In this article, Ole offers a complete overview of the Kujira ecosystem and his unfiltered opinion on the current state of affairs.

This serves as the perfect starting point for new ecosystem participants who wish to get a brief understanding of the Kujira ethics and culture, as well as the products.

Contents

- Nature of Kujira: Mission and Values

- Ecosystem: The Dapps “Empowering Everyone”

- Community

- Tokenomics of KUJI

- Conclusion

1. Nature of Kujira: Mission and Values

“At Kujira, our values are at the heart of everything we do.“

Dedication towards a unified vision and strictly following the project’s principles and values.

“Kujira empowers everyone”: “Everyone deserves to be a whale.”

These are the key mottos and messages that drive the Kujira community forward. The logo of the brand is a whale, with “Kujira” meaning whale in Japanese. Two simple sentences and a simple but beautiful logo encapsulate perfectly the identity of Kujira – to develop and deliver financial products, which not so long ago were mostly accessible to large institutions and investors in the TradFi world.

Kujira’s playbook is to bring finance to the common man, something that is perfectly aligned with crypto’s ideals; every Defi project should work to “empower everyone”, otherwise we create a worse version of central banking and traditional finance.

Revolution

In the first sentence of Kujira’s docs they use the word “revolution”, with the main focus of Kujira being to innovate. They strive to do this by developing a “payment infrastructure” and by “providing sustainable FinTech solutions to protocols, builders, and web 3 users.”

Sustainable

On the first page of the docs this is the second keyword. The team vows to build a “sustainable Layer 1” and “Focuses on sustainable FinTech solutions for protocols, builders, and web3 users”. Ideals do not satisfy thirst, they should be the prompt to act on those ideals. Thus passionate, idealistic people should focus on building things that work in the long run. Rational calculus and a deep desire to change the world for the better sounds like the perfect mix to bring Defi where it should be. Kujira gets it.

War on Inflationary Tokenomics and Mercenary Capital

Taxation is theft. Inflation is hidden theft. With such reasoning, Kujira is dedicated to building their Defi ecosystem without bringing mercenary capital by being non-transparent about their products and tokens. The team promises not to seek fast and easy money from retail speculators by pushing huge APR %s LPs, but instead promises to share revenue with their users without the revenue being achieved by non-sustainable inflationary tokens.

The so-called “real yield”. KUJI staking rewards stakers with the variety of assets traded in the whole ecosystem of dapps. Such examples include anything from KUJI and USK to nBTC and wETH. All rewards are derived from the real on-chain activity.

Inflationary tokens are an even worse version of central banking; a crypto Cantillion effect in which founders and early investors can bring home huge returns by taking advantage of broken tokenomics is hardly Defi (decentralized finance) in any sense.

We already have ‘inflationary yield’ in TradFi so in DeFi we have to take the more difficult but more rewarding ‘real yield’ approach. Moreover, new projects launching their tokens can do it seamlessly on FIN rewarding KUJI stakers with airdrops in the process. An approach further making inflationary incentives obsolete.

The core team gives real yield to the community (stakers) to stimulate community members to give back. Growth through building a culture of kindness and cooperation. They also continue to keep the migration of old KUJI classic tokens from Terra to Kujira, with a keen understanding that investors deserve what is rightfully theirs.

Semi-Permissioned

Not completely permissionless. For a smart contract to be implemented it has to be voted by governance. The traditional system may be defined as permissioned. Most people perform the actions they are permissioned to perform. The higher the ladder a person climbs, the more permissions he gets from the agents of power.

Whilst from an ideological point of view crypto should always be permissionless – since it’s fighting the traditional ‘permissioned’ system, the balance between ideals and pragmatism is not easy to be achieved. Behind a completely permissionless approach the risk of malicious actors and misdirection is open. Defend mechanisms to develop the right culture and bring the best possible projects on-board may come from permissioned elements.

In Kujira’s case, there is the so-called Sentinel; a team of 7 members who review potential code implementations into the ecosystem. Not everybody is a developer with 20+ years of experience and 5+ years in blockchain programming thus having such people on board to provide the technical side of things can always be beneficial for the broad community. This is the technical ‘permissioned’ side.

