Background

In December 2020, the U.S. Securities and Exchange Commission (SEC) initiated a lawsuit against Ripple Labs Inc., accusing the company and its executives, CEO Brad Garlinghouse and co-founder Christian Larsen, of conducting a $1.3 billion unregistered securities offering by selling XRP, a digital token created by Ripple’s founders in 2012. This lawsuit marked a significant event in the cryptocurrency industry, as it sought to classify XRP as a security, which would subject it to additional regulation.

The Ruling

On July 13, 2023, U.S. District Judge Analisa Torres delivered a landmark ruling in the ongoing case. The court partially granted a motion for summary judgment, concluding that Ripple’s sale of XRP tokens on exchanges and through algorithms did not constitute investment contracts and thus were not securities. However, the institutional sale of the tokens was found to violate federal securities laws.

The court stated that Ripple’s institutional sales of XRP were an unregistered securities offering, but programmatic sales on the secondary market were not. The judge granted part of the SEC’s motion pertaining to $728 million in institutional sales. At the time of the SEC’s lawsuit in December 2020, the regulator calculated Ripple’s XRP sales in total to $1.4 billion.

Legal Implications

The ruling has significant implications for the cryptocurrency industry. It sets a precedent for future token classification cases and could potentially influence how digital assets are regulated in the future. The decision also brings into focus the Howey Test, a three-pronged test used to determine whether a transaction qualifies as an “investment contract.”

In the ruling, the court evaluated the Howey Test as follows:

- Howey prong 1: The court found that there was a payment of money.

- Howey prong 2: The court found the existence of a common enterprise because the record demonstrated that there was a pooling of assets and that the fortunes of the Institutional Buyers were tied to the success of the enterprise as well as to the success of other Institutional Buyers.

- Howey prong 3: The court found that reasonable investors, situated in the position of the Institutional Buyers, would have purchased XRP with the expectation that they would derive profits from Ripple’s efforts.

The Market’s Reaction

The market’s reaction to the ruling was immediate and significant. The price of XRP surged more than 30% at one point on Thursday following the announcement, and other altcoins also experienced gains. This ruling has given hope to crypto investors, who breathed a sigh of relief that other altcoins may not be considered securities after all.

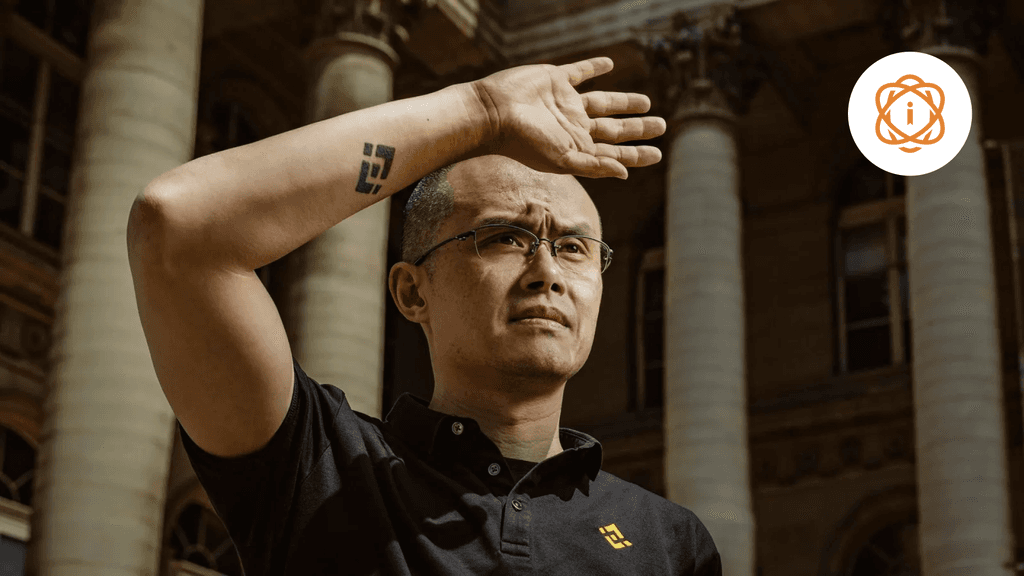

Binance’s Decision

In a related development, Binance, the leading cryptocurrency exchange, announced its decision to delist and discontinue the redemption of XRPUP and XRPDOWN leveraged tokens, effective from July 25, 2023, at 06:00 (UTC). This move comes at a critical juncture as both Binance and Ripple are embroiled in lawsuits filed by the SEC.

What’s Next?

While this ruling marks a significant victory for Ripple, the case is not entirely over. Some aspects of the SEC’s claims must still go to trial for a jury to decide. The outcome of these remaining issues could have further implications for Ripple and the broader cryptocurrency industry.