the DeFi rails that the core Kujira team have built, with leverage utilized more as investor confidence continues to increase.

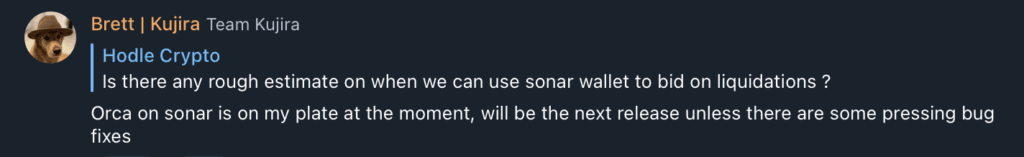

Once integrated into SONAR, the bull market’s best dip-buying machine will be accessible 24/7 on your mobile device, and I’m certain strategies will be built to automate these processes.

Conclusion

Onboarding anybody to Kujira will be as simple as “Download this app and everything is there for you ready” with an intuitive UI. 1-click deposits from all chains directly into Kujira, and ease of on-ramping from CEXs will remove the friction of bridging, attracting all users.

Now that these entirely composable DeFi guard rails have been built, the focus can now shift to making it a friendly environment for developers to build on top of it. We have set the foundations, now it’s time to build intricate economies on top of it. We have a community pool of 3 million KUJI to be used to attract builders to come and develop, and this has already ramped up massively over the past few weeks.

The kicker really is that all of these products don’t have their own token, their own seed raise, or VC investors. One single token capturing revenue from every single one of these products, $KUJI stakers.

I founded Kujira Academy to do this work too, real grassroots outreach to introduce Kujira to new people rather than the same pot. Usually, this is tough work, but if you ask them to download a single app, give them some cash for incentives, and guide them through on-ramping via Kado from the bank to Kujira in 5 minutes? Or direct USDC from Coinbase to Kujira? The pitch sells itself.

We regularly have stablecoin yields of 10-15% on GHOST (lending), 50% on USK/USDC stableswap pools, and savings protocols built to make this as easy as a stablecoin deposit vault -> earn revenue. We’re talking UST yield without ponzinomics, REAL YIELD. ON YOUR PHONE.

Written by KP

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.