On the other hand, there is the broad governance mechanism where each KUJI staker can vote whether a particular smart contract can be implemented. With this approach the trust of loyal community members is rewarded by giving them a say on the future of the ecosystem, including on the matter of what smart contracts should be implemented.

In this context, however, it’s important to keep a truly decentralized validator set and initiatives like POD are important to guarantee decentralization. If all the validators are the founders themselves or people close to them, there would hardly be any ‘permissionless’ elements in a blockchain project. For more on POD check the “Ecosystem: The Dapps “Empowering Everyone“’ section.

On-chain Price Oracle

All 75 active validators submit Kujira’s price oracle as part of the chain’s consensus mechanism. Furthermore, FIN – Kujira’s order book DEX – is completely on-chain which is a novel approach. In contrast, dYdX’s orderbook is off-chain. Complete focus on dapps utilizing on-chain computation without any off-chain segments is a main technical feature of Kujira’s ecosystem.

Self-sufficiency

Kujira builds its own dapps so that it wouldn’t need to trust any third parties. They do not follow the app-chain thesis so prevalent in Cosmos but instead, they build multiple dapps of their own; each dapp has a key role in optimizing UX and providing better services to users.

Thus, Kujira may more accurately be defined as a sector-specific blockchain, similar to Injective and Sei. Sei has marketed itself as the first “sector-specific” blockchain in crypto, but in reality, Injective and Kujira are older chains that match the sector-specific definition.

In Kujira’s case, they are focused on the DeFi-FinTech sector aiming to provide easy-to-use financial products to everyone; without discriminating between financial conditions and the social status of participants. An approach that seems to be a good one as recently Mars Protocol announced they will leave their own chain since it’s not sustainable for them to maintain their app chain as it’s too expensive.

It’s unsustainable for the network’s validators as well. Therefore Osmosis and Neutron are currently fighting to bring Mars Protocol on their respective chains. Osmosis started as an AMM app chain, which however has grown itself as a Defi Hub with multiple dapps and Neutron aims to compete with Kujira and Osmosis for the Cosmos Defi Hub crown. Mars Protocol is quite a unique product so it’s understandable that the best-funded Defi Hubs in Cosmos are willing to acquire it.

Key mention: the main difference between Kujira and Osmosis + Neutron is that the former has already built and continues to build products contributing to having its own self-sufficient Defi Hub, without overspending community funds to acquire third-party teams into the ecosystem.

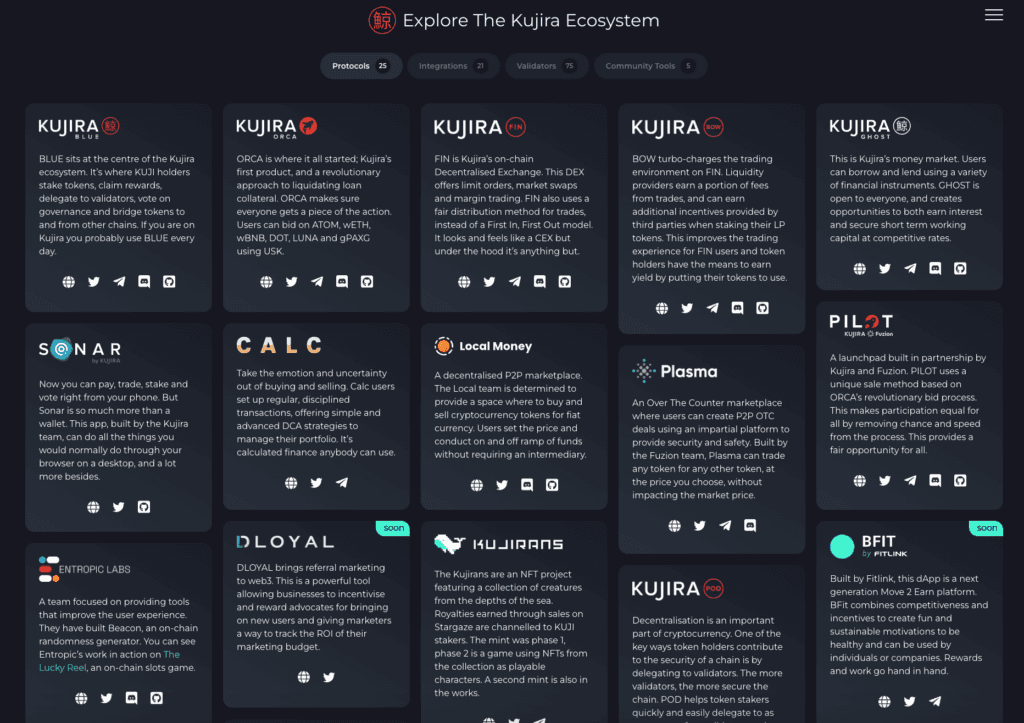

2. Ecosystem: The Dapps “Empowering Everyone“.

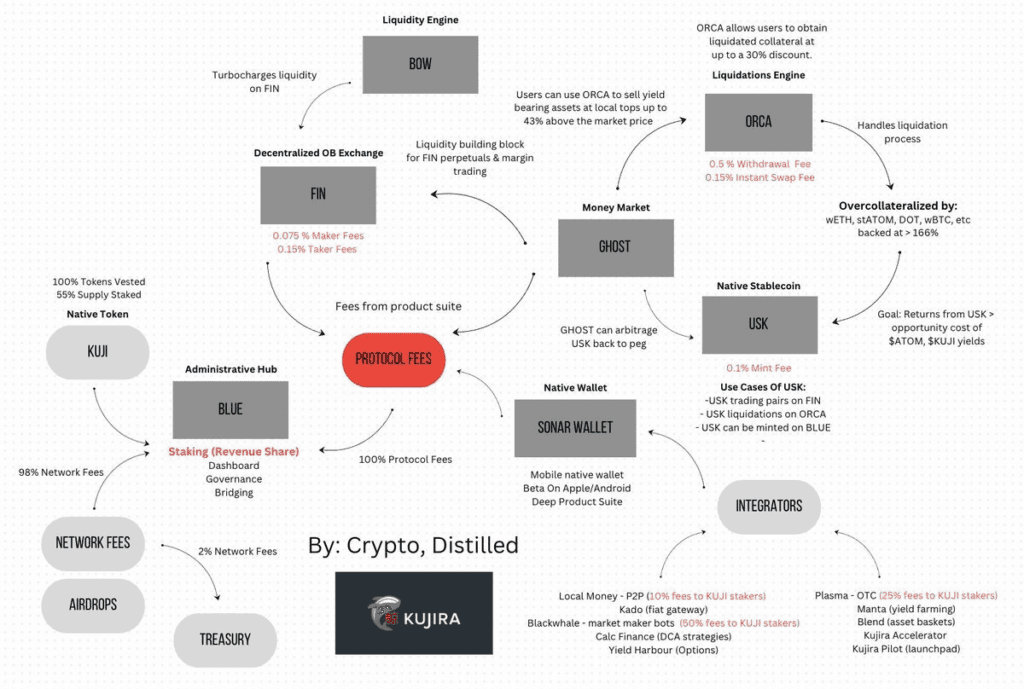

Ecosystem overview: Kujira has become famous among Defi enthusiasts since in just over a year they’ve built a rich ecosystem with diverse applications. These include: 1) ORCA, 2) BLUE, 3) FIN, 4) USK 5) BOW, 6) GHOST 7) Finder, 8) POD, 9) SONAR. All the products shipped up till now can be tracked on Kujira’s Shipping Lane doc. The full list of all dapps built and currently in development you can find here. An elaborate image explaining how the ecosystem works:

ORCA

How it works: Users can obtain liquidated collateral at up to 30% discount from an asset’s market price.

This approach helps find an optimal discount rate to bid to restrict (MEV and arbitrage) bots and whales to manipulate the ORCA markets. Liquidations instead are done by community members who in theory have the ecosystem’s best interest at heart, compared to mercenary whale capital. Overall, ORCA is the flagship product of the Kujira ecosystem.

It’s the cornerstone of Kujira’s flywheel; USK relies on its liquidations to accrue collateral, and GHOST relies on it to handle liquidations of borrower collateral. ORCA is arguably Kujira’s most unique and interesting product.

There are three types of ORCA lending markets: USK backing collateral, Isolated FIN margin, and ef=”https://interchaininfo.zone/indexes/ghost-2″ target=”_blank” data-ici-summary=”A decentralized, open-source platform for creators and publishers” title=”Ghost”>GHOST

(perpetual) liquidation markets. All three can be accessed here. ORCA’s design allows it to be implemented on any EVM or Rust-based applications. ORCA forms bidding wars between participants which limits the influence of bots and whales.

History

As described in the docs, Kujira started out on Terra Luna by developing their liquidations platform for Anchor (Terra’s lending/borrowing protocol, the main driver of activity on the chain) to protect retail investors from whales manipulating assets. Kujira was inspired to develop ORCA on Terra after a big liquidation event on Anchor in May 2021, where whales with bots pushed Luna’s price from $16 to $4 in just a week. This liquidation event liquidated over $1 bil. USD of LUNA.

Leverage is risky – especially if the circulating supply of a token is held by a small minority as in LUNA’s case. That was Kujira’s first play to create a “level-playing field” for retail and institutional investors alike. Knowledge is power and when it is not freely accessible to anybody, this can hardly benefit most users. Removing the blindfoldedness in ‘neo-tradfi’ crypto protocols is a must for having true decentralized finance and Kujira tries to lead the charge in this mission.

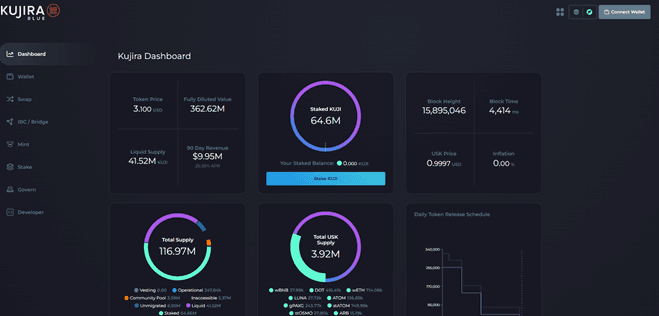

BLUE

The “all-in-one” dashboard of the ecosystem, the central hub. You can stake your KUJI there, check your staking and wallet balance, check on the dashboard metrics of the chain, swap tokens in a simple AMM manner, bridge tokens, mint USK, and vote on governance proposals. There is even a Developer tab allowing developers with qualified (permissioned) access to implement smart contracts.

“Token swaps occur by placing FIN market orders or fixed price limit orders under the hood.“

Currently, token swaps are limited to FIN pairs. In case you want to perform a swap outside of a FIN pair, you would need to swap the first token to USK or USDC / axlUSDC and then with the stables to acquire the desired asset. An image of Blue’s interface can be seen below:

FIN

FIN is a central limit order book (CLOB), thus the computation is completely on-chain. In a CLOB both buy and sell orders must be registered for a transaction to go through. Due to being an order book DEX, it does not rely on inflationary incentives like most AMM dexes thanks to BOW.

FIN offers a CEX-like experience; you can execute market orders or set orders on fixed prices. It shows in a fully transparent way all current buy and sell orders – the price levels and the amounts in USD of all orders placed on each price level. Making crucial information of this type allows anybody to win – not just the privileged, well-informed, and rich whales as it is in most of TradFi. Thus, FIN allows traders to use more complex trading strategies like stop-losses and calculating the upside and downside potential of the tokens they trade. Overall AMMs are simple but limited and that’s where orderbooks like FIN thrive.

USK

Short tech summary: USK is a soft-pegged to-the-dollar stablecoin that can be minted with a variety of assets which makes it overcollateralized by a multitude of cryptocurrencies; some of those include ATOM, wBTC, wETH, wBNB, LUNA, MNTA, DOT, and gPAXG. USK is backed with collateral at a minimum of 166%.

Currently, KUJI cannot be used to mint USK thus its design is far away from UST’s algorithmic mechanism; instead it relies on over-collateralization powered by Kujira’s dapps, most notably ORCA’s liquidation engine. USK is “borrowed” (minted) by locking the collateral in smart contracts; “the collateral is temporarily locked behind debt and can only be retrieved by paying back the debt.”, similar to mortgage house debt. Its code is written in Rust.

It’s using ORCA’s liquidation mechanism, where liquidations via ORCA fund USK’s collateral. When backing collateral falls below 66% over-collateralization, it gets liquidated. When this occurs, 99% of it is burnt, and 1% is distributed to KUJI stakers, along with the 1% borrow interest which is also distributed to stakers in the liquidated collateral asset.

In this way, KUJI stakers receive a variety of staking rewards outside of the native KUJI and USK assets. Moreover, a majority of the USK-filled bids on ORCA are burnt – which guarantees = > 166% collateralization of USK as it guarantees USK’s circulating supply is lower than the collateral deposited for minting it. Again, ORCA is at the heart of the ecosystem.

Why USK?

A main weak point of most stablecoins is that they are quite decentralized; most of the stablecoins of crypto protocols (FRAX on Ethereum and IST on Cosmos for example) are collateralized by USDC. And Circle, the company behind USDC, has a track record of blocking wallets. This proves that crypto cannot thrive without having truly decentralized stablecoins. Even though USK’s code is not completely open-sourced for the moment, the diversified collateral and the decentralized way in which it is minted is a step in the right direction and the collateral backing it can be verified onchain. It is not just another USDC clone, instead it is a stablecoin created on-chain by its users.

One of USK’s unique use cases is that it can be used on ORCA to buy liquidated collateral at a discount. Orca and USK have a beautiful synergy between them which can be hardly copied by other protocols due to the novel nature of both products. USK is heavily present also on BOW where you can provide liquidity on LPs to get rewards from trading activity and incentives. As the docs beautifully say, USK is like is like “a blockchain version of the gold standard and unlike modern banking, USK is not printed out of thin air and is backed at over 166% capacity.”

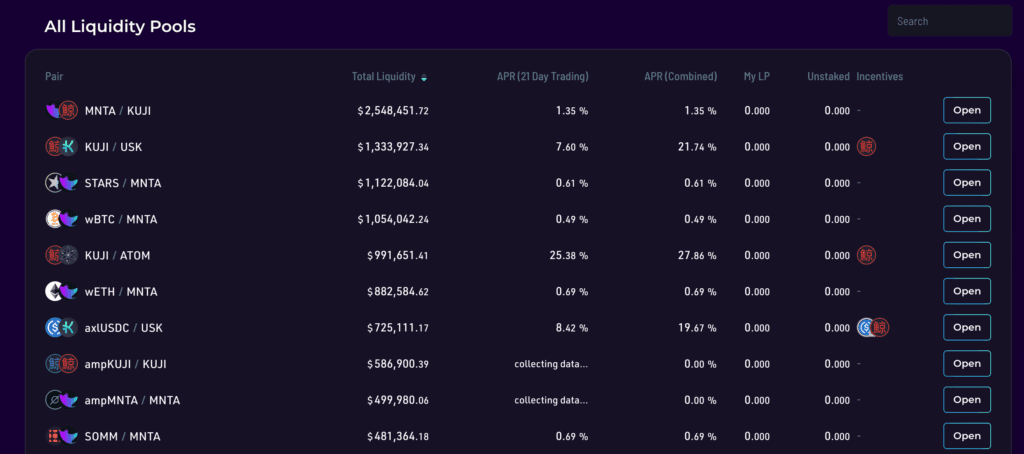

BOW

This dapp was built to bring more liquidity into the ecosystem. FIN relies on Kujira’s on-chain oracle to provide accurate prices. Correct price reporting is essential. Lack of liquidity could be a large hurdle in price reporting; with insufficient liquidity, whales can easily manipulate prices. Here comes BOW’s role – which is to provide optimal trading performance for FIN pairs due to increased protocol liquidity.

How it works: by using an “internal algorithm to automatically place orders on FIN pairs based on its internal token balances, similar to the XYK algorithm used by Automated Market Makers like Uniswap.” BOW’s main function from an infrastructure point of view is to be FIN’s AMM by incentivizing users to deposit into LPs. BOW is “self-sufficient” and “100% on-chain”.

BOW’s liquidity is concentrated on the buy and sell orders placed on FIN within each trading pair. “Like a curved bow, the majority of active liquidity is at the edges (highest and lowest prices), which minimizes the amount of liquidity necessary to create a deep trading experience around each token pair.”. Each LP token represents a trading pair on FIN and if you stake it on BOW you earn trading fees and incentive rewards; a win-win for both LP depositors and traders.

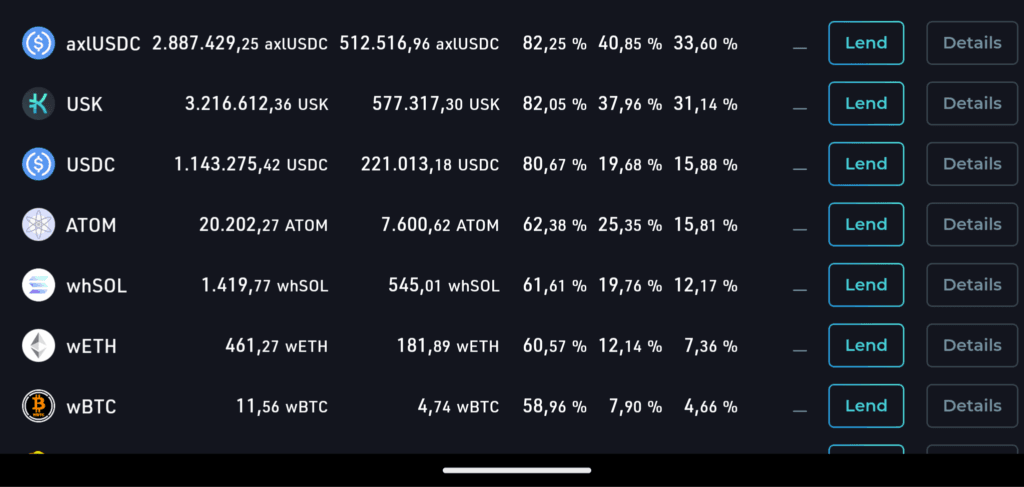

GHOST

“Kujira’s money market”. The lending/borrowing dapp of Kujira is similar to Ethereum’s Aave. GHOST’s advantage is that its part of a rich ecosystem of dapps that boost utility. For instance, you can lend your USK on GHOST, receive the lending asset equivalent – xUSK (“similar to a receipt token that represents a claim to lent TOKEN (in this case USK) on GHOST“ =bankNOTE), then use xUSK on ORCA to bid on liquidations to buy a coveted asset on a discount. Whilst waiting for liquidations, you gain interest on your lent USK.

Ghost is another cog in the Kujira machine aiming to bring more liquidity; the more liquidity Kujira has, the better the experience on each dapp will be. GHOST solidifies USK’s utility too by allowing lenders to earn passive USK income in case they are not into active trading strategies. All loans on GHOST are overcollateralized since interest on borrowing is higher than lending. GHOST enhances the experience on ORCA as it provides liquidation markets with assets other than USK.

FINDER

The official Kujira blockchain explorer. You can use it to track any transaction, address, validator, etc. A cool feature of FINDER is that you can bookmark wallets for tracking. You can view all the bookmarked wallets on FINDER’s My Bookmarks section. The bookmarks are associated with the browser’s cache and cookies, not with the wallet; thus if you clear your browser’s cache and cookies you may remove your wallet bookmarks.

POD

“POD is a custom staking user interface (UI) designed to support decentralization on the Cosmos network, a proof-of-stake (PoS) blockchain.” When staking on Kujira POD shows the voting power of validators in a UI-friendly way pushing stakers to choose to delegate KUJI to validators from the lower placed validators. Uneven stake distribution makes POS vulnerable to attacks and with this in mind Kujira’s devised POD. Validators with more voting power are shown in red, the ones around the mid-range are in yellow and the ones with least voting power are shown in blue. POD however can be used to stake not only KUJI but any Cosmos coin.

SONAR

This will be Kujira’s native wallet and mobile app, currently in Beta, mainnet release will follow in the next weeks/months. Its emphasis is on optimal experience on mobile. Most people nowadays browse on the internet from mobile devices. Indeed, when Kujira released the Sonar beta, DAU (daily active users) increased substantially. Mobile app infrastructure in crypto is suboptimal nowadays and a focus on Sonar makes perfect sense since one good mobile wallet may be the key to the mass adoption of Kujira.

Sonar is optimized for seamless blockchain interaction on mobile devices. Sonar is intended to be something like a blockchain Revolut, offering a rich array of financial services accessible in your hand. Sonar will aim to acquire a user base outside of crypto enthusiasts, which may include vendors, e-commerce enterprises, and everyday users; bringing transparent crypto payments together with real-world payments. Sonar would become a much-needed competition to Keplr. Currently, Leap Wallet is Keplr’s main competition, but we’ll see how things will unfold after Sonar’s full release.

3. Community

From the ashes: Terra’s collapse was a turning point for many. Back in the day, Anchor was printing 20% ARP for the native Terra stablecoin depositors – UST. TVL was surging higher and higher. At its peak, Terra had a TVL only behind Ethereum’s. Lots of money was entering the ecosystem, mainly through Anchor. One weekend everything changed when a coordinated attack destroyed UST’s peg – and the LUNA token evaporated along with it. Thousands of people lost too much; some lost their entire net worth.

Recently @ZeMariaMacedo from Galaxy Digital reported that he lost “8 figures” during the ‘Terraplosion’. There were multiple reports of people who took their own lives due to the financial catastrophe experienced. Around $50 billion ceased to exist, as if a black hole consumed all that money. There were no bailouts, nobody to compensate all the people who lost so much of their net worth. Most were heartbroken, some just accepted with grief their experiences and a minority of community members rolled up their sleeves to do an even better job. Kujira’s team and community were representatives of the minority.

For a bit over a year, its developers shipped a variety of great dApps. Each dApp is part of the whole ‘flywheel’, each contributing to the best possible DeFi experience for its users, like a cog in a machine, making it work; if you remove one cog, the machine may struggle to work. As a result of this unlikely comeback story, Kujirans managed to absorb most of what was left of Terra’s community after the Terraplosion; a significant asset as Terra’s community was one of the most active and passionate ones in all of crypto. The team even compensated KUJI holders on Terra. Therefore, nowadays you can sense on CT the energy and passion of the resurrected community.

There is however a great difference between Terra and Kujira’s vibes on CT; Lunatics were a highly competitive folk, shouting how they’re the best and Do Kwon (Terra’s cult figure) was second to none. Lunatics’ aggression was countered by many critics which, in the end, turned out to be right – UST was one dead spiral away from total collapse. Another case study on why humility and communicating not only with like-minded people is essential. On the other hand, the Kujirans are, similarly to the Lunatics, of a highly competitive nature (as seen with all the disputes with the Osmosis community) but the main difference is the leaders of the project are humble.

Founders

Leading by example, more action, fewer words:@cryptoslang1 and @codehans1 especially are too busy building all the time so are not the most vocal of folks on social media. Hans usually tweets when he is about to cook a new feature on Kujira. A man of much action but few words – a rare but great combination in most cases. @deadrightdove is the public face of the project, and the most active co-founder on social media. Only once did he appear in a YouTube interview –

.

Kind and supportive, always humble and ready to offer advice. Adheres to Kujira’s values focusing on organic growth – tech and community-wise. A turning point was when he denounced all the price shillers saying that Kujira should operate organically when it comes to marketing and raising brand awareness – an approach which at the beginning wasn’t beneficial but with time a fiercely loyal community has been nurtured.

As a result, Kujira catches many admiring glances from outside of Cosmos. Examples of famous CT influencers fans of Kujira are: @IamZeroIka, @thewolfofdefi, and @cryptocevo. In a sector where fakers and shillers dominate, being one of the few ‘real ones’ makes you outshine many of the other projects and communities. Talk the talk, walk the walk.

Cosmos but not exactly Cosmos

Kujira has IBC enabled allowing the chain to connect with other IBC-enabled Cosmos chains seamlessly. This aligns them with Cosmos. However, in the past, there were multiple controversies between Kujirans and Cosmonauts.

Last year there was a heavy propaganda war against Kujira’s closed-source code; which to a big extent was a misconception (probably an intended one). Not all parts of the code are closed-source – the concern of the more informed critics was that USK’s code is largely closed-source. @gadikian and @DonCryptonium were among the most vocal critics at the time. The biggest cosmos influencer @Cryptocito barely talked about Kujira (still not talking much about it btw); if he talked about it he was also

. Core Cosmos project founders like @gregosuri were saying things like that non-open source crypto is not crypto.

How did things unfold? Well, shortly after beginning the propaganda war between Kujirans and Cosmonauts, Evmos was hit hard because Canto copied their open-source code; Evmos sunk badly while CANTO’s price action and community thrived at the time. That was a useful case study in real-time that open-source while being the correct approach to build technology from an ethical point of view, can impact negatively your work since others can freely copy the hard work you’ve done.

Entrepreneurship, especially in the crypto verse, is a merciless endeavor and upon any signs of weakness, your competition will most of the time try to steal your ideas and community. Kujira’s realism protected the project’s future and its community, as proven by Evmos’ setbacks.

Later on, one of Kujira’s most vocal critics – Don Cryptonium – became one of its biggest supporters. In the process he developed one of the most viral memes in Cosmos the last year – the “Cosmos cartel” one. A main tool of Kujirans to hit back at cosmonauts blaming influential cosmonauts for nepotism and misspending on public funds for private benefits. About a couple of months ago the nail in the coffin was a hilarious parody video destroying “Cosmos cartel” members.

Since the video KUJI’s price took off and most “Cosmos cartel” coins have been lagging. The market has decided that the propaganda war was won by Kujirans. Destiny is a funny thing. Kujira’s team has pledged that once they shipped most of the infrastructure and the project has gained traction they will step by step open-source the code.

Governance

KUJI stakers can vote on governance proposals. In the past, there was a senate which was discontinued a few months ago. Similarly to most cosmos chains (the Cosmos Hub as a prime example), validators vote with the funds delegated to them by stakers, but each delegator can override their validator’s vote in case they decide to vote manually on a proposal. Kujira has its governance UI, separate from the Governance dashboard provided by Keplr. In addition to stakers voting on proposals Kujira has Sentinel –practically the technical Senate. It has seven members and via a multisig, they review potential new code implementations for the ecosystem.

4. Tokenomics of KUJI

“Kujira has no inflation and the inflation percentage is always 0%.”, the main distinct feature of KUJI’s tokenomics. The Max supply is 122m. Since last month (19.11.2023), all tokens have been unlocked, no vesting and unlocks anymore. With a fixed supply of 122M and no inflation, downside and slow rug risks are drastically minimized. Over 50% of the total supply is staked – currently, 64.66M are staked from the total 122M supply. A symptom of a loyal community that believes in the project which is key for any crypto endeavour to be a success story. All revenue from every single dApp within Kujira is funnelled to $KUJI stakers.

5. Conclusion

Kujira has gone through the depths of hell to the threshold of heaven in the last year and a half. From being obliterated during the Terraplosion to getting widespread recognition for being one of Defi’s most innovative projects; not just inside of Cosmos, but outside of it as well. They are breaking the shackles of Cosmos projects which are too limited in their ecosystem – both product and social media coverage-wise. There is a beautiful synergy between organic tokenomics and the organic growth of the community and products.

In a ‘plastic surgery’ sector like crypto, having natural beauties like Kujira is a blessing; fundamentals and sincerity are important, even though most project founders and CT folks are saying it’s all pumpamentals vaporware. Kujira is a case in point that you can be successful in crypto by being genuine and patient, building for the long run, and rewarding loyalty instead of taking advantage of it.

At the beginning of the US during the gold rush all was seemingly driven solely by filthy speculation but in the end that ‘filthy speculation’ stimulated the rise of the greatest nation on Earth. Similarly, crypto seems dominated by grifters without any real value, but ultimately crypto’s gold rush is posed to create a Golden New World. As a positive exception, Kujira has the potential to be a part of that new world; especially if they keep on building so hard, if they continue mitigating the lack of liquidity issues, they start open-sourcing the closed parts of the code, and if they continue efforts to expand beyond Cosmos and crypto natives.

Written by Ole Lukandi

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.